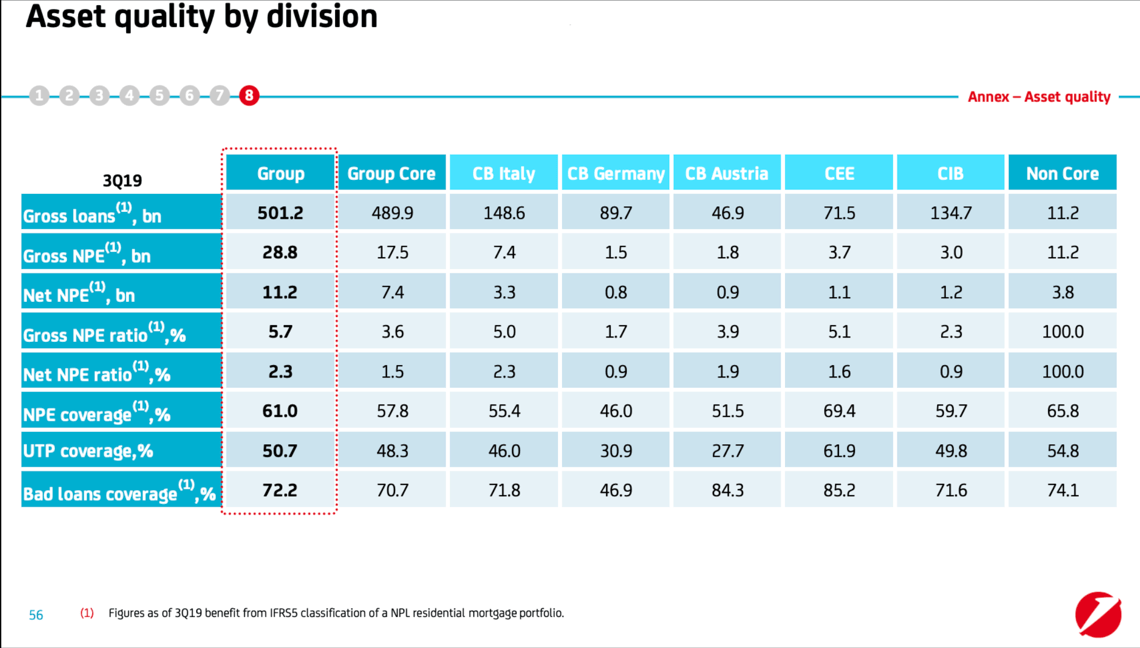

Jean Pierre Mustier, the ceo of Unicredit, said that the bank’s gross distressed credits are below 10 billion euros at the end of 2019 while the ratio of gross distressed credit over the total amount of gross credits of the core Group Core is of 3.6% (see here a previous post by BeBeez). Since the launch of Transform 2019, Unicredit’s distressed credits went down to 50 billion. In 3Q19 Unicredit’s gross NPLs amounted to 28.8 billion (11.2 billion net) from 34.4 billion in 2Q19, for a Group’s NPE ratio of 5.7% from 7% in 2Q19. Gross core distressed credits went down to 17.5 billion (18.7 billion in 2Q19) for a NPE ratio of 3.6% (3.9%), well below the target of 4.7% set for 2019, while non-core gross credits are of 11.2 billion (15.7 billion), close to the 2019 target of 10 billion. Unicredit also annouced a securitization of a portfolio of Npls of 6.1 billion with a Gacs warranty for the senior tranche. Earlier in August, the bank sent to a few potential investors a teaser for the sale of Project Dawn, a portfolio of 1 billion worth unlikely to pay credits. In early June, Unicredit hired Pimco, Gwm and Arec (Aurora Recovery Capital) for handling the special servicing activities for real estate UTPs worth up to 2 billion as part of Sandokan 2. The bank reportedly aims to sell a portfolio of Utps of up to 13.3 billion. Unicredit recently carried on the securitization of corporate loans worth 11.05 billion through the spv Impresa Two (See here a previous post by BeBeez). The spv issued class A senior notes with a floating rate worth 7.7464 billion with an Aa3 rating and unrated junior notes for 3.319 billion. Monica Curti, VP-Senior Credit Officer of Moody’s said that this securitization is the biggest ABS transaction since the end of the financial crisis. Almost one-third of the underlying portfolio includes the securitization of loans to mid and big corporates. Impresa Two includes loans to companies with revenues of above 50 million (32.7%) and above 250 million (10.2%) with a peak value of a single credit of 120 million. The securitization will have 2 years revolving period, and Unicredit will invest such proceeds in new loans that the bank will securitize again through Impresa Two. However, such a strategy may imply risks of higher volatility related to the macroeconomic cycle for the whole portfolio, Moody’s said.

