Blackstone funds are said to be ready to enter Autostrade per l’Italia (ASPI‘s capital together with Italian infrastructure fund F2i sgr and Cassa Depositi e Prestiti (Cdp), Radiocor writes, adding that the fund has been working for months on the dossies. The Americans are aiming to enter the concessions business in Italy and the investment in Autostrade is expected to be in the hundreds of millions. Again according to rumors, the option would be among the most welcome by Cassa Depositi e Prestiti.

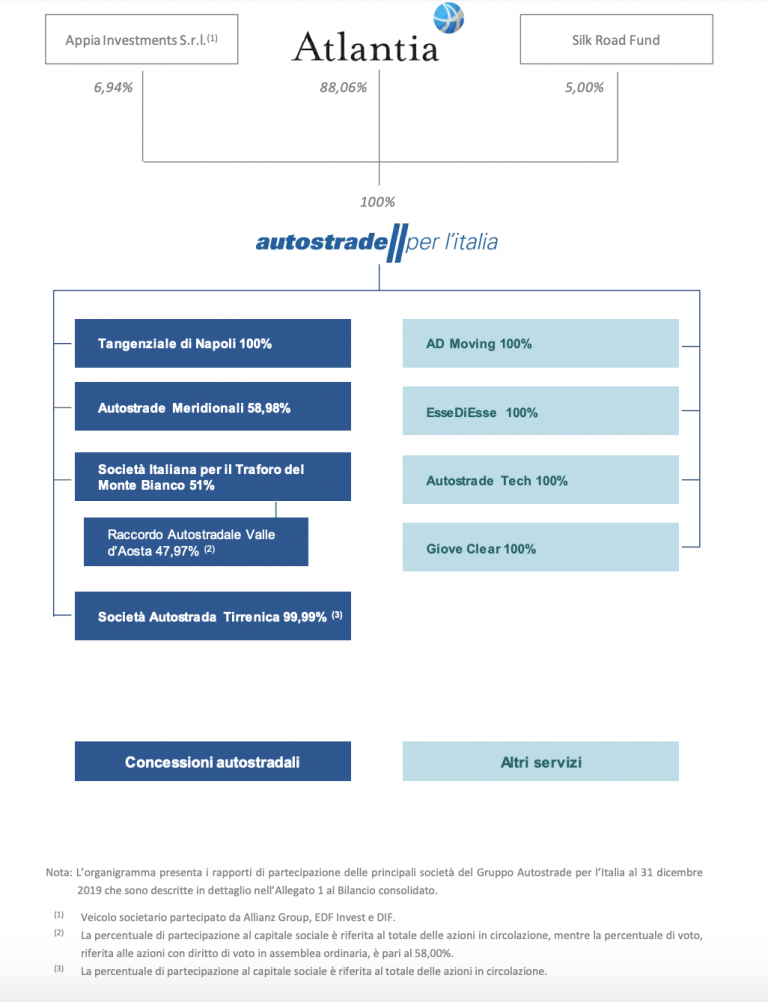

ASPI is 88% controlled by Atlantia, a group listed at the Italian Stock Exchange, which in turn is owned by the Benetton family‘s Edizione Holding, and ended in the storm after the collapse of the Morandi bridge in Genoa on the motorway section of which it has the concession. After a long negotiation with the Italian Government, yesterday Atlantia made two settlement proposals to facilitate the passage of control of ASPI to Cdp, concerning, respectively, a new shaeeholders structure of ASPI and new contents for the settlement of the dispute relative to damages payments (see here press release by the Italian Government).

In detail, on the issue of the new corporate structure, Atlantia proposed two solutions:

1 – the immediate transfer of control of ASPI to a subject with state participation (Cdp), through the subscription of a reserved capital increase by Cdp; the purchase of equity interests by institutional investors; the direct transfer of ASPI shares to institutional investors of Cdp’s approval, with the commitment by Atlantia not to allocate these resources in any way to the distribution of dividends; the proportional demerger of Atlantia, with the exit of ASPI from the perimeter of Atlantia and the contextual listing of ASPI on the Stock Exchange.

2 – alternatively, Atlantia has offered to sell the entire stake in ASPI, equal to 88%, to Cdp and institutional investors of its choice.

