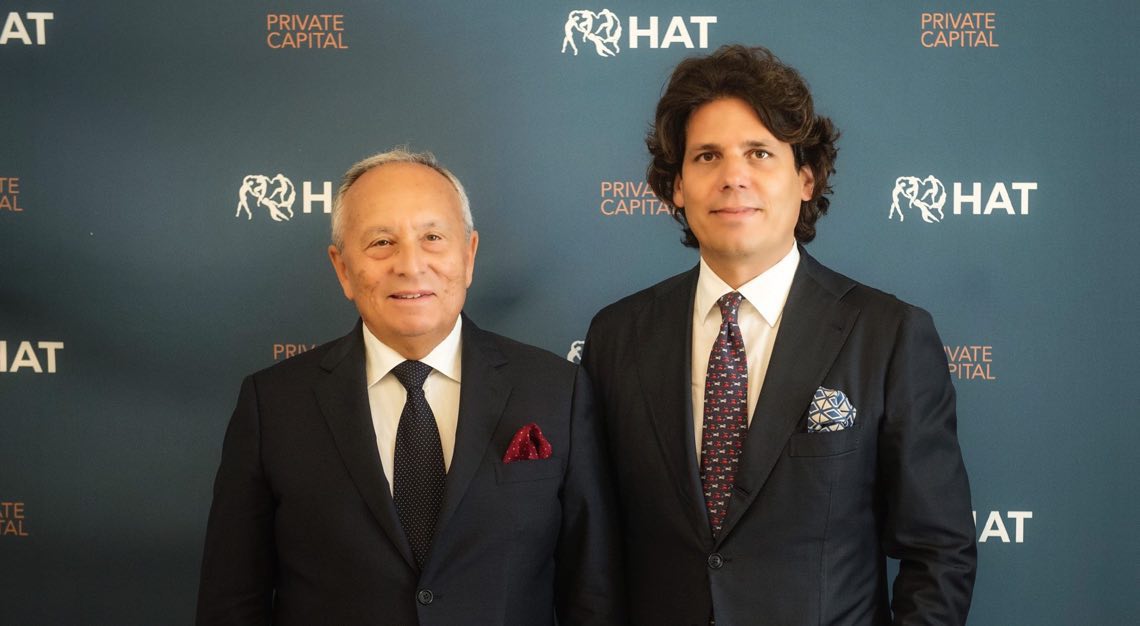

In 2019 HAT, the alternative asset manager whose ceo and chairman are Ignazio Castiglioni and Nino Attanasio, distributed 206 million euros to the subscribers of its funds (see here a previous post by BeBeez). The managers cashed a carried interest of above 25 million. The subscribers of infrastructure investor HAT Sistema Infrastrutture will get 150 million ahead of an initial investment of 130 million. The fund acquired eight assets and sold six of them with a median gain of 3.4 x the invested capital. Hat Sistema still owns renewable energy business Ambra Verde 3, and parking company Re Parcheggi Via Livorno. HAT’s subscriber gained 2.5 X the invested capital net of operating expenses and management fees. The subscribers of HAT Ict will get 56 million ahead of an initial investment of 50 million. Such fund acquired 8 businesses, sold five of these and partially exited from GPI (healthcare) and Wiit (IT outsourcing) through a listing on Milan stock market. The fund cashed a median gain of 2.7 X the invested capital. HAT still owns IT company Ennova. The investors in HAT Ict gaine2 2.2X the invested capital. HAT is currently launching HAT Technology & Innovation (HAT TI), for which set a fundraising target of above 100 million. This fund aims to invest in Italian SMEs with sales of less than 100 million that aim to improve their own technology. HAT TI already invested in Advice (promotion, loyalty & community marketing) and in Marval (a producer of components for agricultural machines) and its NAV for 2019 grew by 26% from 2018. Hat is one of the private capital investors that BeBeez Private Data monitors. Find out here how to subscribe for the Combo version that includes BeBeez News Premium.

