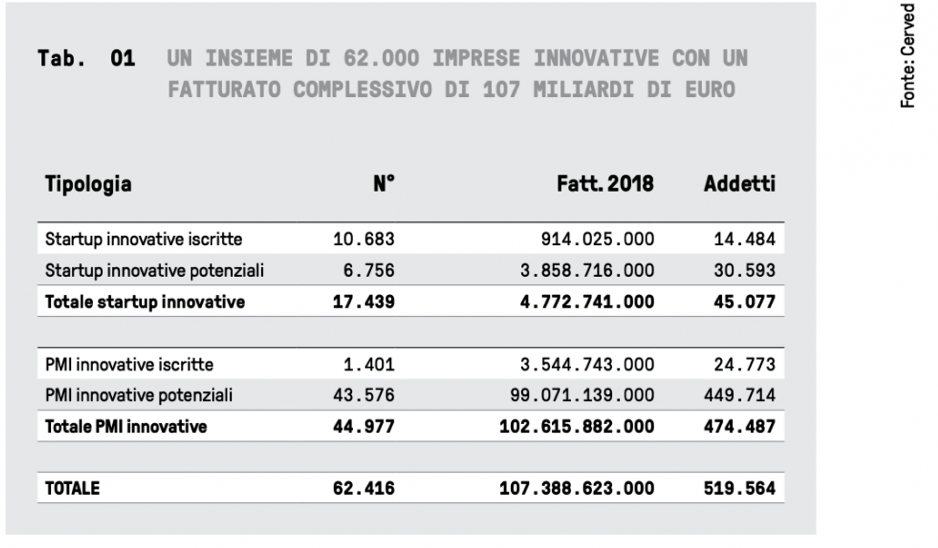

The economic value of Italian startups and SMEs held by investors or potentially subject to investment by venture capital investors is actually much higher than it seems, says the latest P101-BeBeez Venture Capital Report, which also incorporates the main market trends and deal numbers for 2019 (see here a previous post by BeBeez). This fact is firstly, because the induced value generated by many companies with their business is higher than the revenues they record. Secondly, because when it comes to startups and innovative SMEs, only the startups and innovative SMEs registered in the Italian public registers are taken into consideration by statistics and politics, assuming that only those ones represent interesting opportunities for venture capitalists. In reality, however, we know that for various reasons there are many startups and SMEs that do not register but are equally innovative or more. A study by SpazioDati (Cerved Group) made for the P101-BeBeez Venture Capital Report, says tha Italian startups and SMEs who are to be seen as “innovative” are then more than 62k.

The economic value of Italian startups and SMEs held by investors or potentially subject to investment by venture capital investors is actually much higher than it seems, says the latest P101-BeBeez Venture Capital Report, which also incorporates the main market trends and deal numbers for 2019 (see here a previous post by BeBeez). This fact is firstly, because the induced value generated by many companies with their business is higher than the revenues they record. Secondly, because when it comes to startups and innovative SMEs, only the startups and innovative SMEs registered in the Italian public registers are taken into consideration by statistics and politics, assuming that only those ones represent interesting opportunities for venture capitalists. In reality, however, we know that for various reasons there are many startups and SMEs that do not register but are equally innovative or more. A study by SpazioDati (Cerved Group) made for the P101-BeBeez Venture Capital Report, says tha Italian startups and SMEs who are to be seen as “innovative” are then more than 62k.

Cdp Venture Capital will invest 5.7 million euros out of 8 million available for the programme “Seed per il Sud” in 30 startups (see here a previous post by BeBeez). The Seed programme will pour up to 0.3 million in each startup by September 2020. Such investments will be available for 30 seed and pre-seed startups in partnership with 18 accelerators based in the South of Italy such as Entopan Innovation, 012Factory, Campania NewSteel, Arcadia Holdings, Auriga UK – The banking e-volution, Cube Labs srl, Digital Magics, Elteide Spa, H-FARM, ITDM, LVenture Group, SocialFare, Sprint Factory, The Net Value, The Qube, Boost Heroes, Nana Bianca, and BluHub -The Enterprises Engine.