Jean Pierre Mustier, the ceo of Unicredit, said that the bank’s gross distressed credits are below 10 billion euros at the end of 2019 while the ratio of gross distressed credit over the total amount of gross credits of the core Group Core is of 3.6% (see here a previous post by BeBeez). Since the launch of Transform 2019, Unicredit’s distressed credits went down to 50 billion. In 3Q19 Unicredit’s gross NPLs amounted to 28.8 billion (11.2 billion net) from 34.4 billion in 2Q19, for a Group’s NPE ratio of 5.7% from 7% in 2Q19. Gross core distressed credits went down to 17.5 billion (18.7 billion in 2Q19) for a NPE ratio of 3.6% (3.9%), well below the target of 4.7% set for 2019, while non-core gross credits are of 11.2 billion (15.7 billion), close to the 2019 target of 10 billion. Unicredit also annouced a securitization of a portfolio of Npls of 6.1 billion with a Gacs warranty for the senior tranche. Earlier in August, the bank sent to a few potential investors a teaser for the sale of Project Dawn, a portfolio of 1 billion worth unlikely to pay credits. In early June, Unicredit hired Pimco, Gwm and Arec (Aurora Recovery Capital) for handling the special servicing activities for real estate UTPs worth up to 2 billion as part of Sandokan 2. The bank reportedly aims to sell a portfolio of Utps of up to 13.3 billion. Unicredit recently carried on the securitization of corporate loans worth 11.05 billion through the spv Impresa Two (See here a previous post by BeBeez). The spv issued class A senior notes with a floating rate worth 7.7464 billion with an Aa3 rating and unrated junior notes for 3.319 billion. Monica Curti, VP-Senior Credit Officer of Moody’s said that this securitization is the biggest ABS transaction since the end of the financial crisis. Almost one-third of the underlying portfolio includes the securitization of loans to mid and big corporates. Impresa Two includes loans to companies with revenues of above 50 million (32.7%) and above 250 million (10.2%) with a peak value of a single credit of 120 million. The securitization will have 2 years revolving period, and Unicredit will invest such proceeds in new loans that the bank will securitize again through Impresa Two. However, such a strategy may imply risks of higher volatility related to the macroeconomic cycle for the whole portfolio, Moody’s said.

Mps said that it will reach a 12.5% NPE ratio at the end of 2019, from 14.6% at the end of September 2019, exceeding the target of 12.9% by 2021 (See here a previous post by BeBeez). The bank said that at the end of September the group’s gross distressed credits amounted to 14.5 billion from 15.6 billion at the end of June. However, the total gross loans at the end of September would be of 13.9 billion with a 14% NPE ratio stands at 14% if one considers the portfolios of 200 million Utps and of 400 million of non-performing leasing that MPS is selling. MPS aims to sell NPLs for 2 billion euros of NPLs and expects binding offers for a portfolio of UTPs amounting to 200 million, and to achieve a 12.5% NPE ratio.

In 3Q19, Illimity, the listed Italian financial services firm, reached an amount of asset of 2 billion euros and created 1.5 billion of value related to loans to SMEs and Npls corporate (1.19 billion in July) from when it started its activities that took place in September 2018 (see here a previous post by BeBeez). Since September 2018, Illimity’s division for NPL Investment & Servicing created developed sales of above 1 billion. Only in 3Q19 Illimity acquired distressed credits worth 346 million out of a total gross value of the portfolio amounting to 4 billion. The firmi s considering to acquire portfolios worth 3 billion. In 1Q19, Illimity’s brokerage margin has been of 16.4 million with a loss of 6.8 million (loss of 18.2 million in 3Q19). In 3Q19, Illimity also completed the launch of its digital retail bank illimitybank.com which raised 300 million with its saving and current accounts for 14,000 clients. The company also announced the launch of a fund for investing in Utps and in the equity of borrowers. Corrado Passera is the ceo of Illimity.