The Rotelli family, owner of Healthcare Italian Group San Donato, aims to table a bid jointly with Abu Dhabi sovereign fund Mubadala for acquiring a controlling stake in London-listed healthcare plaeyer NMC Health that is facing the allegations of faking accounts from short seller investor Muddy Waters Capital (see here a previous post by BeBeez). Moody’s downgraded the company by five notches and said that UK stock market authority FCA is investigating about NMC. Carson Block, Muddy Waters Capital’s head, reportedly said that NMC overpaid few assets, inflated its cash flows and underestimated its debt. Even though NMC denied the allegations, it hired Louis Freeh, the former head of FBI, for carrying on an internal enquiry. The company also fired the ceo Prasanth Manghat and 5 of the 11 board members. Since 27 February, Thursday, London Stock Exchange suspended the company’s shares from trading. Mubadala has assets under management amounting to 229 billion Dollars and was reportedly interested in tabling a standalone bid for NMC. On 10 February, NMC Health said KKR and Gruppo Ospedaliero San Donato (GOSD), the healthcare company of the Rotelly Family, expressed a preliminary interest for acquiring the business. However, KKR dropped the plan and said it would not have made any offer. GOSD has to make a formal offer by 9 March, Monday and has sales of 1.7 billion euros. NMC has sales of 2.1 billion Dollars.

Tages Helios, an investment vehicle in renewable energy of Tages Capital, announced a partial closing of 104 million euros in commitments from investors for resources amounting to a total of 252 million (see here a previous post by BeBeez). In January 2019, Tages Helios announced to have closed its fundraising at 253 million, that wholly invested. The fund received resources from Aviva, Intesa Sanpaolo Vita, Reale Mutua Assicurazioni, UnipolSai Assicurazioni, pension funds, Banking foundations and family offices. Further to the partial closing of the fundraising, Tages Helios concluded the acquisition of a portfolio of photovoltaic plants with a total power of 14.5 MW from Susi Sustainable Energy and minority owner Plenium Partners.

Cerba Healthcare Italia (part of Cerba Healthcare) acquired Centro Diagnostico Solbiatese (CDS), an Italian provider of medical diagnostic sevices (See here a previous post by BeBeez). CDS has sales of 1.89 million euros with an ebitda of 0.178 million. Cerba Healthcare belongs to Canadian pension fund PSP Investments and European private equity Partners Group and previously acquired three assets in Italy. In 2017, it purchased Delta Medica and Fleming Research. In October 2019, it acquired Curie srl Diagnostica per immagini e terapia. The ceo of Cerba Healthcare Italia is Stefano Massaro.

Seri Jakala, an Italian martech company, acquired London-based 77Agency, a digital media & performance agency (See here a previous post by BeBeez). Fratelli Rossetti, Pennyblack, Lavazza, Juventus,Tiffany, Enel, and Generali are some of the target’s clients. Matteo de Brabanti is the founder of Jakala, while Amedeo Guffanti and Marco Corsaro, are the ceos and majority owners of 77Agency that now will become shareholders of Jakala together with the key people of the sold company. In 2014, Jakala merged with Seri System and rebranded as Seri Jakala. In June 2018, The Equity Club (fka Equity Partners Investment Club, the club deal that Mediobanca private banking launched), PFC (the holding company of Paolo Marzotto’s Family), Ardian Growth and H14 (the holding of Luigi Berlusconi) acquired a stake in SJ. In 2019, Jakala acquired 25% of GeoUniq, a French-Italian company for Mobile Location Intelligence and Volponi, a provider of loyalty programmes for big distribution chains. Jakala has sales of 230 million euros.

Astorg Partners hired Houlihan Lokey and Rothschild to sell Surfaces Technological Abrasives for an enterprise value of 600 million euros (see here a previous post by BeBeez). Astorg acquired the majority of the asset from Xenon Private Equity and the company’s founders (both reinvested for a minority) in July 2017. In December 2016, Surfaces Technological Abrasives acquired Italy’s competitor ADI with the support of lenders Banca Imi and Intesa Sanpaolo. Emisys Capital increased to 13.1 million the size of the Pay If You Can bond (7 years maturity) that Xenon issued for financing the acquisition of Surfaces. Surfaces Technological Abrasives is currently concluding the integration with Luna Abrasivi, a manufacturer of products for the ceramics industry that acquired in October 2019. Surfaces Tecnologica Abrasives has sales of 130 million and an ebitda of above 50 million.

