DWS Alternatives Global Limited has acquired 100% of Medipass srl, a company active in the sector of oncological treatments and advanced diagnostic imaging in Italy and the United Kingdom. The seller is KOS, an Italian group controlled by CIR (the Milan-listed investment holding owned by Italian entrepreneur Carlo De Benedetti) and also owned by Italy’s infrastructure fund F2i (see here the press release). DWS will carry out the acquisition through Inframedica sarl, a newco controlled by the DWS Pan-European Infrastructure III fund.

DWS Alternatives Global Limited has acquired 100% of Medipass srl, a company active in the sector of oncological treatments and advanced diagnostic imaging in Italy and the United Kingdom. The seller is KOS, an Italian group controlled by CIR (the Milan-listed investment holding owned by Italian entrepreneur Carlo De Benedetti) and also owned by Italy’s infrastructure fund F2i (see here the press release). DWS will carry out the acquisition through Inframedica sarl, a newco controlled by the DWS Pan-European Infrastructure III fund.

Prior to the divestiture, KOS will buy back its Indian subsidiaries Clearmedi Healthcare and Clearview Healthcare from Medipass. The acquisition of Medipass will be made on the basis of an enterprise value of 169.2 million euros and an equity value of approximately 103 million, net of the outlay incurred by KOS for the purchase of the assets in India. The consideration that will be paid at closing by DWS to KOS will be subject to adjustments, also linked to the actual financial situation of Medipass as of 30 September. The completion of the transaction, expected by the end of the year, is subject to the issuance of the necessary authorizations by the competent authorities and certain third party waivers in relation to KOS loan agreements.

In the transaction, KOS was assisted by the Carnelutti firm as legal advisor, by Mediobanca as sole financial advisor and by Deloitte for vendor due diligence. Dws was supported by Legance – associate lawyers as legal advisor, Nomura as financial advisor, DC Advisory as debt advisor, and PwC, Bain & Company, Rosa & Roubini and Marsh for due diligence.

Medipass is a leading provider of cancer care and advanced diagnostic imaging services in Italy and the UK. Acquired by KOS in 2006, Medipass has become one of the key players in providing private and public healthcare facilities with turnkey solutions for the management of diagnostics and cancer care departments, managing standard technologies (e.g. CT, RX, ultrasound imaging), advanced technologies such as Nuclear Medicine (PET-CT) for diagnostics activities, and Radiotherapy departments for cancer care. Medipass serves over 20 healthcare facilities (hospitals and clinics) in Italy and the UK and it is uniquely positioned to meet the growing demand in the sector for investments to renew and expand the existing stock of equipment providing life-saving services. In India today Medipass is one of the first providers of technological services for healthcare. Medipass closed 2019 with approximately 80 million euros in revenues, of which 20.7 million related to the Indian business. Regarding the India-based activity, the CIR note explains that “KOS will evaluate available options to realise its value“.

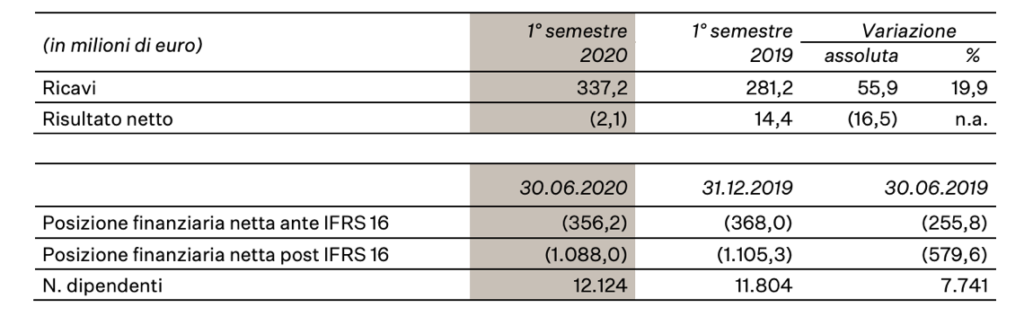

KOS currently manages 90 facilities in Italy, with almost 8,700 beds, and 47 in Germany, with about 4,000 beds. There are almost 13,700 collaborators, of which about 8,900 in Italy (7,400 employees) and about 3,800 in Germany. In 2019 KOS achieved a turnover of 595 million euros, of which about 10% related to the Medipass perimeter sold to DWS. The deal will allow KOS to realize a net capital gain of approximately 50 million and reduce debt by approximately 160 million, compared to a net debt of 356.2 million at 30 June last.