Ubi Banca’s distressed credits went down to 8.3 billion euros (-21% yoy), minus 690 million in 3Q19 (See here a previous post by BeBeez). In 3Q19, the bank’s recovery of distressed credits has been of 6.1% (5.5%) with a Npl ratio of 9.34% (9.97% in 2Q19 and 10.42% in 4Q18) or 9.07% Pro-forma if one includes the last tranche of distressed credits that Ubi is reportedly selling. Ubi Banca said it is considering selling by the end of 2019 a Gacs-backed portfolio of residential mortgages with a gross value of 800 million. (find out here how to subscribe to BeBeez News Premium for just 20 euros per month and read the BeBeez NPL Reports and Insight Views). After the conclusion of such sale, Ubi’s Npe ratio will be of 8%.

At the end of 3Q19, the distressed credits of Banco BPM amounted to 10.4 billion euros (10.66 billion at the end of 2Q19), taking the bank’s NPE ratio to 9.4% (9.7%), the Utps to 6.95 billion (7.25 billion) and the NPLs to 3.36 billion (3.3 billion) (See here a previous post by BeBeez). The net value of distressed credits is 5.96 billion (6.19 billion), with a net NPE ratio of 5.6% (5.9%). Earlier in April, Banco Bpm signed a partnership with Illimity for selling a portfolio of leasing Npls with a face value of 650 million. In February 2019, the bank carried on the securitization of a portfolio of NPLs worth 7.4 billion after having signed in December 2018 an agreement with Credito Fondiario and Elliot. The spv Leviticus issued senior, mezzanine and junior abs worth a total of 1.9 billion for a median price of 25.68%. The senior tranche is GACS-backed. Elliot will subscribe 95% of the junior shares. In June 2019, Credito Fondiario acquired a 70% stake of CF Liberty Servicing (fka First Servicing), the servicing platform of Banco BPM that will manage the portfolio of Elliott, the bank’s remaining Npls, and 80% of the new flows of distressed credits for the next 10 years.

Npls RE Solutions (part of Gruppo Gabetti) and real estate auction firm Astasy signed an agreement for merging in 2020 and name the Newco Npls RE Solutions (see here a previous post by BeBeez). After the merger, the shareholders of Npls RE Solutions will be Gabetti (15%), AxiA.RE (Gruppo Rina, 60%), Astasy’s ceo Mirko Frigerio (15%), and other investors (10%). In September 2017, Npls RE Solutions and Astasy signed a partnership for supporting the credit recovery procudures of banks, Reocos, servicers and Npl investors.

Milan-based investor in Npls and servicer Davis & Morgan (D&M), listed a 5 million euros minibond on Milan ExtraMot Pro (see here a previous post by BeBeez). The issuance pays a 7% coupon and is due to mature on 11 November 2024. The bond has an amortizing structure and will refund 25% of the principa on the third and fourth year and 50% at the maturity. The bonds are secured by a revolving pledge on mortgage NPL loans that have real estate assets based in the main Italian cities. The rotational nature of the pledge allows the issuer to purchase new single name non-performing mortgage loans as soon as the cash flows from the recovery activity carried out on the loans already pledged have returned. Such bonds will help Davis & Morgan to increase its investors base and to support its business plan that set an investment target in single name distressed credits of 20 million for 2019 and 20 million for 2020. This year, D&M already issued minibonds for 10 million.

The liquidators of bankrupted Banca Popolare di Vicenza (BPVi) sold Immobiliare Stampa to Bain Capital Credit for 200 million euros (see here a previous post by BeBeez). The price paid is worth half of the estimated value of the target’s real estate assets that is in the region of 400 million. Immobiliare Stampa attracted the interest also of Prelios, Cerberus, Apollo Global Management, Lonestar, Allianz, Invesco, Hines, Blackstone, TPG, Starwood Capital, and Tristan. After such an acquisition Bain Capital Credit now handles real estate assets, distressed credits and lease contracts worth 3.5 billion. Aquileia Capital Services, a company of Bain Capital, will manage the portfolio together with Kryalos. Immobiliare Stampa has sales of 25.38 million, an ebitda of 19.83 million and losses of above 33 million, while net cash and real estate assets stand at 19 million and 170.9 million.

