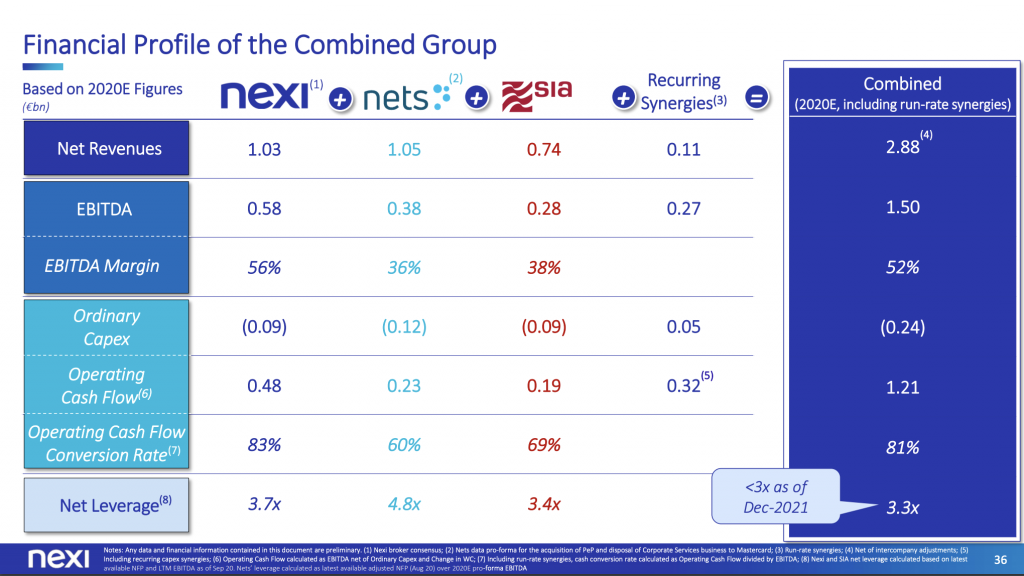

Milan-listed paytech Nexi announced the merger with Danish competitor Nets (see here a previous post by BeBeez). The integration of the companies, together with the already announced merger between Nexi and SIA, will generate a turnover of 2.9 billion euros with an ebitda of 1.5 billion. Nexi and Nets will swap their shares on the ground of an enterprise value of Nets of 7.8 billion euros with an equity value of 6 billions and a 20x EV/ebitda multiple. In 2022, Nets may get an earn-out of up to 250 million worth new shares of Nexi, which is also acquiring SIA, whose controlling shareholder is Cdp Equity. Nexi is a company monitored by BeBeez Private Data (find out how to subscribe for only 110 euros a month).

Milan-listed paytech Nexi announced the merger with Danish competitor Nets (see here a previous post by BeBeez). The integration of the companies, together with the already announced merger between Nexi and SIA, will generate a turnover of 2.9 billion euros with an ebitda of 1.5 billion. Nexi and Nets will swap their shares on the ground of an enterprise value of Nets of 7.8 billion euros with an equity value of 6 billions and a 20x EV/ebitda multiple. In 2022, Nets may get an earn-out of up to 250 million worth new shares of Nexi, which is also acquiring SIA, whose controlling shareholder is Cdp Equity. Nexi is a company monitored by BeBeez Private Data (find out how to subscribe for only 110 euros a month).

Cedacri, a company of which FSI Mid-Market Growth Equity Fund (FSI) has 27.1% since 2018, is accelerating its ipo plan but wants to grow with a merger with an industrial peer before (see here a previous post by BeBeez). Deutsche Bank is assisting the company to this end. Cedacri also belongs to Banca Mediolanum (15.6%), Gruppo Cassa di Risparmio di Asti (11.1%), Gruppo Banco di Desio e della Brianza (10.1%), Unipol Banca (7.5%), Banca Popolare di Bari (6.6%), Cassa di Risparmio di Bolzano (6.5%), Banca del Piemonte (4.2%), Credem (3.9%), Cassa Sovvenzioni e Risparmio fra il Personale di Banca d’Italia (2%), Reale Mutua Assicurazioni (1.3%), Banca del Fucino (1.1%), Banca Valsabbina (1.1%), Cassa di Risparmio di Cento (1%), and Cassa di Risparmio di Volterra (1%). FSI committed to invest 99 million euros in equity and signed a call option to increase its stake to 33% on the ground of an enterprise value of 430 million that matches the equity value. In 2019, Cedacri acquired Oasi from Nexi for an enterprise value of 151 million and 88% of Cad It. Renato Dalla Riva and Corrado Sciolla are the company’s chairman and ceo. Cedacri has sales of 382.9 million with an ebitda of 81.2 million and net profits of 28.8 million. Cedacri is a company monitored by BeBeez Private Data (find out how to subscribe for only 110 euros a month).

