Singapore’s sovereign wealth fund GIC bought a minority stake in Intercos, a weel-known Italian group specializing in the production of cosmetics for third parties. The fund has in fact reached an agreement with Dario Ferrari, founder and chairman of Intercos and the holding of his family, Dafe, for the sale of minority stakes in the sub-holdings that control Intercos (with 44% of the capital and 52% of voting rights), upon which the Asian fund will indirectly hold 9% of Intercos.

The entry of the fund was also agreed with the funds that already hold minority stakes in the company: L-Catterton, present since 2014 with a 35% stake; and Ontario Teachers Pension Plan (Otpp), in Intercos since 2017 with a 20% stake (see here a previous article by BeBeez). L-Catterton had entered the capital of Intercos in December 2014, when Tamburi Investment Partners instead had divested (see here a previous article by BeBeez). Just a couple of months earlier, the company had withdrawn the announced listing on Piazza Affari (see here a previous article by BeBeez).

Following the agreement with GIC, Mr. Ferrari retains control both at the holding level and at the Intercos operating company level. The transaction, subject to the usual approvals by the antitrust authorities, is expected to close by February 2021.

The sale of the minority strengthens the Intercos shareholding structure to support its development plans,  especially on the important Asian market. The entry of GIC does not change the Intercos Stock Exchange listing project. In October 2019 company actually had chosen the global coordinators of the listing: Ubs, Bnp Paribas, Morgan Stanley and Jefferies (see here a previous article by BeBeez). However, the listing has now been shelved due to the uncertainty brought to the markets by the coronavirus. At the time the cosmetics manufacturer was said to be worth over 1.5 billion euros.

especially on the important Asian market. The entry of GIC does not change the Intercos Stock Exchange listing project. In October 2019 company actually had chosen the global coordinators of the listing: Ubs, Bnp Paribas, Morgan Stanley and Jefferies (see here a previous article by BeBeez). However, the listing has now been shelved due to the uncertainty brought to the markets by the coronavirus. At the time the cosmetics manufacturer was said to be worth over 1.5 billion euros.

In the Summer of 2016, there were rumors that reported an assignment to Samsung Securities to organize the listing in Seoul within the next 12 months of the Intercos Asia Holdings holding created in Hong Kong at the end of 2015 (see here a previous article by BeBeez). At the time there was talk of a 230 million pounds ipo, referring to a free float that could have been 40-50%, taking into account the fact that when Intercos had tried to go public even earlier in Milan, in October 2014, the free float should have been 44%. Finally, we recall that the company acquired Italy’s Cosmint in mid-2017 (see here a previous article by BeBeez).

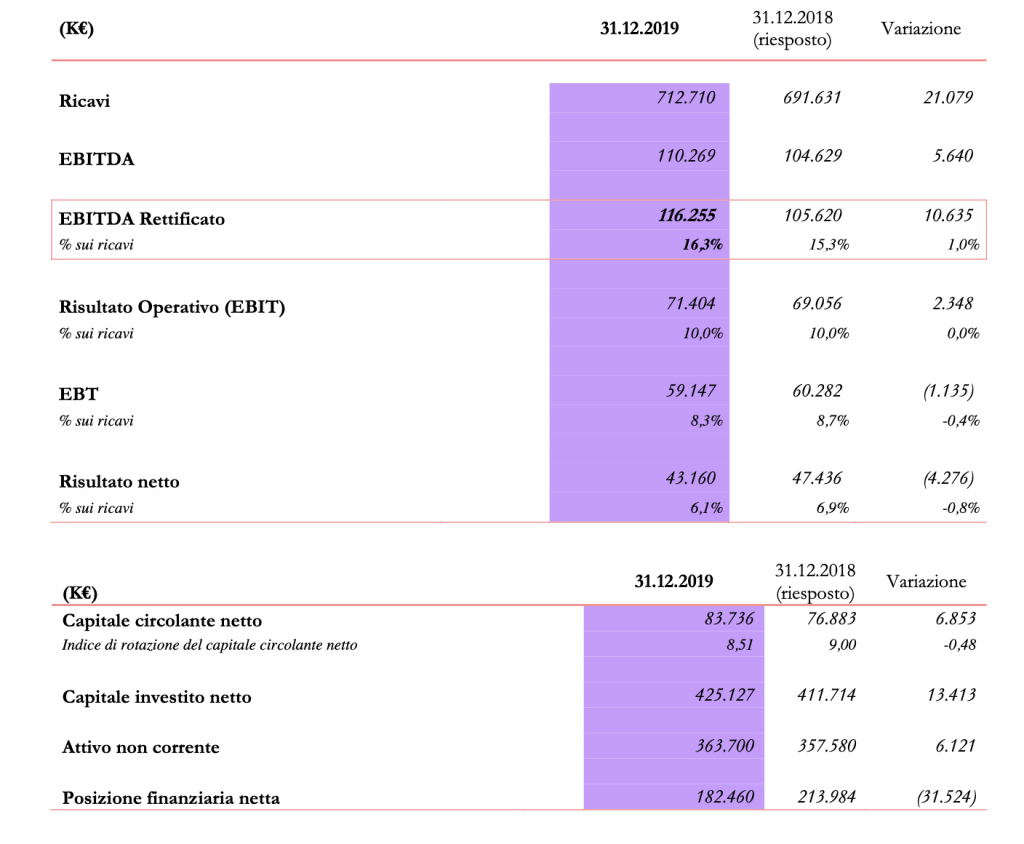

Intercos closed financial year 2019 with about 713 million euros of revenues, 116 millions of adjusted ebitda and a net financial debt of about 182 million euros, down from 213 million at the end of 2018 (see here FY 2019 Financial Statements). Debt at the end of 2019 included 120 million euros of bonds issued in 2015 and due in 2025 that were redeemed last March (see here the press release).