DeA Capital acquired officially 38.82% of Quaestio Holding and the Npl management unit of Quaestio Capital Management (See here a previous post by BeBeez). Dea Capital Alternative Funds will own the units of Quaestio that manage the funds Atlante and Italian Recovery Fund and the soon-to-be-launched Italian Recovery Fund II that have assets amounting to 2.353 billion euros. Quaestio generated management fees for 36.9 million, 7 million of these come from the NPL Management, and net profits of 2.9 million. Dea Capital reportedly paid 12.2 million for the Npl management unit of Quaestio Capital Management. After the sale of the NPL Management business, Quaestio will have 7.5 billion of asset under management, and change ownership together with the majority the parent company Quaestio Holding for 14.1 million, including the warrants purchased. A price adjustment is also planned on the ground of the targets cash generation and the proceeds from the sale of other assets. Furthermore, the shareholders of Quaestio Holding will have the right to sell their shares to Dea Capital if it acquires 51% or more Quaestio Holding in the next five years. After this transaction, the shareholders of Quaestio are Fondazione Cariplo (34.01% from 41.2%), Cassa Italiana di Previdenza ed Assistenza dei Geometri Liberi Professionisti, Fondazione Cassa di Risparmio di Forlì, Direzione Generale Opere Don Bosco (27.17% from 31%), while Alessandro Penati and the firm’s management team sold their whole 27.8%.

Italian SMEs will have to invest 20,000 – 40,000 euros per year for implementing the required risk management systems and internal audit procedure for the self-assessment of financial solidity (see here a previous post by BeBeez). The implementation of such procedures will have an aggregate cost of 3.8 billion euros, said Rapporto Osservitalia 2019, a report that Cerved, the listed Italian corporate intelligence provider, on the ground of a pool of sector experts. The Italian association of accountants, Consiglio Nazionale dei Dottori Commercialisti e degli Esperti Contabili (CNDCEC), and Cerved elaborated the following ratios for previewing distressed situations: cash flow over assets (DSCR); equity over liabilities, and financial debts over revenues.

Milan-listed investment firm Tamburi Investment Partners (TIP) started on 14 November, Thursday, a roadshow with international investors for the placement of an unsecured fixed-rate senior bond of 250-300 million euros with a 5 years maturity (See here a previous post by BeBeez). TIP placed in April 2014 a 100 million Milan-listed bond paying a 4.75% coupon and due to mature on April 2020 available to retail investors as well. TIP will invest the proceeds of this new issuance in strengthening its financial position. At the end of 3Q19, TIP posted net profits of 84 million with a net equity of 842 million (+175.7 million since 31 December 2018).

Ver Capital, an European financial firm, aims to launch three new funds by the end of 2019, while in 1H20 it will launch an Eltif and a fund that will invest in euros-denominated loans (See here a previous post by BeBeez). The Eltif will invest in private debt opportunities of the top percentile, Ver Capital ceo Andrea Pescatori said to BeBeez on the sidelines of the firm’s Investor Meeting for 2019. Ver Capital Credit Fund, an Ucits short term and short duration fund, a vehicle for insures and other investors with a yield to maturity of 4-5% and low volatility. Ver Capital i salso about to launch an open non-Ucits fund that will invest in loans and bonds and a 10% monthly redemption window. This fund will target pension funds. Ver Capital Partners VII, a closed fund of private debt who already received 50 million euros from the European Investment Fund, is also about to start its activity and extend its focus from Italy to France and Germany. A part of the fund will provide support for working capital. Investors may require the warranty of EIF and reduce the risk by 50%.

Alternative Capital Partners (ACP), an ESG investor in alternative assets, launched a fund with an investment focus on biofuels, renewable energies and energy-saving technologies (See here a previous post by BeBeez). The European Investment Bank may invest up to 30 million euros in the fund that has a target of 150 million. Sources said to BeBeez that the fund will mainly invest in private debt, with a focus on project finance. However, it could invest in securitizations and in up to 20% of the equity of the companies to whom it lends. ACP set the first closing for spring 2020.

