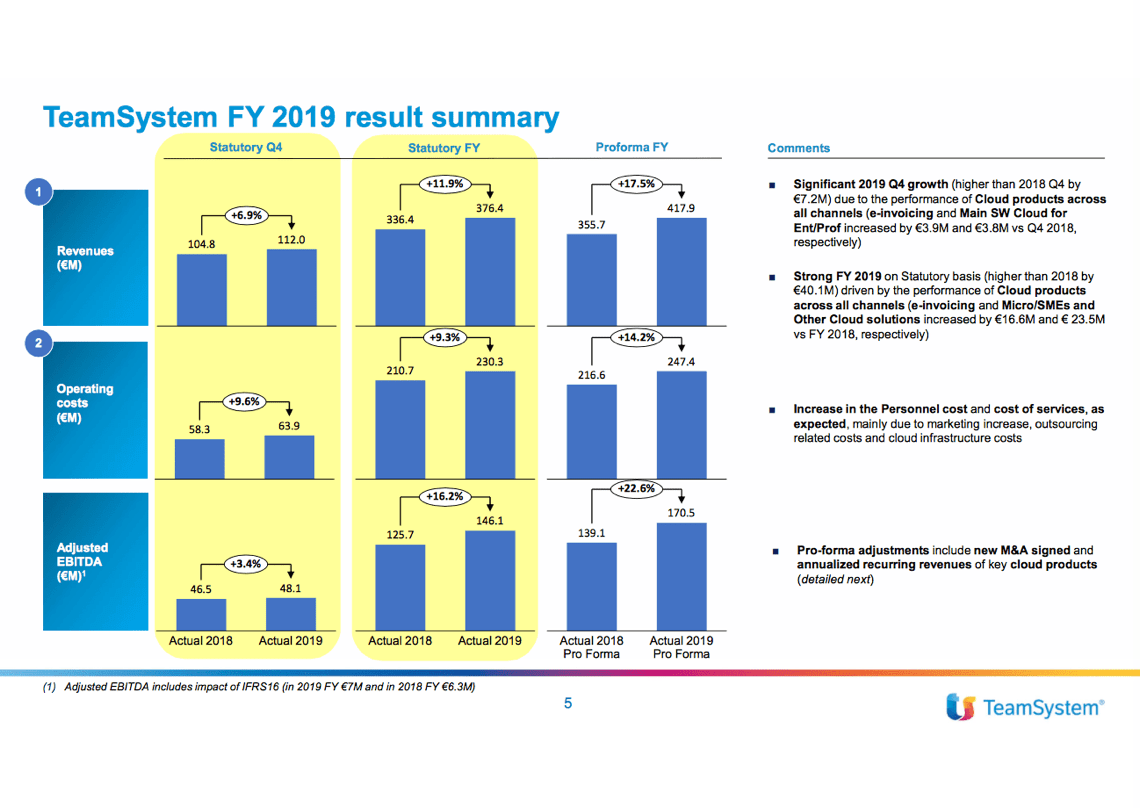

Teamsystem, the group active in the development of software for companies and professionals, controlled by the Hellman & Friedman private equity firm, ended FY 2019 with 417.9 million euros in pro-forma revenues (including therefore the latest acquisitions and recurring revenues) and an adjusted ebitda of 170.5 millions (see presentation to bondholders here).

Teamsystem, the group active in the development of software for companies and professionals, controlled by the Hellman & Friedman private equity firm, ended FY 2019 with 417.9 million euros in pro-forma revenues (including therefore the latest acquisitions and recurring revenues) and an adjusted ebitda of 170.5 millions (see presentation to bondholders here).

