The twenty chairmen of the football clubs members of Italy’s Lega Calcio Serie A, the top soccer League in Italy, held their meeting yesterday and unanimously gave the green light to the project aiming to create a media company in which the multi-year TV rights of the League could be brought together. A project that will be supported by private equity funds.

The response to the plan Lega’s chairman, Paolo Dal Pino, was not taken for granted, given that fears had spread that Claudio Lotito, chairman of the Lazio club, was known as hostile to the idea of private equity firms having hands on the Lega tv rights and was more inclined to a solution on the debt front. Mr. Lotito was said to be managing to bring at least 5 other colleagues to his side. In fact, to pass with a general meeting vote, the project needed at least 14 votes in favor out of 20. In particular, it was necessary to understand what Napoli’s chairman, Aurelio De Laurentiis, would have decided as in recent months he had been the proponent of an alternative project for the creation of a production company that should have been 100% owned by Lega Calcio and that would have directly managed the TV rights. In that case the project would have been financed by credit funds (see here a previous article by BeBeez). In reality, then, both Mr. Lotito and Mr. De Laurentiis also aligned themselves with the will of the majority.

At this point, the only two binding offers that have arrived on the table will be examined. A job, this one, which is said to take no more than a fortnight and with an upcoming meeting that will vote on the preferred offer. “Now there are some steps to take, we will deepen the two proposals of the consortiums for the media company because there are some details to be verified. If the negotiation does not go through, the only solution remains the media company, regardless of the presence of the funds. but it would be only the last resort “, said President Dal Pino, who spoke at the press conference at the end of the meeting (see ANSA here). And Mr. Dal Pino added: “The League has worked for years with intermediaries, but it is time for the value to remain at home. Unanimity? It is not me who convinced anyone, it was they who convinced themselves along the way. It is difficult for someone to row against the overall interest. We do not have different visions on the future. Call for TV rights? We will do it anyway, there are times and we will fit everything “.

In recent months, various names of potential investors interested in the rich deal have alternated and in particular in recent days the strong interest of Fortress has emerged, with an investment proposal on the debt front, in consortium with Apax Partners and The Three Hills Capital Partners private equity firms (see here a previous article by BeBeez). But in the end the forces left in the field with an official proposal are just two.

From one top is the three-party consortium Advent International-CVC Capital Partners-FSI. The proposal that provides for the purchase of a 10% stake in the media company that Lega Calcio will set up to manage TV and commercial rights and which overall would be valued at over 16 billion euros. The funds, in fact, would inject 1.625 billion euros for their share, with a guaranteed minimum (see here a previous article by BeBeez). The consortium of the three funds seems particularly strong, given that CVC already has a solid investment experience in the sports field (Formula 1, MotoGP and rugby), and Advent in the media sector (see the list of investments here), while FSI , led by Maurizio Tamagnini, guarantees the consortium an Italian side. Furthermore, the consortium’s project does not stop there, because the idea of using part of the capital to launch an infrastructural fund, which could provide financial support for the creation of new stadiums, for the Italian clubs that have it has also returned. planned, or for the renovation of existing stadiums. This is an idea that CVC has been studying since last May (see here a previous article by BeBeez).

Last June the FSI fund had come into play alongside CVC when the fund was still in exclusive negotiations with the League (see here a previous article by BeBeez) and it was said that involving an Italian investor of solid reputation in the operation would have been a very welcome aspect to the presidents of the various clubs, especially since FSI sgr is 51% controlled by Tamagnini and the other managers, but the other 49% is owned by Cdp and Poste Vita (see here a previous article by BeBeez). Then CVC had expired the exclusivity without a stalemate, also because in the meantime much higher informal offers had arrived from other subjects, in particular from Advent International and Bain Capital (see here a previous article by BeBeez) and therefore the tender it was officially reopened, with Lazard acting as advisor (see here a previous article by BeBeez).

With CVC at the window, FSI was still in the game by taking the field alongside Advent, who was said to have valued Lega Calcio Serie A at 13 billion euros, compared to the valuation of 10-11 billion on which CVC was reasoning when it was exclusive. The three funds then decided to join forces and up the ante. The consortium’s advisors are Rothschild, Credit Suisse and Barclays on the financial level and the Gattai Minoli Agostinelli firm on the legal level. A pool of banks led by Goldman Sachs is ready to finance the consortium.

The competing consortium is instead made up of two and is made up of Bain Capital and NB Renaissance Partners. The latter has joined with Bain Capital in recent weeks. The interest of Bain Capital was instead known as early as last June, when it was said that it had valued the Lega Calcio at 12 billion euros (see here a previous article by BeBeez). Now Bain Capital has also upped the ante and values the deal over 13 billion. The consortium’s proposal is in fact to inject 1.35 billion euros for 10% of the media company, but with the addition of variable components and a guaranteed minimum. The consortium’s financial advisors are Nomura and Mediobanca, while the legal advisor to Bain Capital is the Greenberg Traurig Santa Maria firm. Morgan Stanley, Mediobanca and Nomura would be ready to finance the consortium, but the pool could also include other Italian banks.

Meanwhile, on the political front, right wing party Fratelli d’Italia presented an urgent question to the government in the past few hours on the assignment of multi-year Serie A television rights with the aim of pushing the government to activate the golden power and stop the project. And, as reported yesterday by MF Milano Finanza, there are two other questions of the same content ready to go.

However, that the Lega Calcio issue is under the government’s lens is obvious. Also because the game on TV rights is intertwined with the future structures of telecommunications in Italy and with the destinies of other strategic companies. If the single network project is successful (see here a previous article by BeBeez), the competition between telecommunications companies will shift to content, the key to differentiating the offer and winning over customers. From this point of view, football would be the goal that everyone would like to achieve.

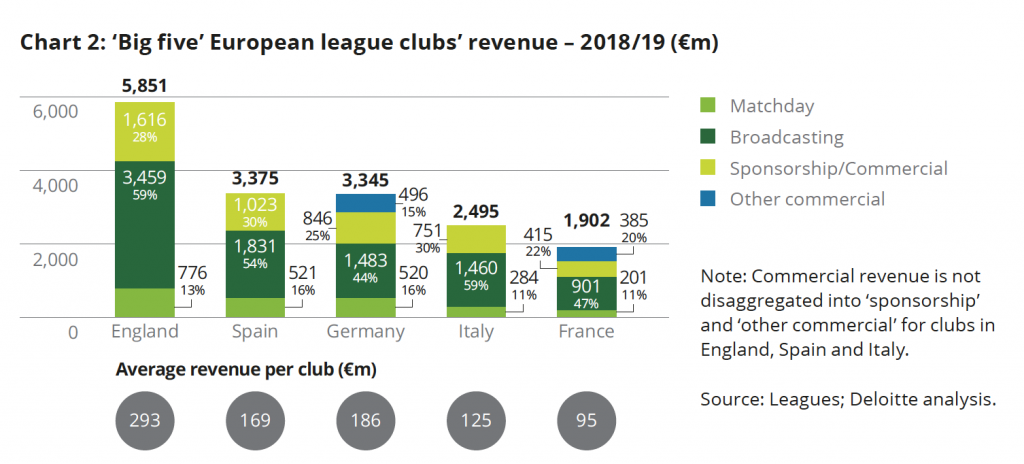

According to Deloitte’s Annual Review of Football Finance 2020, TV rights represent 59% of the revenues of all Italian Serie A teams. Serie A is the fourth richest football league in Europe, behind England, Spain and Germany, capable of generating approximately 2.5 billion euros in revenues in the 2018-2019 season, out of a European total of 28.9 billions.

EdiBeez srl