Eni and HitecVision launched Vårgrønn, a joint venture for investing in the renewable energy sector in Northern Europe (see here a previous post by BeBeez). Eni has 69.6% and HitecVision 30.4%.

EOS Investment Management, the UK manager of alternative assets that Ciro Mongillo founded, sold 23 photovoltaic plants to Denmark’s Obton (See here a previous post by BeBeez). Mongillo previously said to BeBeez that EOS IM aims to raise 250 million euros with a hard cap of 350 million for a fund that invests in renewable energy assets. EOS is one of the private capital investors monitored by BeBeez Private Data (find out how to subscribe for only 110 euros a month).

Made in Italy Fund acquired the majority of GCDS from creative director Giuliano Calza and ceo Giordano Calza that will keep a minority of the business (see here a previous post by BeBeez). Patrizio di Marco will support the company’s managers. Lazard assisted GCDS, a company born in 2015 and with revenues of 20 million euros. Made in Italy Fund aims to raise 200 million. Made in italy Fund is one of the private capital investors monitored by BeBeez Private Data (find out how to subscribe for only 110 euros a month).

Barentz, a Dutch company that belongs to Cinven, acquired Italy’s Sevecom from the founders Nazzaro Serino and Enrico Pigorini that will keep their managers role (See here a previous post by BeBeez). Sevecom has sales of 26.6 million euros, an ebitda of 2.4 million and net cash of 2 million. Cinven is one of the private capital investors monitored by BeBeez Private Data (find out how to subscribe for only 110 euros a month).

Gruppo Celli, a portfolio company of Ardian, acquired the whole of UK T&J Installations (see here a previous post by BeBeez). Celli acquired 30% of T&J in March and exercised the call option for 70% of the business. Nigel Farrar is the ceo of Celli Group UK. Adalberto Pizzi is the head of the asset management unit of Gruppo Celli, which previously acquired UK-based ADS2, Angram, FJE Plastic Development, and MF Refrigeration. In 2016, Celli acquired Italy’s Cosmetal. Ardian acquired Celli in February 2019 from Consilium Private Equity Fund (which purchased 70% of the businsess in July 2013) and the Celli Family. The company has sales of 130 million euros. Celli is a company monitored by BeBeez Private Data (find out how to subscribe for only 110 euros a month)

Antin Infrastructure Partners acquired a stake of 80% in Hippocrates Holding, a network of drugstores (see here a previous post by BeBeez). Cofounders and co-ceos Davide Tavaniello and Rodolfo Guarino sold the stake and reinvested for a minority while keeping their management roles. The asset attracted the interest of EQT, Permira, Pai, Investindustrial, and F2i, which owns Farmacrimi. The asset could be worth 600 million euros for an equity value of 420 million. Hippocrates has sales of 200 million and an ebitda of 40 million. Tavaniello and Guarino founded Hippocrates in 2018 and raised 50 million from DVR Capital (10% owners), the Notarbartolo-Marzotto Families (10%), Antonio Tazartes (7%). Paolo Colonna, Gerardo Braggiotti, Lorenzo Manca, the Riello Family, the Alessi Family, Paolo Pizzarotti, Paolo Barilla, Marco Drago, Michele and Enrico Catelli, Alberto Recordati, Nerio Alessandri, Giuliana Benetton, Carlo and Franca Bertagnin, Michele and Giovanni Gervasoni, Franco Moscetti, and Gianandrea De Bernardis own further minorities. Antin is one of the private capital investors monitored by BeBeez Private Data (find out how to subscribe for only 110 euros a month).

