On 25 November, Wednesday, Stefania Peveraro, the Chief Editor of BeBeez and chairwoman of EdiBeez, and Alessandro Fischetti, the ceo of Leanus, will host a webinar about the receivership procedures for 2019/2020 (see here a previous post by BeBeez). Sign up here to get further information and register for the event

On 25 November, Wednesday, Stefania Peveraro, the Chief Editor of BeBeez and chairwoman of EdiBeez, and Alessandro Fischetti, the ceo of Leanus, will host a webinar about the receivership procedures for 2019/2020 (see here a previous post by BeBeez). Sign up here to get further information and register for the event

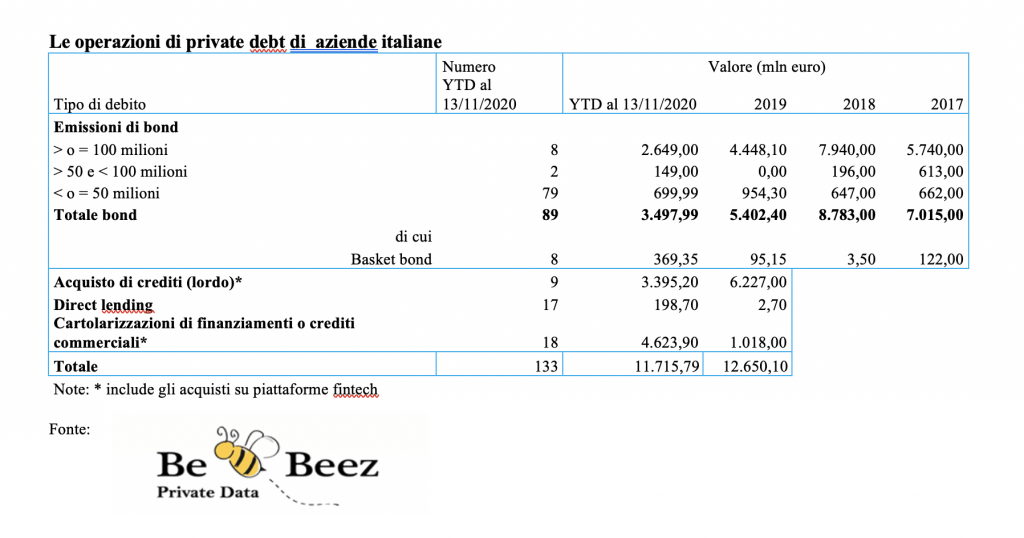

The coronavirus crisis pushed private debt investors to focus on industrial projects, said Innocenzo Cipolletta, the chairman of AIFI, the Italian Association of private capital operators (see here a previous post by BeBeez). Private debt and direct lending funds are increasingly supporting private equity for their acquisitions through the issuance of loans, mezzanine, subordinated and convertible facilities and are increasing their risk appetite. BeBeez Private Data says that since the January direct lending and private debt investors, including Utp corporate funds, securitization SPVs and investors active on fintech platforms, made investments for 11.7 billion euros in Italian companies (12.65 billion in the whole 2019) (see here the Report Private Debt 2019, available for BeBeez News Premium and BeBeez Private Data subscribers, see here how to subscribe).

In light of the COVID-19 crisis, the most frequent credit rating of minibonds issuers is B2.1, while in 2015-2019 it was of B1.2, this means down to speculative grade to investment grade, Fabrizio Negri, the ceo of Cerved Ratings Agency (CRA), said to BeBeez ahead of the presentation of the company’s private debt report and the Private debt investors forum (see here a previous post by BeBeez). CRA analysed 215 issuers of minibond for which provided a corporate rating since 2014. However, investors are still interested in such asset class. Since January 2020, issuances amount to 3.5 billion euros, BeBeez Private Data says.

Real Sud issued a 2 million euros minibond that HI CrescItalia PMI Fund, a subsidiary of Hedge Invest, subscribed (see here a previous post by BeBeez). The company aims to list on Milan market in 2021. Real Sud belongs to the Rispoli Family, Clemente Rispoli is the ceo and has sales of 13.3 million with an ebitda of one million. The senior unsecured bond pays a fixed rate coupon of 5.8% and is due to mature on 30 September 2025 with a quarterly repayment after an initial pre-amortising period of 6 monts. Fondo Centrale di Garanzia will provide a warranty for up to 90% of the issuance through MCC. di Real Sud.

Secap (Società Edile Costruzioni e Appalti Provvisiero), an Italian contractor, issued a minibond of 2.5 million euros that Unicredit subscribed (see here a previous post by BeBeez). Fondo Centrale di Garanzia provided a warranty for 90% of the issuance. This minibond pays a quarterly floating-rate coupon and matures in 6 years. Ciro Palma is the ceo of Secap which has sales of 34 million, an ebitda of 1.16 million and will invest such proceeds in its organic development. Sign up here for BeBeez Newsletter about Private Debt and receive all the last 24 hours updates for the sector.