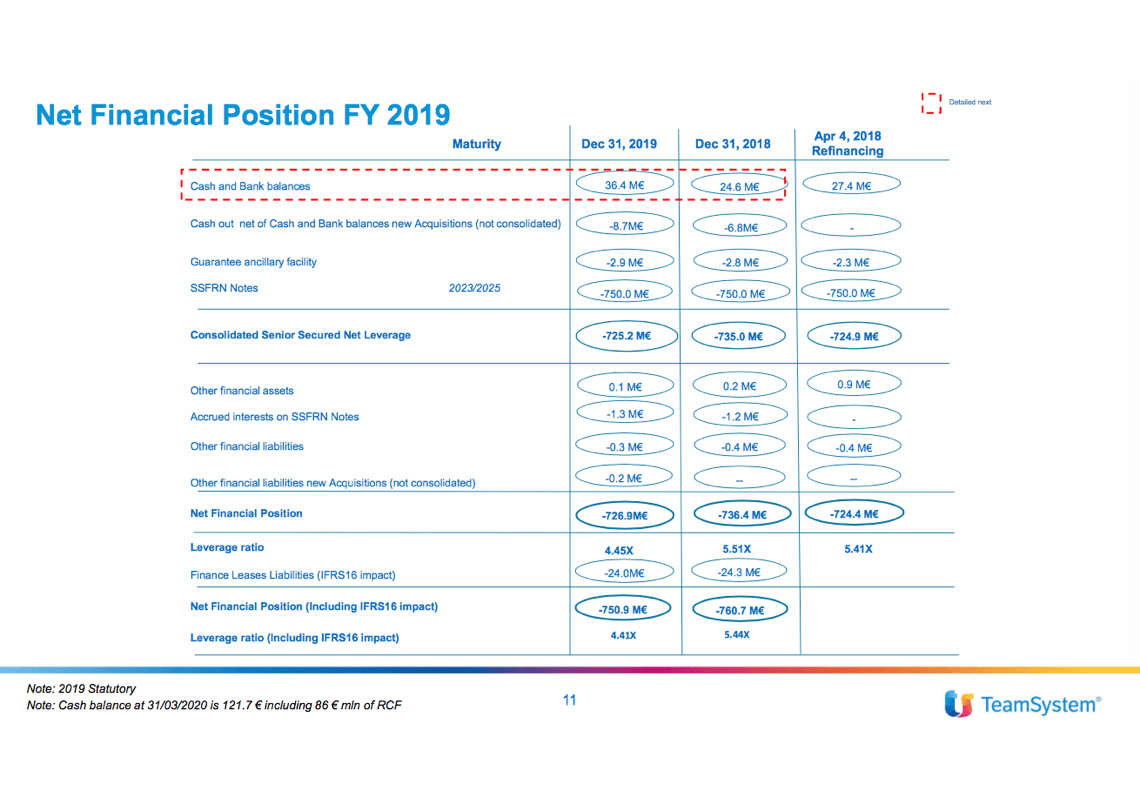

These figure compare with the pro-forma results of 2018, when the group had reached 335.7 million euros in revenues and 139.1 millions in adjusted ebitda, with a net financial debt which at the end of 2019 was 750.9 million euros compared to 760.7 millions at the end of 2018 (including the impact of the new accounting standard IFRS16), for a leverage therefore of 4.41x the 2019 adjusted ebitda (from 5.44x at the end of 2018) (see here a previous article by BeBeez).

Although the debt remains high, it was refinanced in March 2018 for 750 million euros, with the issuance of two senior secured bonds, one of 550 million euros maturing on April 15 2023 and the other of 200 million at April 15 2025, both indexed at the 3-month Euribor rate plus 400 basis points, with a minimum of 0% and listed on the Luxembourg Stock Exchange (see here a previous article by BeBeez).

These are therefore numbers that, considering the multiples that ran in the tech sector up to before the coronavirus, between 10 and 13x the ebitda, lead to a 1.7-2.2 billion euros enterprise value for the group providing management IT solutions for companies. Actually, from the first indications, the tech sector is one of those that has not been impacted by the Covid-19 crisis and therefore the assessment in question should be confirmed. Indeed, in the last few days the auction on Italy’s IT Namirial has closed. The company was acquired by Ambienta fund on the basis of a valuation of 150 million euros, equal to just under 20x the 2018 ebitda (see here a previous article by BeBeez). For one year, rumors have been circulating that Hellman & Friedman has been thinking about leaving the investment.

These are therefore numbers that, considering the multiples that ran in the tech sector up to before the coronavirus, between 10 and 13x the ebitda, lead to a 1.7-2.2 billion euros enterprise value for the group providing management IT solutions for companies. Actually, from the first indications, the tech sector is one of those that has not been impacted by the Covid-19 crisis and therefore the assessment in question should be confirmed. Indeed, in the last few days the auction on Italy’s IT Namirial has closed. The company was acquired by Ambienta fund on the basis of a valuation of 150 million euros, equal to just under 20x the 2018 ebitda (see here a previous article by BeBeez). For one year, rumors have been circulating that Hellman & Friedman has been thinking about leaving the investment.

Teamsystem has been part of the Hellman & Friedman fund since December 2015, when H&F had bought control of the group from Hg Capital, which it had then reinvested for a minority. On that occasion, however, he had definitively left the capital Bain Capital, which, when he in turn transferred control of Teamsystem to Hg capital in the summer of 2010, had maintained a minority in the group’s capital (see here a previous article by BeBeez).

Last February Teamsystem and the IT company from Brescia, Solutions Informatiche srl, invested in two Aldebra business units dedicated to the marketing of software solutions and related consultancy services (see here a previous article by BeBeez). The company recently launched: Smart4Italy, a suite of digital collaboration solutions to ensure business continuity for SMEs and professionals; and Cash4Italy, a fintech platform to respond to the growing need for SMEs’ liquidity.

In October 2019 Teamsystem had acquired 51% of TechMass, a startup active in the design and development of software to digitize production processes. The B2B innovation platform Gellify (through the vehicle Gellify Digital Investment), the Paduan strategic consulting firm specializing in complete lean transformation auxiell and the founder Andrea Massenz, sold, who maintained a minority stake in the company, in addition to the platform of Venetian innovation H-Farm spa (see here a previous article by BeBeez).

In addition, in July 2019 Teamsystem entered into an industrial partnership with the investor in commercial invoices Factor @ Work and the invoice financing platform Whit-e “for integration with its management systems (installed at more than 250 thousand SMEs) and electronic invoicing (sold to over one million customers), in order to facilitate and increase the generation of investable invoices by the securitization vehicles of which Factor @ Work is and will be the agent ” (see here a previous article by BeBeez).