CDP Venture Capital joined VC Hub Italia, an association of actors of the Italian ecosystem for startups (see here aprevious post by BeBeez). The founders of VC Hub are 360 Capital, Indaco Venture Partners, P101, Panakès Partners, PrimoMiglio, United Ventures, include anche LVenture Group, Sofinnova Partners, Milano Investment Partners, Oltre Venture, Endeavor Italia, Embed Capital, AurorA Science, Genextra, Gaia Capital, Boost Heroes, A11 Venture, Lumen Ventures, RedSeed Venture, Biovalley Investment Partners, and other corporate venture funds active in Italy. Francesco Cerruti is the coo of VC Hub Italia.

UCapital24, a Milan-listed global social network for finance, will merge through a reverse takeover with SelfieWealth, a roboadvisor that Edoardo Narduzzi founded and received the authorization from the FCA (see here a previous post by BeBeez). The shareholders of SelfieWealth will hold above 34% of the merged entity after having received new shares of UC24 worth 5.4 million euros. The company’s publicly traded equity will amount to 16%.

WeSchool raised 6.4 million euros from P101, Italia 500, Tim Ventures, Cdp Venture Capital, Club Digitale, andClub Italia Investimenti 2 (See here a previous post by BeBeez). WeSchool’s directors are Marco De Rossi (ceo), Andrea Laudadio (chairman) for Tim, Andrea Di Camillo (P101), Anna Paola Concia, and Salvo Mizzi. Marco Rossi founded WeSchool in 2016.

The e-commerce for luxury artisanal-made items Artemest raised 4.5 million euros from Olma Luxury Holdings,Brahma, Nuo Capital, Italian Angels for Growth, and Bagheera (See here a previous post by BeBeez). Artemest previously raised one million in 2017 and 4 million in April 2018. The company’s ceo is Marco Credendino, while Ippolita Rostagno, the chief creative director, founded the firm in October 2015 together with Marco Credendino, co-ceo. Artemest has sales of 3.78 million, an ebitda of minus 2.6 million and net cash of 0.182 million

Italian barber shops chain Barberino’s raised 1.71 million euros from 158 investors, above the target set at 1.25 million for its equity crowdfunding campaign on Mamacrowd (See here a previous post by BeBeez). The company’s pre-money value is of 5.2 million and its founders are Michele Callegari and Niccolò Bencini. Barberino’s attracted the reosurces of Fabio Mondini de Focatiis, Federico Monguzzi, Net4Capital, anf OneDay Group. The startup has sales of 1.34 million and an ebitda of 62,000 euros.

Helbiz the US scooter provider that Salvatore Palella founded in 2017 signed a pre-acquisition partnershpi with MiMoto Smart Mobility, an Italian charterer of electric motorbike (see here a previous post by BeBeez). Once completed the acquisition of MiMoto, Helbiz aims to list on Nasdaq and on Milan market. Alessandro Vincenti, Gianluca Iorio and Vittorio Muratore founded MiMoto in 2015.

PostePay joined the 35 million US Dollars investment round of Volante Technologies (VT) (see here a previous post by BeBeez). VT is a provider of systems for payments and financial messaging based on cloud and on-premise technology. Wavecrest Growth Partners acted as lead investor. The company attracted the resources of BNY Mellon, Citi Ventures and Visa Inc. Wavecrest’s co-founder and managing partner Vaibhav Nalwaya will join the board of directors of VT which will invest the raised proceeds in its organic development. Uday Thakur and Vijay Oddiraju are the company’s cofounders.

SisalPay | 5 (SP5) acquired a controlling stake in Pluservice, a software house that founded myCicero (mC), a digital platform for mobility and parking ticketing. (see here a previous post by BeBeez). In April 2019, SP5 invested 3.5 million euros for acquiring a 30% of mC through a capital increase. Emilio Petrone is the ceo of SP5.

Italian crowdfunding portal Opstart and SEED Venture, a blockchain-based platform that helps startups to raise financing, signed a partnership for the implementing the token technology for crowdfunding campaigns (see here aprevious post by BeBeez). The stakes of the startups will be tokens, digital assets easy to trade. Giovanpaolo Arioldiis the ceo of Opstart, while William Pividori (ceo) and Sergio De Prisco are the founders of SEED Venture.

EdiBeez srl