One of the few markets that might experience a positive effect by the coronavirus infection is the secondary market for alternative investment funds. In fact, many asset managers will reallocate the exposures of their portfolios, much more than they have done so far. At the same time, it will also be possible to see investors who are experiencing some distress due to the worsening in the economic and financial situation and who therefore will have to liquidate their positions for cash.

Julien Gervaz, ceo of Palico, a well-known fintech platform dedicated to trading private equity fund shares on secondary market, explained to BeBeez: “Some time ago sellers of stakes of alternative funds were often driven by distressed situations for which they could no longer sustain future commitments as the funds called capital. And obviously those positions were sold at a high discount. Instead, in recent times most sellers put their positions on the market simply because they are changing their asset allocation and prices, therefore, they are sold at par, but sometimes they are sold even with a premium”.

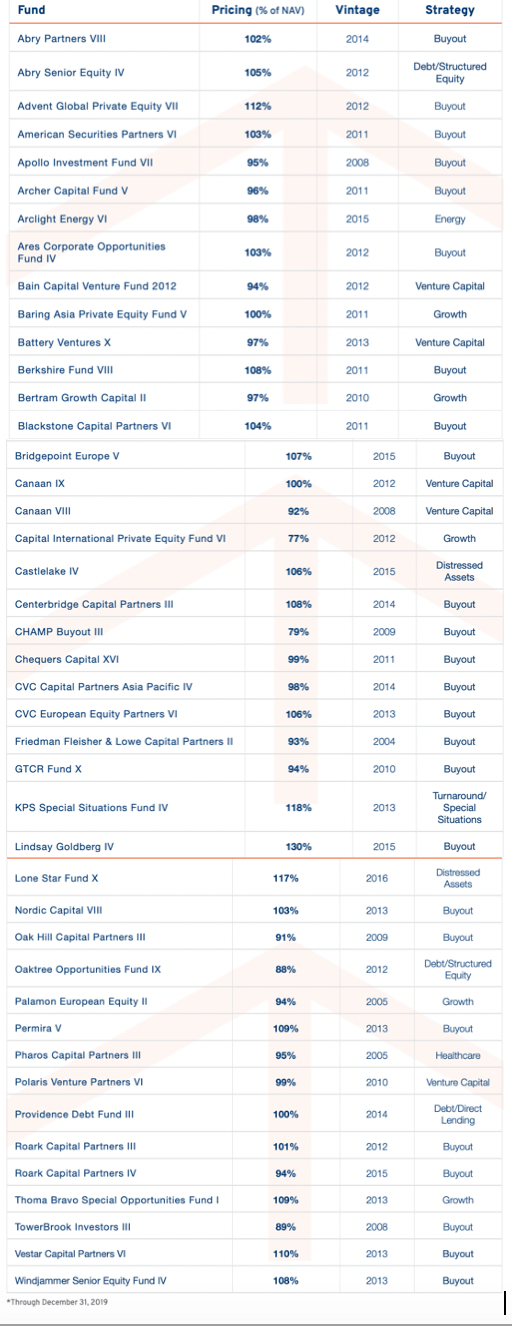

A study made by Palico at the end of December 2019 calculated that in the previous six months prices set for 43 alternative funds of various strategies traded on the platform were on average 101% of the net asset value (NAV), that is, three percentage points more than we had seen in the six months ended at the end of October 2019. As for the median, it is on par. According to Palico, keeping prices high is intense competition between investors focused on a limited number of funds.

By limiting the observation to only the funds for which an at par or premium transaction was closed, the average premium in the six months considered was 7% above NAV, a level that is second only to the 8% premium achieved in the second half of 2018 and is above both the 5% premium recorded in the first half of 2019 and the 6% marked in the six months ended at the end of September last year.

Having said that, the number of funds that closed transactions above the NAV in the period is only 53% of the total, in line with the 52% calculated at the end of September, but much lower than the 64% recorded at the end of June.

We will now see what will happen with prices. But what is clear is that trading will increase. On all types of assets, from private equity to restructuring funds.

“Palico acts in a very specific market segment, which does not concern large transactions, but rather those with an average ticket of 20 million euros. A market that would otherwise be absolutely opaque,” said Gervaz again, adding that “Palico does not act as market maker, but it is a fintech platform that connects supply and demand and works with an auction mechanism. Buyers and sellers are the ones who make the price. If they want to rely on our analysts for advice, this is another service that we can provide. In any case, we generally manage to place a stake of a fund within 24 hours from the request and our volumes are growing exponentially. Today we are around 60 million euros per month “. And who are the registered investors on the platform? “We have about 3,200 of them. There are also many from Italy who, however, generally sell shares of pan-European funds”.

Founded inn 2012, said Gervaz, “the platform has changed significantly in the last two years, refocusing itself on the secondary market and targeting exclusively institutional investors. We have also grown in terms of our team, which has gone from 9 to 21 people and the company is now active from its offices in New York and Paris, while it will also open soon in London”. And to support the company in its growth , the ceo of Palico anticipated: “By the end of the year we are planning a financing round. Today our investors are especially professionals who come from the world of private equty and have invested personally, as well as family offices with experience in investing in private equity. For the most part they are based in Paris, Nw York. London”.