Unicredit signed an agreement with Italian wine producer Banfi of which the Mariani family is the controlling shareholder and Enrico Viglierchio the ceo (see here a previous post by BeBeez). Unicredit allocated 6 million euros of supply chain finance facilities for cashing the invoices of Banfi’s suppliers through Unicredit Factoring. Simone del Guerra is the ceo of Unicredit Factoring. Banfi has sales of 64 million euros. Unicredit signed reverse factoring agreements with Milan-listed yacht producer Sanlorenzo and Unico a wholesale supplier of drugs. Sign up here for BeBeez Newsletter about Private Debt and receive all the last 24 hours updates for the sector.

Augens Capital and Bank of Montréal raised for their asset HOFI a direct lending facility of 3 million euros from Anthilia Capital Partners (see here a previous post by BeBeez). Giovanni Landi is the ceo of Anthilia Capital Partners. HOFI’s controlling shareholders are Augens Capital and BMO Global Asset Management, part of Bank of Montreal. Since 2019, HOFI owns Impresa San Siro American Funeral which is implementing a growth strategy through M&A. Sign up here for BeBeez Newsletter about Private Debt and receive all the last 24 hours updates for the sector.

Magnetar Capital carried on a recapitalization of Zoom Immersive Experience, the owner of Zoom bio park (See here a previous post by BeBeez). Magnetar Capital converted in equity part of the 18 million euros convertible loan that agreed to the CasettaFamily for acquiring the stakes that Ersel Asset Management and Invitalia Ventures had in the company. Magnetar provided the company with fresh resources of 2 million through the subscription of further bobds. Zoom has sales of 7.4 million with an ebitda of 2.9 millions and a net financial debt of 3.8 millions.

Milan Court sentenced the bankruptcy of Utet Grandi Opere which had applied for receivership on 24 March (see here a previous post by BeBeez). Luca Giani, the judge in charge of the procedure, appointed Roberta Zorloni as insolvency administrator. The company’s creditors will meet on 2 March 2021 for tracing the assets of the company. On 31 August 2020, the company’s liabilities amounted to 6.5 million euros while assets were worth 2.26 million, with losses of 0.566 million.

The European Commission aims to issue by the end of 2020 a statement about the NPEs, the Economy commissioner Paolo Gentiloni said (see here a previous post by BeBeez). The European banking system may face a higher amount of NPEs and therefore it needs the right normative frame for insolvency and credit recovery, while further developing a secondary market for distressed credits.

Cherry Sea, the observatory of Cherry Bit, the artificial intelligence platform of Cherry for the appraisal of distressed credits said that the bankruptcy procedures in Italy can vary in each court (see here a previous post by BeBeez). This aspect has a direct impact on the price of NPLs.

Intesa Sanpaolo sold to Banca Ifis a portfolio of NPLs with a face value of 553 million euros (see here a previous post by BeBeez). At the end of 3Q20, Intesa Sanpaolo had NPEs for 29 billion euros (35.6 billion including those of UBI Banca), down from 29.9 billion at the end of 2Q20. The bank has a gross NPE ratio of 6.9% (7% with UBI Banca) and a net NPE of 3.3% (3.5% with UBI).

Alantra appointed Francesco Dissera as managing director for the securitization activities (see here a previous post by BeBeez). Dissera will work with James Fadel for the secured funding activities. Dissera previously worked for Banco Santander, StormHarbour Securities, UBS, and JP Morgan.

Aquila Capital acquired the road lighting networks of eight Italian municipalities (see here a previous post by BeBeez). The assets are worth in the region of 3 million euros. Aquila carried on the transaction with the same return criteria of the social impact bonds. Roman Rosslenbroich is the ceo and co-founder of Aquila Group which has assets under management for 11.1 billion. Sign up here for BeBeez Newsletter about Private Debt and receive all the last 24 hours updates for the sector.

Clessidra Holding, the private equity that belongs to Italmobiliare and the Pesenti Family, launched Clessidra Capital Credit sgr (see here a previous post by BeBeez). The new asset management company will manage the investments in corporate UTPs made by the Clessidra Restructuring Fund which already raised 320 million euros through the acquisition of a portfolio of credits of 10 banks. Clessidra is reportedly acquiring Compagnia europea factoring industriale (Coefi). Sources said to BeBeez that Coefi’s business has strong synergies with Clessidra Restructuring Fund.

Unicredit sold to Illimity a portfolio of corporate UTPs with a gross value of 153 million euros (see here a previous post by BeBeez). This transaction is the seconda tranche of a deal worth 600 million. After this closing, Illimity’s portfolio of NPEs will amount to 7.7 billion (1.7 billion of Utp).

Giuseppe Castagna, the ceo of Banco Bpm, said that Italian banks may face an excess of UTPs and NPLs from January 2021 due to coming back in charge of the calendar provisioning rule (see here a previous post by BeBeez). Corrado Passera, the ceo of Illimity, said that Government-backed bad banks should leave space to private players in the market. Anna Tavano, the head of Global Banking Italy of Hsbc, said that the Italian Government has to support the aggregation of Italian mid-market companies that otherwsie may become takeover targets. Fabrizio Pagani, Global Head of Economics and Capital Markets Strategy of Muzinich & Co, said that the economic recovery has a K shape as the manufacturing sector is growing and services are in crisis.