The Milan-listed paytech Nexi yesterday left 5.75% on the ground in Piazza Affari, after the shareholders private equity funds Bain Capital, Advent International and Clessidra, united in the Mercury UK Holdco investment vehicle, sold another 13.4% stake of Nexi’s capital in an accelerated bookbuilding process, thus reducing their stake to approximately 20% (see the press release here).

In detail, the vehicle sold 84 millions of Nexi ordinary shares for a value of approximately 1.3 billion euros. The placement was made at a price of 15.5 euros per share, which is an 8% discount on Oct. 6th’s closing price. Following the operation, the free float now exceeds 50% of the capital. In the transaction, Mercury was assisted by Legance. Bookbuilding was handled by Barclays, Citigroup and Goldman Sachs as joint global coordinator and joint bookrunner.

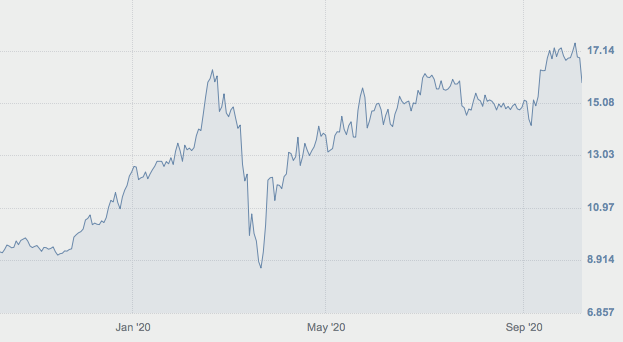

The funds had previously reduced their stake in Nexi, again with an abb process, last May, selling around 55 million shares, equal to 8.8% of the capital, at a price of 14.2 euros per share for a total of 781 million euros (see here a previous article by BeBeez) and last January, selling around 48.5 million shares, equal to 7.7% of the capital at the price of 11.6 euros per share for a total of 560 millions (see here a previous article by BeBeez). At the end of June, the closing of the transaction was signed with which the company branch of Intesa Sanpaolo relating to the acquiring activity carried out for over 380 thousand points of sale was transferred to Nexi. As part of the transaction, Intesa Sanpaolo purchased Nexi shares equal to 9.9% from Mercury UK HoldCo, at a price of 653 million euros (see here a previous article by BeBeez). Following all these operations, therefore, the funds still held approximately 30.4% of the paytech capital.

The sale just announced took place after the announcement of the merger of Nexi with Sia, the leading group in payment services and infrastructures, controlled by Cdp Equity (see here a previous article by BeBeez). Mercury has committed about a lockup period on the remaining stake of Nexi’s cpaital which, once the sale is completed, will be equal to 126 million shares, corresponding to 20.1% of the capital and 14% of the capital pro-forma post merger with Sia. The lockup will concern 100% of the shares in Mercury’s hands for the first 6 months following the closing of the Sia transaction and 50% of the equity investment for the following 12 months under certain conditions. At current market values, the new group will have a total capitalization of over 15 billion.

Nexi closed 2019 with 984.1 million euros in revenues, an ebitda of 502.5 million and a net financial position of 1.47 billion, a clear improvement from 2.45 billion at the end of 2018, thanks to the repayment and refinancing of past debt (see here a previous article by BeBeez) and to the cash generation for the period. Last April Nexi then placed 500 million euros of unsecured equity-linked senior bonds maturing in 2027 to finance part of the consideration provided for the acquisition of the merchant acquiring activities from Intesa Sanpaolo (see here a previous article by BeBeez).

Nexi is one of the companies monitored by BeBeez Private Data, the private capital databaseby BeBeez

See here how to subscribe for just 110 euros per month