The NPL market has restarted in Europe after the stall due to the Covid-19’s lockdown. In particular, the largest number of transactions was seen in Italy and Greece. Debtwire calculated this in his latest report on impaired loans, anticipated to BeBeez.

In total, in fact, in the first half of the year transactions for 30.4 billion euros were concluded, of which 89.8% between Italy (18.2 billion euros) and Greece (9.1 billion). The 30.4 billions compared with deals for as much as 41.8 billion euros  in H1 2019 and with a record 105.2 billions figure in the H1 2018.

in H1 2019 and with a record 105.2 billions figure in the H1 2018.

So the weight of the lockdown can be seen entirely on the numbers of H1 2020, but in the final part of the second quarter, an important recovery of the transactions started to be seen, which then continued in July.

It is no coincidence that in Italy in the first 7 months of the year 42 transactions on impaired loans for 20.4 billion euros gross were concluded or announced, after a 2019 in which 82 deals were announced for 52 billion euros. In the last two months, in particular, there has been a great acceleration of the activity that had stalled due to the Covid emergency, so much so that at the end of April only 19 deals had been mapped for 1.8 billion euros (see here the BeBeez NPL Report on 7 months 2020, available for subscribers to BeBeez News Premium; it will be translated in English by tomorrow).

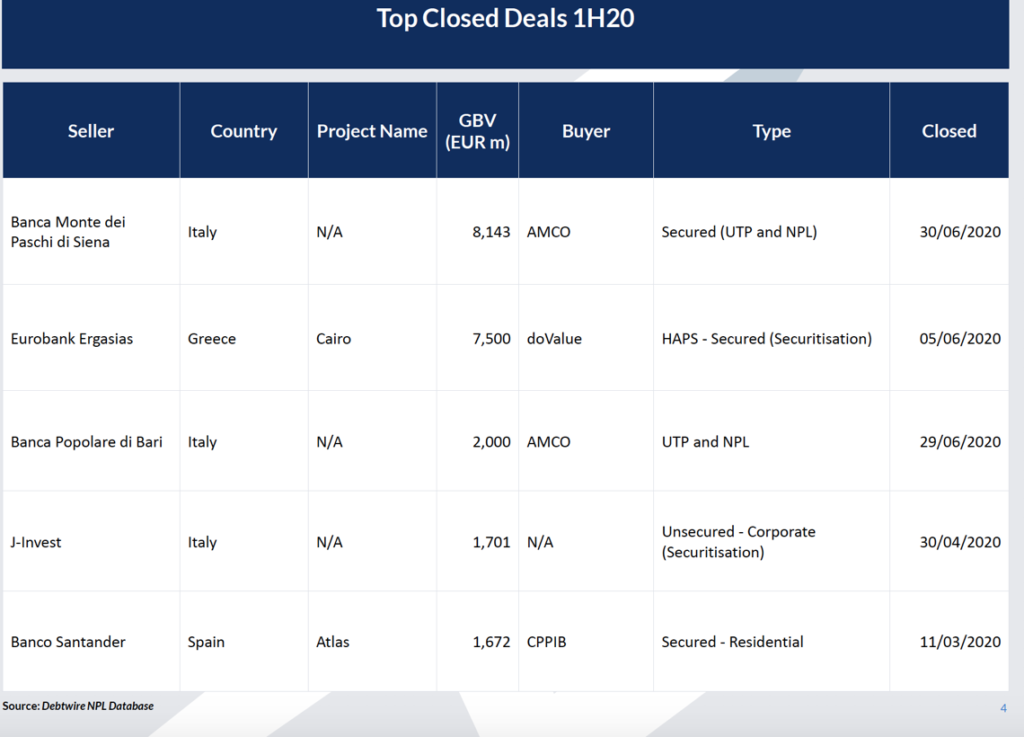

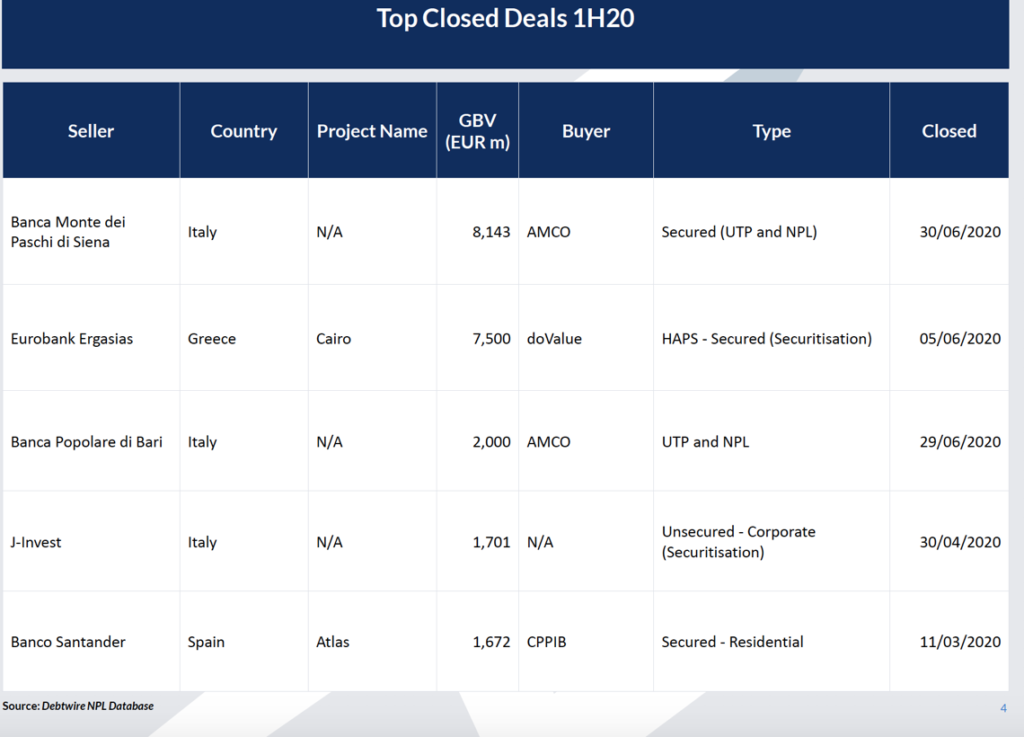

Returning to the first half European data, the Debtwire ranking indicates as the most important transaction of the semester the one made by AMCO which signed the definitive agreement to acquire 8.1 billion euros of Utp and bad loans from Montepaschi as part of the Hydra project (see here a previous article by BeBeez).

In second place is the 7.5 billion euros securitization (Cairo project) closed by Eurobank Ergasias, the first securitization guaranteed by the government program Hellenic Asset Protection Scheme (Hercules or HAPS), approved last December. The 2.4 billion euros of senior notes are covered by the state guarantee, while part of the mezzanine notes (1.5 billion) and junior notes (3.6 billion) were bought by the Italy’s doValue. The transaction was completed in early June (see press release here) together with the purchase of 80% of the capital of the credit management platform of Eurobank Ergasias, Eurobank FPS Loans and Credits Claim Management Company, by doValue.

