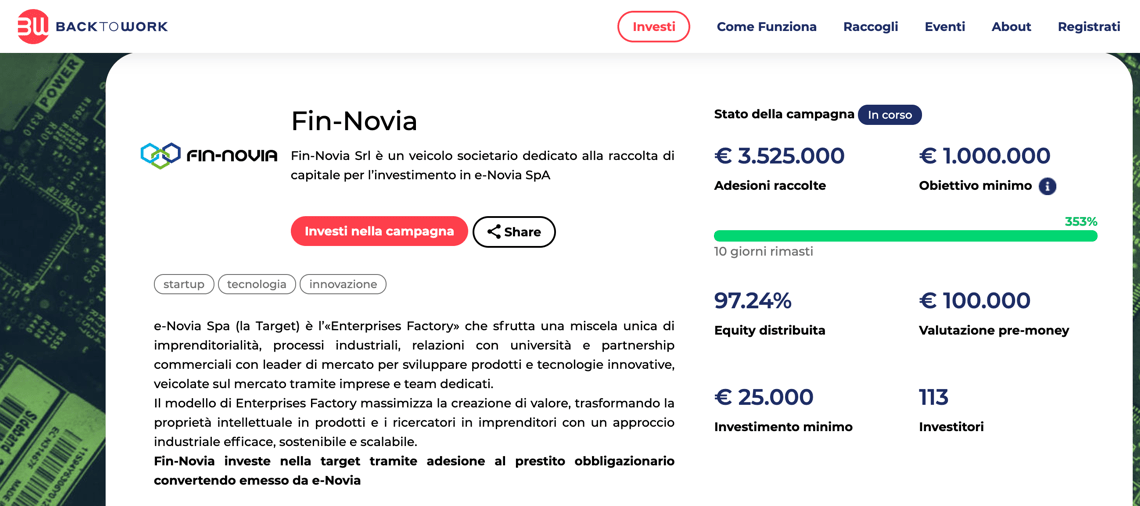

BacktoWork is hosting the equity crowdfunding campaign of investment firm Fin-Novia which set the upper target at 7.95 million euros, little below the threshold of 8 million that requires the publishing of an information prospectus (see here a previous post by BeBeez). Fin-Novia will invest such proceeds for subscribing part of a 25 million compulsory convertible bond issued by the Italian business incubator and accelerator e-Novia. The issuer reached 10.3 million euros in revenues in 2019 from 8.4 millions in s 2018, while the aggregate turnover of the portfolio companies of e-Novia is above 22 millions in 2019. Vincenzo Russi, Ivo Boniolo (cio), and Cristiano Spelta (cfo) founded e-Novia, which previously attracted investments from Brembo, Dompè, Landi Renzo, Fassi, Dainese, Pelliconi, Streparava, Eldor, Rubinetterie Bresciane, Mermec, and other entrepreneurs and financial firms. Fin-Novia set an initial target of one million euros for its equity crowdfunding campaign, but 131 investors already poured 4.3 millions in a few days with the least ticket of 25k euros. Fin-Novia chairman and ceo Lorenzo Dal Verme and ceo and cfo Luigi Bruno invested 100k euros in the company. The campaign is also receiving the support of Intesa Sanpaolo Private Banking that is purposing such an investment to its clients. Alberto Bassi, the ceo of BacktoWork, said to BeBeez that the conversion of e-Novia’s bond will go through the launch of an ipo on a regulated market 12 – 18 months after the end of the equity crowdfunding campaign.

BacktoWork is hosting the equity crowdfunding campaign of investment firm Fin-Novia which set the upper target at 7.95 million euros, little below the threshold of 8 million that requires the publishing of an information prospectus (see here a previous post by BeBeez). Fin-Novia will invest such proceeds for subscribing part of a 25 million compulsory convertible bond issued by the Italian business incubator and accelerator e-Novia. The issuer reached 10.3 million euros in revenues in 2019 from 8.4 millions in s 2018, while the aggregate turnover of the portfolio companies of e-Novia is above 22 millions in 2019. Vincenzo Russi, Ivo Boniolo (cio), and Cristiano Spelta (cfo) founded e-Novia, which previously attracted investments from Brembo, Dompè, Landi Renzo, Fassi, Dainese, Pelliconi, Streparava, Eldor, Rubinetterie Bresciane, Mermec, and other entrepreneurs and financial firms. Fin-Novia set an initial target of one million euros for its equity crowdfunding campaign, but 131 investors already poured 4.3 millions in a few days with the least ticket of 25k euros. Fin-Novia chairman and ceo Lorenzo Dal Verme and ceo and cfo Luigi Bruno invested 100k euros in the company. The campaign is also receiving the support of Intesa Sanpaolo Private Banking that is purposing such an investment to its clients. Alberto Bassi, the ceo of BacktoWork, said to BeBeez that the conversion of e-Novia’s bond will go through the launch of an ipo on a regulated market 12 – 18 months after the end of the equity crowdfunding campaign.

Italian apparels brand Furla will implement the dynamic discounting solution for cash invoice developed by the fintech startup FinDynamic (see here a previous post by BeBeez). Enrico Viganò, who previously worked for Bain&Co and General Electric, founded FinDynamic in 2016. The list of the company’s 30 clients also includes Unicomm, Unieuro, Sapio, Liu-Jo. In June 2019, Unicredit acquired a 10% of FinDynamic signing a partnership for distributing FinDynamic’s solution to its corporate clientes. FinDynamic also recently signed a partnership with Credemtel, a subsidiary of Credem for the supply of digital services to enterprises and government companies.

Nausdream, a supplier of tourism support services to tour operators in which Barcamper Ventures fund managed by Primomiglio sgr invested, launched an equity crowdfunding campaign on 200Crowd (see here a previous post by BeBeez). The fundraising target is 120-350k euros (for at least 5.56% of the business) on the ground of a pre-money value of 2.04 millions. Maria Antonietta Melis, Ousmane Dieng, Giuseppe Basciu, and Marco Deiosso (ceo) founded the company in May 2016 with the support of Contamination Lab based in Cagliari. Nausdream, raised 630k euros in three rounds between 2017 and 2019 from Primomiglio (230k euros) and the company’s chairman Gian Luca Puggioni (formerly General Manager Area Delegate of Azimut Capital Management).

Italian actor Luca Argentero acquired 2% of Italian startup Befancyfit, a provider of health tips that his girldfriend fitness influencer Cristina Marino founded (see here a previous post by BeBeez). Argentero purchased 1% of the company from Ms. Marino and 1% from Zagir, a company equally owned by Argentero himself, Massimiliano Marsiaj (the vice chairman of Sabelt, an Italian producer of safety belts and seats for automotive), Emanuele Boero (the owner of Monaco Fines Wines and the founder rare wines merchant Ebw Consulting) and real estate investor Marco Giovanni Chiono. Befancyfit also belongs to Ms. Marino (65.5%), her brother Vittorio Marino (5% ceo), Alessandro Paolo Gerbino (17.5%), and to Dario Montagnese (10%), who recently invested in Bizpop. This is not the first time that Argentero invests in startup. Together with Paolo Tenna he actually founded Myvisto, a platform that connects videomakers with brands. In January 2019, Myvisto raised 500k euros from Club degli Investitori, a network of business angels.