Itelyum, a portfolio company of Stirling Square, acquired Gruppo Idroclean, a provider of services for cleansing industrial waters and 80% of Carbonafta, a manager of industrial waste (see here a previous post by BeBeez). Itelyum is born out of the merger of Viscolube, a recycler of industrial lubricants, and Bitolea, a provider of services for cleansing solvents. Stirling acquired the majority of Viscolube in December 2011 from Rietschaar and Giorgio Carriero, who kept a minority of the business after having previously purchased the company from ENI. In July 2017, Clessidra sold 80% of Bitolea (acquired in 2012) to Viscolube while the Intini Family kept 20% and exited definitely when Striling Square acquired the company. After such acquisitions, Itelyum’s turnover will be in the region of 330 million euros. Stirling Square reportedly hired Rotschild for selling the asset. Marco Codognola is the ceo of Itelyum. Idroclean has sales of 14.4 million and an ebitda of 1.86 million. Carbonafta turnover is of 3.75 million with an ebitda of 0.572 million

Iconic Italian pencils and stationery producer Fila acquired Arches from Finland’s Ahlstrom-Munksjö Oyj for a debt-free cash-free price of 43.6 million euros (See here a previous post by BeBeez). Fila belongs to the Candela Family and is listed on Milan Stock Market since November 2015 after having implemented a business combination with the Spac Space. In April 2018, Simona Candela, sold her 31% of the holding Pencil (the controlling shareholder of Fila) to Blue Skye for 50 million (10 million in cash and the remaining 40 million paid with a financing of US Fund Elliott). Massimo Candela, 69% owner of Pencil, unsuccesfully tried to block such a sale to Blue Skye. Fila has sales of above 600 million.

Italian Wine Brands (IWB), a Milan listed wine producer and distributor, acquired Swiss -Italian producer of sparkling wines Raphael Dal Bo srl di Valdobbiadene (RDB) from Raphael Dal Bo (90%) and Giuseppe Geronazzo (10%) for an enterprise value of about 13.4 million Swiss Francs (See here a previous post by BeBeez). RDB has sales of 10.7 million (+10.4% yoy) rispetto alle vendite consolidate del 2018). Raphael Dal Bo invested 2.9 million for acquiring a 2.84% IWB and amy pay a further 2 million by 31 March 2021 on the achievement of targets. IWB is born out of the merger of Giordano Vini and Provinco Italia that carried on the business combination with the Italian Spac Ipo Challenger in January 2015. Alessandro Mutinelli is the chairman and ceo of IWB.

Ibla Capital, hit the 30 million euros hard cap for the fundraising of its turnaround fund that attracted resources of a Swiss asset manager that acted as cornerstone investor (See here a previous post by BeBeez). The fund will invest in Italian SMEs that have sales of 10 and 50 million and are in need of turnaround. The fund will acquire stakes, industrial goods or debt of the targets. The investment tickets will be of 1-5 million. Alessandro Lo Savio, the former cfo and coo of Italian ICT Linkem, founded Ibla.

Italian restaurants chain Pizzerie Sorbillo attracted the interest of Aksìa and eventually of DeA Capital Alternative Funds which acquired 70% of Alice Pizza in March 2019 (See here a previous post by BeBeez). Sorbillo has sales of 2.3 million euros and an ebitda of 0.35 million.

Carlyle and its coinvestors GLG and Stellex Capital Management (together AHG) aim to close soon a deal with Maccaferri (see here a previous post by BeBeez). On March 2nd, Carlyle sent a new draft rescue proposal to the advisor Rothschild for Seci (the holding company through which the Maccaferri family controls the Maccaferri Group), Samp and Officine Maccaferri (both part of the Maccaferri Group). To that draft proposals some changes had already been made yesterday. According to BeBeez, the Board of Directors of Seci has decided that it will meet to deliberate on the matter only in the next few days.

Investindustrial, the private equity investor that Andrea C. Bonomi founded, appointed Michael Guan as senior principal and president for the fund’s Asian activities (see here a previous post by BeBeez). Guan previously worked as chairman m&a for North Asia at Deutsche Bank, Edmond de Rothschild and Rothschild & Co. in Hong Kong, China and the UK. Investindustrial’s Asia team includes four professionals, but the company is going to make further hires. Investindustrial set its Shangai subsidiary in April 2010. Investindustrial is one of the private capital investors that BeBeez Private Data monitors. Find out here how to subscribe for the Combo version that includes BeBeez News Premium.