In the first half of 2020, the KOS group achieved revenues of 337.2 million euros (+ 19.9% from 281.2 millions in 6 months 2019) and consolidated ebitda was 65.3 millions, in line with the corresponding period of 2019 (65.9 millions). The improvement in numbers is the result of the contribution of the Charleston group, a German company active in the provision of residential services for non self-sufficient elderly and ancillary services for elderly and highly disabled patients, acquired by KOS in August 2019 from the Swedish private equity fund EQT (see here a previous article by BeBeez).

Last August KOS then sold two RSAs in Liguria and Veneto to a leading real estate fund. The facilities were also leased to the subsidiary Kos Care srl (see here a previous article by BeBeez). In March, however, KOS took over the health practice of the Villa Armonia Nuova nursing home, a Roman residential facility for the hospitalization and treatment of psychiatric pathologies authorized and accredited also for the treatment of eating disorders and for the treatment of beginnings psychiatric pathology in minor adolescents (see here a previous article by BeBeez).

F2i Healthcare, a vehicle company controlled by the F2i Second Fund and invested in by other investors, had invested in KOS in March 2016 (see here a previous article by BeBeez) when it bought a stake in KOS from Ardian for 240 million euros, while CIR had acquired the remainder for 52 million. At the same time, CIR had then acquired the residual stakes of management and other minority shareholders for 33 million, with the result that CIR had gone from 51.3% to 62.7% of the capital of KOS for a total investment of 85 million euros, while F2i had acquired a 37.3% stake. At the beginning of August 2016, Bahrain Mumtalakat Holding Company, a sovereign investment fund of the Kingdom of Bahrain, then invested indirectly in KOS, through the purchase of a stake in F2i Healthcare (see the press release at the time). As part of that transaction, CIR had sold 3.2% of KOS to F2i Healthcare for a consideration of approximately 20 millions. Following that transaction, CIR had risen to the current 59.53% and F2i Healthcare to 40.47%, with F2i remaining the majority shareholder of F2i Healthcare, with a 61.4% stake. .

DWS Infrastructure is a leading infrastructure investor and it is part of DWS Group & GmbH Co KGaA, an independent listed asset manager (ETR: DWS), with a presence in c. 40 countries and approximately 745 billion euros of assets under management (as of June 2020). DWS Infrastructure is one of the largest European infrastructure investors and has approximately 20.8 billions of assets under management as of December 2019. DWS Infrastructure seeks to create and add value to its funds’ investments through active asset management as well as through its network, experience and funding to achieve the company’s growth potential.

Hamish Mackenzie, Global Head of Infrastructure at DWS said: “We are delighted to invest in Medipass and to partner with its impressive management team in this next phase of its journey. Medipass has been one of the pioneers in the Cancer Care sector, offering outsourcing services in diagnostics and cancer care since the 1990s, with a consistent track record of providing patients with the highest quality of care using cutting edge technology. Medipass represents our third investment in Italy and the second investment for our fund, PEIF III, which is supported by a large component of Italian pension funds and insurance companies, and invests in infrastructure companies providing essential services across Europe. KOS has done an excellent job in growing the company over the past years. Together with the management team, we will look to leverage Medipass’ expertise, our resources and our experience as infrastructure investors, to further expand the Company’s presence in healthcare centers across Europe to enable them to enhance their technology parks and services for the benefit of their patients”.

EdiBeez srl