Demos 1, the retail private equity fund of Azimut Libera Impresa, signed an agreement for acquiring 65% of Sicer, an Italian chemical company (see here a previous post by BeBeez). Gianfranco Padovani, the target’s chairman, and Giuliano Ferrari will keep a minority of the business while Isabella Seragnoli will sell all of its interest in Sicer. Seragnoli invested in the company in 2016 on the ground of a the genearation of a turnover of 100 million euros in the following years. Sicer has sales of 73 million. Azimut is one of the private capital investors monitored by BeBeez Private Data (find out how to subscribe for only 110 euros a month).

Aksìa Group acquired the majority of Nappi 1911 from the eponymous family, while Michele and Domenico Nappi will keep a minority of the business and their management roles (See here a previous post by BeBeez). Nappi hired Houlihan Lokey as its financial advisor and also attracted the interest of Riverside, Stirling Square and Bluegem Capital Partners. Nappi has sales of 38.5 million euros, an ebitda of 5.48 million and net cash of 2.5 million. Aksìa Group is one of the private capital investors monitored by BeBeez Private Data (find out how to subscribe for only 110 euros a month).

Italmobiliare paid 24 million euros for 92.5% of Casa della Salute that Marco Fertonani, the ceo and founder, sold (see here a previous post by BeBeez). Fertonani will keep his management role. Italmobilare one of the private capital investors monitored by BeBeez Private Data (find out how to subscribe for only 110 euros a month).

Fincantieri is going to acquire Inso – Sistemi per le Infrastrutture Sociali and its subsidiary SOF from Italian contractor Condotte (see here a previous post by BeBeez). The asset attracted the interest of Salini Impregilo (in the frame of Progetto Italia), Pizzarotti, Icm (fka Impresa Costruzioni Maltauro), Rizzani de Eccher-Illimity, Consorzio Stabile Ifratech, Cimolai, Toto Costruzioni, Gruppo Vitali, Equitix, De Sanctis Costruzioni, Frimat Costruzioni Generali, Hitrac Engineering Group, Macquarie, and China State Construction Engineering Corporation. Condotte is separately selling Condotte America and other contracts.

Macquarie Infrastrutture Real Assets and Crèdit Agricole are in exclusive talks for acquiring Ital Gas Storage (IGS) (see here a previous post by BeBeez). IGS is worth 1.2 billion euros and has debt of 860 million. Macquarie will need the authorization of the Italian Government for closing the acquisition. Macquarie is also reportedly holding talks for acquiring 88.06% of ASPI from Atlantia together with CDP and Blackstone and for a stake of Open Fiber which is worth 8 billion. Morgan Stanley Infrastructure Partners acquired 49% of IGS in August 2015 together with Whysol Gas Storage Holding. In January 2016, Morgan Stanley agreed an above one billion euros credit line for the company and raised its stake in IGS to 92.5%, with Whysol that had 7.5%. Macquarie is one of the private capital investors monitored by BeBeez Private Data (find out how to subscribe for only 110 euros a month).

Poste Italiane signed a preliminary agreement for acquiring Italy’s Nexive Group from Amsterdam-listed Postnl European Mail Holdings (20%) and Frankfurt-listed Mutares Holding (80%) for an enterprise value of 60 million euros (see here a previous post by BeBeez). The target has sales of 200 million. Nexive is one of the portfolio companies monitored by BeBeez Private Data (find out how to subscribe for only 110 euros a month).

KKR Global Impact completed the acquisition of 70% CMC Machinery (see here a previous post by BeBeez). The Ponti family, the vendors, will keep 30% of the business. Earlier in February, KKR Global Impact completed the 1.3 billion US Dollars fundraising. Earlier in May, CMC completed a capital increase of 2.5 million euros and issued two minibonds for a total of 7 million that Riello Investimenti Partners subscribed. Cmc has a turnover of about 61 million with a 16% adjusted ebitda margin. KKR is one of the private capital investors monitored by BeBeez Private Data (find out how to subscribe for only 110 euros a month).

