The consortium made by CVC Capital Partners, Advent International and FSI has been awarded the exclusive talks with Lega Calcio Serie A to proceed with the project to set up a media company to which the TV rights of the 20 associated soccer clubs will be transferred, as decided by the Lega in a previous meeting at the beginning of September (see here a previous article by BeBeez). This was announced by the Lega yesterday afternoon, after the meeting which voted by a large majority (15 votes in favor and 5 abstentions, i.e. Naples, Lazio, Verona, Udinese and Atalanta) to proceed with the negotiation of the terms and conditions of the offer . A special League Commission will start negotiations with the consortium for a period of 4 weeks. The Commission is made up of Juventus, Rome, Bologna, Udinese and Naples (see the press release here). The alternative offer on the table was the one by a consortium made up of Bain Capital and NB Renaissance Partners. Actually, at the last minute, on Monday 12th, Fortress too finally delivered its own bid (see here Calcio e finanza), which had been rumored before for some time but never materialized (see here a previous article by BeBeez).

The company, the note states, also “highlighted the moment of great economic difficulty linked to the certain decrease in revenues from stadiums and consequently from sponsorships, against costs, especially labor, which remained unchanged (on the subject see a previous article by BeBeez, note of the editor). The topic will be the subject of an upcoming Lega Serie A meeting which hopes an institutional intervention to safeguard the financial stability of the top league, the engine of the entire Italian football pyramid “.

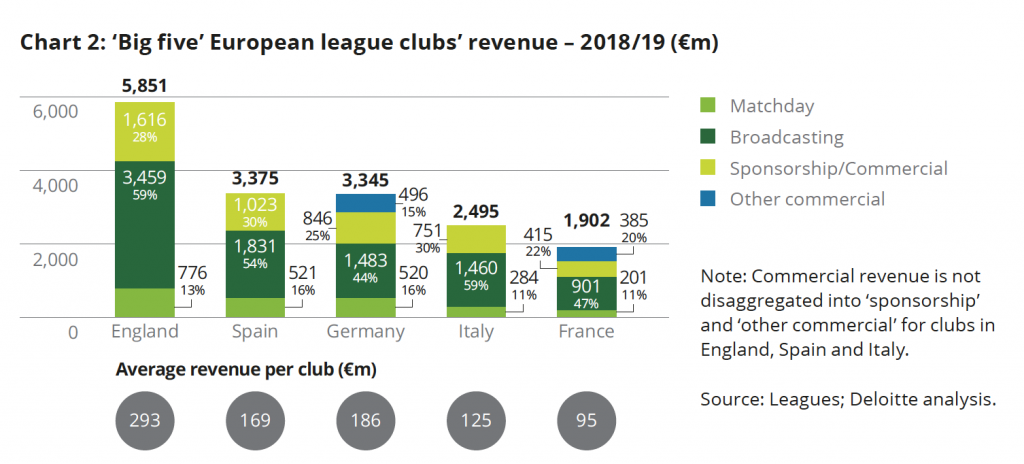

Recall that, according to Deloitte’s Annual Review of Football Finance 2020, TV rights represent 59% of the revenues of all Italian Serie A teams. Serie A is the fourth richest football league in Europe, behind England, Spain and Germany, capable of generating approximately 2.5 billion euros in revenues in the 2018-2019 season, out of a European total of 28.9 billions.

As is well known, the proposal of the three funds provides for the purchase of a 10% stake in the media company that Lega Calcio will set up to manage the TV and commercial rights and which overall would be valued at over 16 billion euros. The funds, in fact, would inject up to 1.625 billion euros for their stake, with a guaranteed minimum (see here a previous article by BeBeez). And the most interesting fact would be an advance of 1.1 billion to be paid immediately, at closing, to pump oxygen into the club accounts. As for the exit, the offer includes a first offer right for the Lega in the event that the funds wish to sell their stake and a call option in favor of the Lega at fair market value, which some estimates place around 2 , 8 billion (14x the expected ebitda).

The consortium of the three funds seems particularly strong, given that CVC already has a solid investment experience in the sports field (Formula 1, MotoGP and rugby), and Advent in the media sector (see the list of investments here), while FSI , led by Maurizio Tamagnini, guarantees the consortium an Italian side. Furthermore, the consortium’s project does not stop there, because the idea of using part of the capital to launch an infrastructural fund, which could provide financial support for the creation of new stadiums, for the Italian clubs that have it has also returned. planned, or for the renovation of existing stadiums. This is an idea that CVC has been studying since last May (see here a previous article by BeBeez). Last June the FSI fund had come into play alongside CVC when the fund was still in exclusive negotiations with the Lega (see here a previous article by BeBeez) and it was said that involving an Italian investor of solid reputation in the operation would have been a very welcome aspect to the presidents of the various clubs, especially since FSI sgr is 51% controlled by Mr. Tamagnini and the other managers, but the other 49% is owned by Cdp and Poste Vita (see here a previous article by BeBeez) . Then CVC’s exclusive period had expired without a stalemate, also because in the meantime much higher informal offers had arrived from other subjects, in particular from Advent International and Bain Capital (see here a previous article by BeBeez) and therefore the tender was officially reopened, with Lazard acting as advisor (see here a previous article by BeBeez). With CVC at the window, FSI was still in the game by taking the field alongside Advent, who was said to have valued Lega Calcio Serie A at 13 billion euros, compared to the valuation of 10-11 billion on which CVC was reasoning when it was exclusive. The three funds then decided to join forces and up the ante. The consortium’s advisors are Rothschild, Credit Suisse and Barclays on the financial level and the Gattai Minoli Agostinelli firm on the legal level. Goldman Sachs is said to be ready to finance the consortium.