Virginio Cassina acquired a minority of Valetudo, an Italian producer of cosmetics, from the founder Vittorino Bortolin (see here a previous post by BeBeez). Cassina previously owned Italian packaging business Fustiplast and sold it to NYSE-listed competitor Greif. Cassina will work as Valetudo’s director for strategic planning and control. Valetudo has sales of 15.5 million euros and an ebitda of 2.2 million.

On 6 February, Monday, Milan Court accepted the receivership application of The Organic Factory, an Italian producer of ingredients for the animal husbandry sector (See here a previous post by BeBeez). The company will have to outline a restructuring plan by 30 days in view of a meeting with its creditors scheduled for 29 June 2020. Finplace, an investment company that Walter Maiocchi, the chairman of Zanotti (part of Daikin since 2016), founded and that in 2018 acquired Italy’s troubled textile company Malo. Enrico Ceccato and Paolo Scarlatti, part of the management team of turnaround investor Orlando Italy, founded The Organic Factory in 2016. In early 2017 The Organic Factory acquired a plant of Italian oil producer Carapelli Firenze and troubled Molino Oleificio Manzoni. In June 2018, Electa Ventures and Azimut Global Counseling invested in The Organic Factory through the fund Ipo Club, a vehicle that targets assets in their pre-booking stage or are going to list. Ipo Club acquired special shares of the company ad subscribed a convertible bond of two tranches of 8 million euros each. However, the company faild to hit the necessary targets for the launch of an IPO and posted a debt of 35 million. On 31 October 2019, Finplace tabled a 9.915 million bid for acquiring The Organic Factory. Sources said to BeBeez that IPO Club completely amortized the transaction that is worth 5% of it investment power.

Trevi Finanziaria Industriale (Trevifin) delayed from 31 March to 31 May the deadline for executing the announced capital increase sSee here a previous post by BeBeez). The launch of the operation could take place in March. The capital increase should amount to 130 million euros and shareholders Polaris Capital Management and FSI Investimenti (a company of Cdp Equity) will subscribed with the company’s lenders. TreviFin revenues amount to 603 million (-70 million than expected), ebitda is in the region of 59 million (-14 million). Trevifin recently closed the first step for the sale of its Oil&Gas division to Megha Engineering & Infrastructures (MEIL) (See here a previous post by BeBeez). TreviFin sold a minority of Petreven for 20 million and will invest such proceeds in repaying the leasing fees for industrial goods that will belong to the Oil&Gas Division. The second stage of the closing may take place by 10 March with the sale of all TreviFin’s Oil&Gas assets to MEIL. The vendors will invest the raised proceeds in repaying their debt.

Valter Mainetti, a minority shareholder of Edisud, the publisher of Italian paper La Gazzetta del Mezzogiorno (LGM), may apply for a new receivership plan (see here a previous post by BeBeez). On 19 February 2020, Edisud dropped the receivership plans that should have received the support of Banca Popolare di Bari (BPB) who committed to pour 14 million euros for the implementation of the turnaround strategy. On the ground of these conditions, Mainetti would have taken a controlling stake of Edisud. However, BPB could not keep such commitment as its executives are reportedly facing criminal allegations. Mainetti currently poured one million in Edisud for having the possibility to apply again for receivership. The association of the entrepreneurs of the Southern Italian regions of Apulia and Basilicata are trying to raise 14 million for supporting Mainetti. In January 2019, Giampaolo Angelucci (the publisher of Il Tempo, Libero, and of local papers of the central Italian region of Umbria) tabled a 12 million offer for LGM, but he didn’t receive any answer from Catania Court. In mid-February 2020 made another offer of 5 million for acquiring LGM, its website and database and keeping less than a half of the workforce. Publishing firm Distante (the owner of TV broadcasters Antenna Sud, Canale 85, Antenna Sud Live-Tele Onda and online papers Lo Jonio and L’Adriatico) said to be interested in making an offer for LGM, but it didn’t table any official bid. LGM is under special administration since September 2018 as Catania Court accused the paper’s publisher and 70% owner Mario Ciancio Sanfilippo of supporting mafia. In 2018, LGM posted operative losses of above 7 million.