IBL Banca acquired Banca Capasso and Banca di Sconto e Conti Correnti di Santa Maria Capua Vetere (see here a previous post by BeBeez). In 1H20, Banca Capasso Tier 1 ratio was of 47.66%, with 32 million euros of its own resources and credits to clients for about 60 million. BSCC issued credits for 57 million with assets of above 84 million. Mario Giordano is the ceo of IBL Banca.

Italian textile company Piacenza 1733 acquired Lanificio Piemontese which has revenues of above 6 million euros (see here a previous post by BeBeez). Mauro Caneparo, the vending founder, will keep his management role. Carlo Piacenza is the ceo of Piacenza 1733 whose turnover amountes to 53 million.

Italpizza acquired Antico Forno a Legna, a company in receivership, for 4.9 million euros (see here a previous post by BeBeez). Antico Forno a Legna has sales of 10.5 million. Italpizza, whose ceo is Cristian Pederzin, committed to invest 5 million in the target. In 2008, Bakkavor acquired 90% of Italpizza and in 2014 sold a 40% to Pederzin which acquired the whole company in 2015. Italpizza has sales of 140.6 million euros and an ebitda of 6.15 million.

Today MZB Holding will end the tender offer it launched on 26 October, Monday, for Milan-listed Massimo Zanetti Beverage Group (MZBG) (see here a previous post by BeBeez) MZB will pay 5 euros per share or an equity value of 172 million euros, for a 28.2% gain above the 3.90 euros price at the moment of the launch of the offer and a 23% above the weighed average of the prices of the last six months. In 2015, the company launched an IPO at 11.6 euros per share for an equity value in the region of 325 million euros. In 1H20, MZBG posted sales of 404 million (439.5 million in 1H19), an adjusted ebitda of 14.7 million (35.7 million) and a net financial debt of 287.3 million (266.5 million at the end of 2019). MZB Holding will launch an offer on 31.953% of the company’s publicly traded equity. MZB Holding belongs to Luxembourg’s M. Zanetti Industries whose owners are Massimo Zanetti (70%), Laura and Matteo Zanetti (15% each).

Oxera Consulting says that in Italy there are 2911 companies that are eligible for listing, but still remain private (see here a previous post by BeBeez). This makes Italian listing gap second only to The United Kingdom’s where the figure amounts to 3,524 (for a total of 17.512 firms in Europe, the thior listing gap owns to Germany with 2833 companies). Oxera considered companies with revenues of 50 million euros and above and assets of more than 43 million or 250 employees.

Quaestio Italian Growth Fund sold the majority (8.22%) of its 9.94% stake in Milan-listed Tinexta (fka Tecnoinvestimenti) through an accelerated bookbuilding (abb) procedure at 18.50 euros or 71.9 million euros. Quaestio signes a 90 days lock-up on its remaining 1.7% of the company. Tinexta listed in 2014 through a capital increase of 22.8 million and a share price of 3,40 euros (see here a previous post by BeBeez).

Investment AB Latour acquired Vega from Paolo Vitturini (ceo) and its other founders (see here a previous post by BeBeez). Vega has sales of above 20 million euros.

Raffaele Cappiello, the extraordinary administrator of troubled Milan-listed Stefanel, called for a new expression of interest for the company’s assets by 20 November, Friday (see here a previous post by BeBeez). The company previously attracted two non-binding offers that Cappiello deemed as inadequate. Stefanel applied for receivership on 14 December 2018 after having announced losses of 20.9 million euros 3Q18 and an equity value of 7.5 million. Treviso Court accepted the company’s application on 11 January 2019.

SisalPay|5 rebranded as Mooney (see here a previous post by BeBeez). Mooney is born out of the integration of SisalPay with Banca 5, part of Intesa SanPaolo. SisalPay acquired the payment activities of Sisal Group and Banca 5 at the end of 2019. Mooney belongs to Sisal Group (70%), a portfolio company of CVC Capital Partners, and to Banca 5 (30%). Sisal has a turnover of 869.4 million, an adjusted ebitda of 259.6 million and a net financial debt of 731 million.