The turnover of the Italian real estate sector will drop by 18.3% this year due to the closures imposed by the coronavirus: this is the widespread forecast of the Scenari Immobiliari study center, contained in its first European Outlook for 2020 (see the press release here).

“The turnover of the Italian real estate market could drop by 18.3%, down to 106 billion euros in 2020. Above all, the volumes traded have decreased, due to a total three months stop and a slow ascent phase is in view for a similar period. Average prices are slightly down, but with growing sectors such as logistics. For 2021, a clear rebound of the markets is expected throughout Europe “, commented Mario Breglia, president of Scenari Immobiliari.

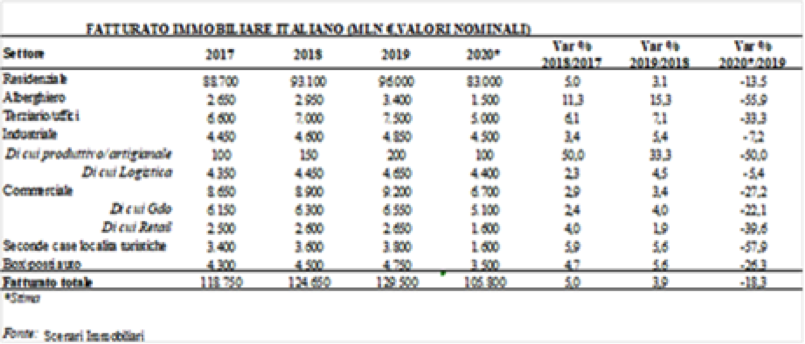

In recent years, the Italian real estate market had started a slow recovery from the crisis of 2010. Growth rates were halved compared to what happened in other European countries, but still positive. Year 2019 closed with a turnover of around 130 billion euros, with an increase of 3.9% over 2018 (see also the BeBeez Real Estate Report 2019-2020, with the tables of all the deals, available for subscribers to BeBeez News Premium).

For the second consecutive year, all sectors had a positive sign, with some particular performances such as in the hotel sector and in international investments. The “big sick” of the Italian market continues to be the residential (which represents almost 75% of it) with a growing demand, but a low quality offer which also explains the prices anchored to zero. Only in a few areas (such as Milan) the trend is positive both in sales and in prices. The other sectors are improving.

The situation created by Covid-19 has blocked all sectors and for this reason the forecasts for the end of the year indicate a drop in turnover of 18.3%. The estimate is based on the months of lockdown and a restart phase that will be slow. It is difficult to speculate that lost volumes can be recovered in the last four months of the year. A more or less intense rebound in 2021 is more likely. But the variables that condition the market trend are manifold, from employment to the weight of public intervention to the propensity of investment by families and businesses.

For some sectors such as hotels and short-term rentals, this is a “lost year”, while logistics will have a further boost if connected to ecommerce. The residential sector is still suffering, where the concerns of families are accompanied by the slowdown in new projects. In the office sector, in the face of a drop in turnover, there will be little performance in the prime segment and a strong crisis in the product of classes B and C.

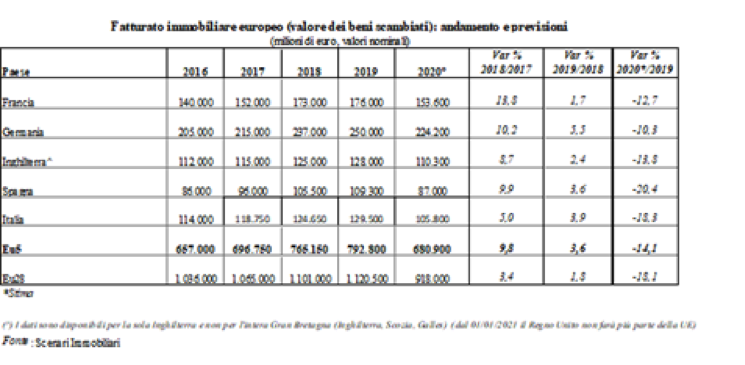

The drop in turnover in the real estate sector of the 28 European countries will be in line with the Italian one and equal to 18.1%, settling below one trillion euros. Together, France, Great Britain, Germany and Italy will suffer a loss of 14.1%, with turnover equal to just under 700 billion euros. The expected drops, compared to last year, range from 10.3% in Germany to 20.4% in Spain.

2019 had been a year of great liveliness in the residential sector in Europe. Sales prices and rental fees increased both in the first and second part of the year. Across the European region, data for the end of last year indicated an average increase in house prices of four percent. Italy is still lagging behind, which was not growing at the same rate, with a national average substantially equal to zero. The most marked increases in the top five countries were recorded in Germany (+ 10.4%) and France (+ 3.4%). By widening the analysis to the other member states, there were drops in Cyprus (-5.9%), Hungary (-1.5%), Denmark (-0.6%) and Finland (-0.1% ). The most significant increases at the end of the last quarter of 2019, on an annual basis, occurred in Latvia (+ 13.5%), Slovakia (+ 11.5%), Luxembourg (+ 11.3%) and Portugal ( + 10.3%).