In reality, the preferred solution seems to be the first. According to what was reconstructed yesterday afternoon by Radiocor, in fact, work is underway for 1) a capital increase of ASPI of at least 3 billion euros dedicated to Cdp, which will bring Cdp to own a 33% stake; and 2) for a sale of a 22% stake of ASPI by Atlantia to one or more investors appreciated and identified by Cdp. All in the context of a split of ASPI contextual to an ipo, which will bring Edizione Holding to dilute to 11%. In addition, the ASPI debt guarantee (5 billion euros) now held by Atlantia will pass to new investors.

The new shareholding structure of ASPI will then see a block composed of Cdp (33%) with institutional investors (22%) who will thus form a majority of 55% while Edizione will be at 11%; both the consortium led by Allianz (today at 7%) and the Chinese of Silk Road (today at 5%) will be diluted but will be able to go back by purchasing on the market. Edizione can decide whether to keep the quota or sell it gradually on the market.

A key element of the whole reorganization will obviously be the value assigned to ASPI on the basis of which the capital increase and then the transfer of the shares will be conducted. Today the market estimates a 11 billion euros enterprise value on a RAB based method, which is less than the 14.8 billion euros on the basis of which the last operation on the capital of ASPI was conducted in 2017. Back then he consortium formed by Allianz Capital Partners, EDF Invest and DIF, on the one hand, and the Silk Road Fund, on the other, had bought 11.94% of the capital of Autostrade per l’Italia (see here the press release of August 2017 and here the April 2017’s press release).

ASPI’s 2019 financial statements closed with revenues of 4.1 billion, an ebitda of 710 million (which reflects a provision for charges of 1.5 billion euros, related to the commitment envisaged in ongoing negotiations with the government and with the Ministry of Infrastructure and Transport aimed at closing the disputes advanced for the Ponte Morandi affair) and a net financial debt of 8.4 billion.

Blackstone is just the last name in the long line of interested in ASPI. In recent months, for example, there was talk of a newly created F2i fund, to which Atlantia could confer control of ASPI (see here a previous article by BeBeez) and to which F2i would transfer its motorway and airport assets, without prejudice free of investors of the Third Fund which today has those investments in its portfolio (see here a previous article by BeBeez). A hypothesis, this, which however would not be the only one under study by F2i, because the alternative is that the new fund may be limited to the management of the only ASPI asset, with Atlantia that would simply sell the asset, instead to become a fund listing. In any case, among the investors ready to subscribe the new fund, there was talk of Poste Vita, which would be studying an investment of at least 300-400 million euros. Other possible investors in the new vehicle would include some banking foundations and some pension funds, such as Cassa Forense (lawyers), Enpam (doctors), Inarcassa (architects) and Cassa Geometri. In addition of course to foreign investors and Cdp. Recall that in the third fund of F2i the major underwriters were Gic, the sovereign wealth fund of Singapore, and PSP, the pension fund of Canadian civil servants and law enforcement agencies (see here a previous article by BeBeez).

The F2i project is parallel to other initiatives. For example, at the beginning of April 2020 there was talk of an alleged arrival agreement with Allianz for the German insurance giant’s infrastructure private equity arm to acquire 51% of the capital of Autostrade per l’Italia. The agreement was later denied, but the hypothesis was realistic, given that Allianz is already a shareholder of ASPI through Appia Investments srl which since August 2017 has owned 6.94% of the company (Allianz Capital Partners is a shareholder of Appia 74%, while EDF Invest owns 20% and DIF, through its funds DIF Infrastructure IV and DIF Infrastructure V, 6%). While the Chinese of the Silk Road Fund in turn have 5% of ASPI since 2017.

F2i had already looked at the ASPI dossier in 2017, when Allianz and Silk Road had finally entered. On that occasion, the dossier had also been looked at by the Australian Macquarie Infrastructure, which in fact, not by chance, would now in turn be ready to invest in ASPI. Finally, the US giant KKR would also be interested in the game. Another hypothesis is that of the possible involvement in the game of the former ASPI ceo and former ceo of F2i sgr, Vito Gamberale (see here a previous article by BeBeez). The latter, in fact, has returned to deal with investments in infrastructure, this time at the head of a new investment company that has two closed-end funds in partnership with Pramerica sgr.

In fact, in the last few days the hypothesis has been leaked that the sale operation by Atlantia of the significant minority stake of highways toll payment system Telepass could be slowed down or blocked by the exercise of the golden power, on the basis that Telepass manages sensitive data (see here a previous article by BeBeez),

EdiBeez srl