As for the next deals, DebtWire has calculated that in Europe there are 71.4 billion euros in non-performing exposures on the market and that, of these, 29.4 billions are Greek loans deals and another 19.5 billion euros are on Italian credits. According to BeBeez calculations, to date the deals on the market are even more or 20.8 billions (see here the BeBeez NPL Report on 7 months 2020, available for subscribers to BeBeez News Premium; it will be translated in English by tomorrow).

Finally, Debtwire also stressed that European banks are preparing for a new wave of non-performing loans as a result of the Covid crisis. In the first quarter of the year, in fact, the main European banks set aside over 21.5 billion euros to cover losses from bad debts, a figure that is equal to 207% of the 7 billions provisions at the end of the first quarter in 2019.

Finally, Debtwire also stressed that European banks are preparing for a new wave of non-performing loans as a result of the Covid crisis. In the first quarter of the year, in fact, the main European banks set aside over 21.5 billion euros to cover losses from bad debts, a figure that is equal to 207% of the 7 billions provisions at the end of the first quarter in 2019.

The largest percentage increase was recorded for banks in the United Kingdom and the DACH area (Germany, Austria, Switzerland) with a + 450% from the same period last year. In particular, the British banks have set aside 7.7 billion euros, with HSBC and Barclays alone providing for 2.7 billions and 2.4 billions respectively, respectively. The largest coverage was posted by the Spanish Santander Group (3.9 billions), with the four largest Spanish banks having posted a total of 6.2 billions coverage, an increase of 140% from 2019.

UniCredit posted provisions for 1.2 billions, of which 900 millions relating to potential losses due to the Covid-19 emergency. Greek banks have posted a total of 1.4 billion provisions, of which 860 millions relating to Covid.

EdiBeez srl