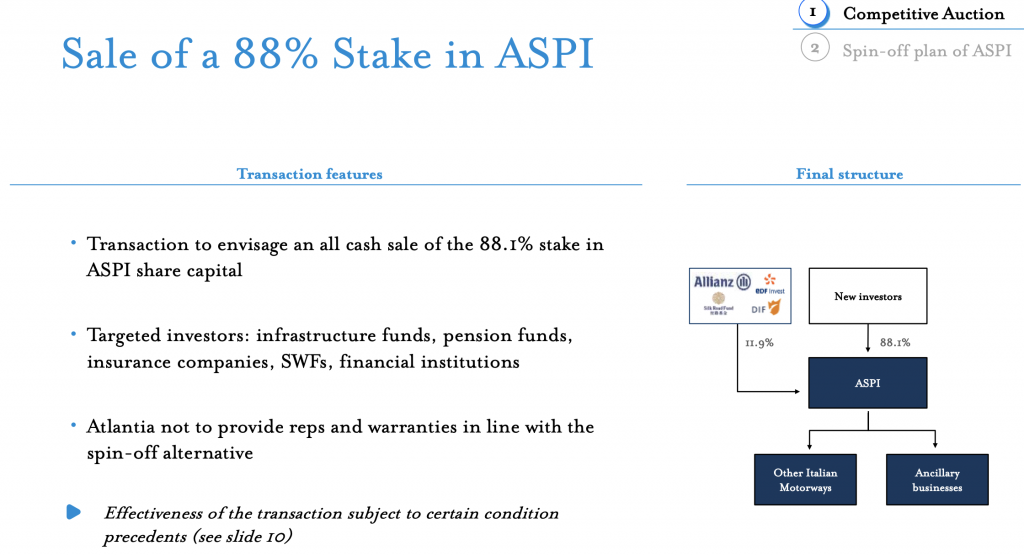

On 14 October, Wednesday, Atlantia’s shares closed up 9.16% at 14.48 euros after the announcement of exclusivity talks for the sale of 88.06% of the subsidiary Autostrade per l’Italia (ASPI) with Cassa Depositi Prestiti until 18 October, Sunday, (see here a previous post by BeBeez). Earlier in September, the directors of Atlantia announced the launch of a dual track process for the sale of the stake in ASPI.

On 14 October, Wednesday, Atlantia’s shares closed up 9.16% at 14.48 euros after the announcement of exclusivity talks for the sale of 88.06% of the subsidiary Autostrade per l’Italia (ASPI) with Cassa Depositi Prestiti until 18 October, Sunday, (see here a previous post by BeBeez). Earlier in September, the directors of Atlantia announced the launch of a dual track process for the sale of the stake in ASPI.

The directors of Seci, the holding of Maccaferri Group, accepted the bid that Carlyle, Man GLG and Stellex Capital (Ad Hoc Group – AHG) tabled for Officine Maccaferri (see here a previous post by BeBeez). Seci applied with Bologna Court for a quick sale procedure on the ground of Carlyle bid. Sources said to BeBeez that Officine Maccaferri hasn’t attracted other binding offers. French contractor Vinci expressed interest for Officine. Gruppo Maccaferri reportedly attracted offers for some of its subsidiaries that have debt of 750 million euros and are in receivership. Bonfiglioli Riduttori tabled a bid for Sampingranaggi, while Samp Machine Tools attracted the interest of Emag and an Anglo-Chinese bidder. Belgium’s Gauder & Co. is instead interested in Samp Sistemi. Maccaferri is also holding talks for the sale of Naturalia Ingredients and Powercrop.

The chairmen of the 20 Italian Football teams that are part of Lega Calcio Serie A decided to hold exclusive talks with Advent International-CVC Capital Partners-FSI who aim to acquire a 10% of the media company that will handle the contents of the Italian football league (see here a previous post by BeBeez). The funds will receive the the financing support of Goldman Sachs on the ground of an enterprise value of 16 billion euros. Advent-CVC-FSI were reportedly competing with Bain Capital–NB Renaissance Partners (See here a previous post by BeBeez). These investors aimed to buy a 15% of the media company that Lega could buy back after at least six years for up to 1.35 billion.

London Stock Exchange Group (LSEG) agreed to sell Borsa Italiana to Euronext, Cdp and Intesa SanPaolo for 4.325 billion euros (16.7x adjusted ebitda) (see here a previous post by BeBeez). LSEG will invest such resources in reducing the debt due to the acquisition of Refinitiv for a total amount of liabilities to 1-2x ebitda. Borsa Italiana reportedly also had attracted the interest of Deutsche Borse and Six. The closing of such sale to Euronext-Cdp is pending on the authorization of the European Commission to LSEG for acquiring Refinitiv. The deal on Borsa Italiana, which is expected to close by the first half of 2021, will be financed by CDP and Euronext through a mix of existing cash (300 million euros), a 1.8 billion euros loan facility provided by a pool of banks (Bank of America Merrill Lynch, Crédit Agricole Corporate and Investment Bank, HSBC France and JPMorgan Securities plc) and new equity capital in the form of a capital increase in Euronext subscribed in a private placement reserved to Cdp Equity and Intesa Sanpaolo (700 million euros, respectively for a 7.3% and a 1.3% stake) and a rights offer to Euronext’s shareholders (1.7 billion euros). After such transaction, the Italian market will be the most relevant within Euronext as it will generate one third of the firm’s 1.3 billion turnover (with an ebitda of 711 million). In 2019, Borsa Italiana generated a turnover of 478 million and an ebitda of 278 million.