Milan-listed alternative energy firm Alerion Clean Power (part of Gruppo Fri-El) received a project financing loan of 35 million euros from Banco Bpm (See here a previous post by BeBeez). The financing is for 3 wind farms based in Sardinia with a total power of 70 MW. In September 2019, Alerion reportedly said it aims to issue a Dublin-listed green bond of 150-200 million euros for qualified investors.

Tages Helios 2, the second fund of Tages Capital with a focus on renewable energy, refinanced with 425 million euros a portfolio of solar plants and wind farms with a power of 142 MW (See here a previous post by BeBeez). Banca Imi, Banco Bpm, Bayerische Landesbank Anstalt des öffentlichen Rechts, Banco Santander, Bnp Paribas, and Société Générale issued the financing to Holdco Ortigia Power 51 and Tages Helios 2. This is the second loan that Holdco Ortigia Power 31 received in 2019 after a previous banking loan of 85 million.

Banco BPM (pool agent), Crédit Agricole Italia, Mediocredito Italiano, UBI Banca, and Unicredit (mandated lead arrangers) financed Investcorp for the acquisition of Vivaticket (fka Best Union) (see here a previous post by BeBeez). In September 2019, Investcorp acquired the majority of Vivaticket, a supplier of ticketing software, from the company’s founders Luca Montebugnoli and Luana Sabattini (who reinvested for a minority), Giuseppe Camillo Pilenga, Stefano Landi, and Bravo Capital Partners. In June 2018, the company’s shareholders delisted Vivaticket.

Italian textile company Plissé listed on Milan market a short term minibond of 650k euros (see here a previous post by BeBeez). The liability is due to mature on 15 July 2020, pays a 4.5% coupon and is the first tranche of a total issuance of 1 million which is part of a 3 million programme. In October 208, Plissè issued a 750k euros listed bond with a 2.6% coupon that came to maturity on 31 October, Thursday, and that Cofiter, Neafidi, and Ascomfidi Nord Ovest guaranteed for up to 250k euros each. In December 2017, the company placed a 0.5 million liability that matured in September 2018 and paid a 2.6% coupon for which Cofiter and NeaFidi guaranteed for 250k euros each. Plissè has sales of 24.4 million and an ebitda of 2.6 million and will invest the proceeds of these transactions in its working capital and financial balance.

The Government warranty for the Apulia Region minibond fund for local SMEs will raise to 40 million euros from previous 25 million (See here a previous post by BeBeez). Unicredit is the arranger of the transaction. The fundraising target was initially of 100 million, however, the Apulia Region decided to set a 160 million target. During the first month of the project’s operativity, seven SMEs applied for the issuance of minibonds of 2-10 million each and with a 7 years maturity amounting to 60 million. All the bonds will be part of a basket and a subsequent securitization. Unicredit will acquire these bonds of unlisted SMEs, carry on a securitization and sell the asset-backed shares to institutional investors, while Cassa Depositi e Prestiti will act as anchor investor. Mcc, Banca Popolare di Bari, Banca popolare Pugliese and Banca Popolare di Puglia e Basilicata will acquire the ABSs and Unicredit will buy 5% of them.

Italian construction company Ricci issued a 3 million euros minibond that will place on 2 December on Milan ExtraMot Pro3 market (See here a previous post by BeBeez). The bond is due to mature on 5 December 2022 and pays a 5% coupon. However, investors may gain a 5.5% yield during the distribution of the bond that has an issuing price of 98.5%. Ricci received a B.2.1. rating from Cerved and will invest the proceeds in its organic development and in MT Ricci, an innovative start-up that develops software and methods for the appraisal of buildings seismic risk. In August 2018, Ricci issued a 4 million Milan-listed bond that will mature in 2022 and pays a 5% coupon. At the end of June 2019, the residual value of the bond was of 1.06 million. Ricci has sales of 33.8 million, an ebitda of 1.6 million and a net financial debt of 10.8 million.

Planetel, an Italian TMT company, issued a 1.5 million minibond that Unicredit wholly subscribed (See here a previous post by BeBeez). The bond has a five-year term and pays a quarterly floating rate coupon indexed to the Euribor rate. Planetel will invest the proceeds in its organic development. The company has sales of 8.8 million and an ebitda of 1.64 million.