CPI Property Group (CPIPG), a Luxembourg-based real estate investment vehicle that belongs to Radovan Vítek, is buying Nova Re siiq for handling and carrying on its Italian investments (see here a previous post by BeBeez). On 7 October, the board of directors of Nova RE accepted the bid of CPIPG that will invest 2,36 euros per share or 26 million euros for an above 50% stake of the target and then launch a public offer on the remaining shares. The 26 million capital increase i spending on the approval of one of the lenders of Nova Re.

One Equity Partners (OEP) suspended the sale of Lutech (see here a previous post by BeBeez). The fund has actually launched a public tender offer on Milan-listed Techedge and, if it will be succesful, a merger between Techedge and Lutech is highly expected. The hypothesis of a possible merger between Techedge and Lutech had already been recently highlighted by BeBeez, while reporting the considerations of the Board of Directors of Techedge regarding the offer. In fact, we recall that the bid, which started on 25 September and will end on 23 October 2020, although made in agreement with some of the major shareholders, finds an obstacle in the Board of Directors led by the ceo Domenico Restuccia, the main shareholder of the company both directly (0.34%) and indirectly through Jupiter Tech Ltd and Jupiter Tech srl (31.7%). Moreover, Restuccia has just committed itself to purchase another 1.22% of the share capital by the end of the year. In its comment on the conditions of the takeover bid, Techedge’s BoD stressed in fact, among other things, that “if the idea of a possible and not excluded integration with Lutech, the Board of Directors cannot fail to report the risk in terms of prejudice to the overall financial balance of the group in light (…) of the debt position and level of financial leverage of Lutech itself and/or the group it heads”. The private equity fund will pay 5,40 euros per share or 113 million euros for delisting Techedge.

Vam Investments, Fondo Italiano d’Investimento (FII) and Italmobiliare acquired Italian fashion firms Giuntini, Ciemmeci Fashion and Mely’s Maglieria and launched Florence, a pole for luxury clothing (See here a previous post by BeBeez). The funds will own 65% of the companies while the remaing stake will belong to the targets’ founding families Giuntini, Capezzuoli, Maltinti, Ciampolini, and Sanarelli. Societè Generale, Intesa Sanpaolo, Banca Nazionale del Lavoro, Cassa Centrale Banca, and private debt fund Green Arrow financed t he buyers. Florence expects to generate sales of 150 million euros under the leadership of ceo Attila Kiss and chairman Francesco Trapani, the controlling shareholder of Vam Investments, in which invested Tages and founder ceo Marco Piana.

Holding Industriale (Hind) acquired Albachiara, a third parties producer of luxury wome clothing (see here a previous post by BeBeez). Albachiara’s founders Fabio Maggini and Barbara Burzi sold their shares in the company and will keep their operative roles as well as the ceo Giulio Guasco. Albachiara has sales of more than 2 million euros. Giulio Guasco leads Hind who previously acquired RBS, a competitor of Albachiara, and a stake in Alex&Co, a producer of leather accessories through Holding Moda that generated sales 52 million euros.

Pool Service/Medavita, a producer of hair cosmetics that belongs BlueGem, acquired the Italian competitor Panzeri Diffusion from the founder Ivano Panzeri (See here a previous post by BeBeez). Bluegem owns Pool Service/Medavita in July 2019 on the ground of an enterprise value of 64 million euros, or 9X ebitda. Panzeri has sales in the region of 49 million. Stefano Banfo, will be the ceo of the merged companies that will have a turnover of 90 million and an enterprise value of 130 millioni di euro. Bluegem has assets under management for 600 million. Pool Service/Medavita is a company monitored by BeBeez Private Data (find out how to subscribe for only 110 euros a month).

First Advisory, a financial services firm of which Riello Investimenti owns 51% since April 2020, acquired Life & Wealth, a life insurance broker that handles transactions for 3 billion euros (See here a previous post by BeBeez). The target’s founder Renato Lot joined First Advisory whose managers Massimiliano Merlo, Giuseppe Frasca and Lorenzo Fanti hold 49%. Riello Investimenti is one of the private capital investors that BeBeez Private Data monitors. Find out here how to subscribe to the Combo version that includes BeBeez News Premium.

Ambienta acquired Mobert, an Italian producer of machinery for the eco-packaging industry (See here a previous post by BeBeez). The fund will merge Mobert with Amutec, a company that acquired in 2019, and with Scae Europe, purchased in June. Mobert has sales of 11.5 million euros, an ebitda of 2.35 million and net cash of 4.8 million. Mobert, Amutec and Scae Europe will be part of In.Pack Machinery, an industrial pole for the eco-friendly packaging.

Tinexta, a Milan-listed Credit Information & Management company, acquired 70% of Corvallis’ units for IT and R&S (see here a previous post by BeBeez). Tinexta also acquired 60% of Yoroi (the owner of Cybaze, Emaze and @Mediaservice.net) and 51% of Swascan. Tinexta signed a put/call agreement for acquiring the 46.5 million euros worth minorities of the targets (Corvallis – 30%; Yoroi – 40%; Swascan – 49%) in 2024. Tinexta will invest 47.8 million (including an earn-out of 0.6 million) for acquiring the company will take over also the 7 million liabilities. The buyer will finance such buys with its own resources and banking facilities. The enterprise value of the three targets is of 85.2 million or 10-11 X the expected ebitda for 2020, the put\call agreement amounts to 8 X the expected ebitda for 2023.

GTS, a provider of low cost train journeys, hired Mediobanca as it is looking for a minority investor that could take an up to 25% stake (see here a previous post by BeBeez). The company belongs to the Muciaccia Family and its ceo is Alessio Muciaccia while Giuseppe Desantis is the coo. GTS has sales of above 100 million euros with an ebitda in the region of 18 million.

The Italian fashion company Parajumpers is about to attract the offers of L-Catterton and Oakley Capital (see here a previous post by BeBeez). According to rumours, the company had an enterprise value of 120 million euros before the lockdown. Parajumpers belongs to Ermanno and Giuliano Paulon who founded the company in 2006 together with Massimo Rossetti. Parajumpers has a turnover of 70 million, an ebitda of 12.2 milion and net cash of 12 million. The company aims to grow in USA and Japan.

Antonio Quintino Chieffo, the ceo of AC Finance and of the incubator Bemycompany, set a club deal for acquiring Rifle, the troubled Italian fashion company (see here a previous post by BeBeez). Kora Investments, a Swiss investment company that Alessandro Pallara and Salvatore Insinga lead, acquired 44% of the company in 2017 and in 2018 raised its holding to 55%. Rifle has sales of 16 million euros, an ebitda of minus 4.3 million and net cash of 0.572 million.

Made in Italy Investimenti – Monferrato’s general manager Andrea Bruzzone said that the financial firm is assessing the acquisition of Italian football team Genoa Calcio (See here a previous post by BeBeez). In 2021-2023, Made in Italy plans to invest 120 million euros in the sectors of infrastructures, agrifood (especially in the field of wine), spa tourism termale, and energy. On 12 October, Monday, Gestio Capital, a London-based family office that Matteo Manfredi founded, withdrew its 105 million bid for Genoa Calcio that tabled in August together with Andrea Radrizzani, an undisclosed private equity firm and Aser Ventures. In June 2019, York Capital held talks for acquiring Genoa Calcio whose chairman Enrico Preziosi hired Assietta for selling the team. Genoa Calcio has net profits of 10.2 million.

Lifestyle Impact & Innovation (LII), a Luxembourg private equity vehicle that Mirabaud Asset Management launched earlier in January, may reach its first fundraising closing by the end of October (See here a previous post by BeBeez). LII aims to raise 200 million euros by 2021. Mirabaud started to invest in the private equity sector in 2017 after having hired former French Ministry for SMEs Renaud Dutreil who also acted as chairman for LVMH North America and as director of LCapital. Mirabaud will focus its private equity investments in those companies of the luxury sector that have an innovative technology and an ESG approach.

FSI is holding exclusive talks for acquiring a stake in Givi, a producer of accessories for bikes (See here a previous post by BeBeez). Givi belongs to the Visenzi Family and hired Lazard as its financial advisor. Giueppe Visenzi is the company’s chairman and his daughter Hendrika is the ceo. Givi has sales of 111.1 million euros, an ebitda of 25.8 million, net profits of 17 million, and net cash of 10.6 million. Givi aims to list on the stock market.

Italy’s unlisted SMEs that resort to private capital investors should get tax incentives, said Paolo Langé, the chairman of the Italian Association for Private Banking (Aipb) during an audition of the Finance Commission of the Italian Parliament (see here a previous post by BeBeez). Wealthy individuals may channel in the real economy their 862 billion euros worth resources that private bankers are currently managing. Aipb suggested the Italian Government to convince the European Commission and the ESMA to rank as semi-professional investors those private clients with resources of above 0.5 million euros and sophisticated advisors; allow them to invest 0.1 million (from current 0.5 million), and to agree tax incentives for investments in Eltif (European Long Term Investment Fund). The companies that raise private capitals should also get significant tax incentives that would include advisory fees as well.

The Salary Survey for the private equity sector of PageGroup said that the salary of analysts and investment managers in Italy amounts to 30K -0.12 million euros per year (see here a previous post by BeBeez). The gross salary is proptortional to the size of the fund.

Atum Technologies & Solutions, a Milan-based insurtech company, acquired Tecso, a firm operating in the fields of analytics, big data and information governance (see here a previous post by BeBeez). Atum has sales of 1.69 million euros, an ebitda of 0.211 million and net cash of 0.633 million.