BeBeez is a media partner of 23rd annual SuperReturn International, the global event for private equity, venture capital, and private debt that will take place at Berlin InterContinental Hotel from 25 to 28 February 2020 (See here a previous post by BeBeez). More than 3,000 senior members of the financial community and more than 1,000 investors will attend the SuperReturn Conference where it will be possible to arrange one-to-one meetings. BeBeez readers can get a 10% discount bookng with the VIP code FKR2487BEBEEZ.

BeBeez is a media partner of 23rd annual SuperReturn International, the global event for private equity, venture capital, and private debt that will take place at Berlin InterContinental Hotel from 25 to 28 February 2020 (See here a previous post by BeBeez). More than 3,000 senior members of the financial community and more than 1,000 investors will attend the SuperReturn Conference where it will be possible to arrange one-to-one meetings. BeBeez readers can get a 10% discount bookng with the VIP code FKR2487BEBEEZ.

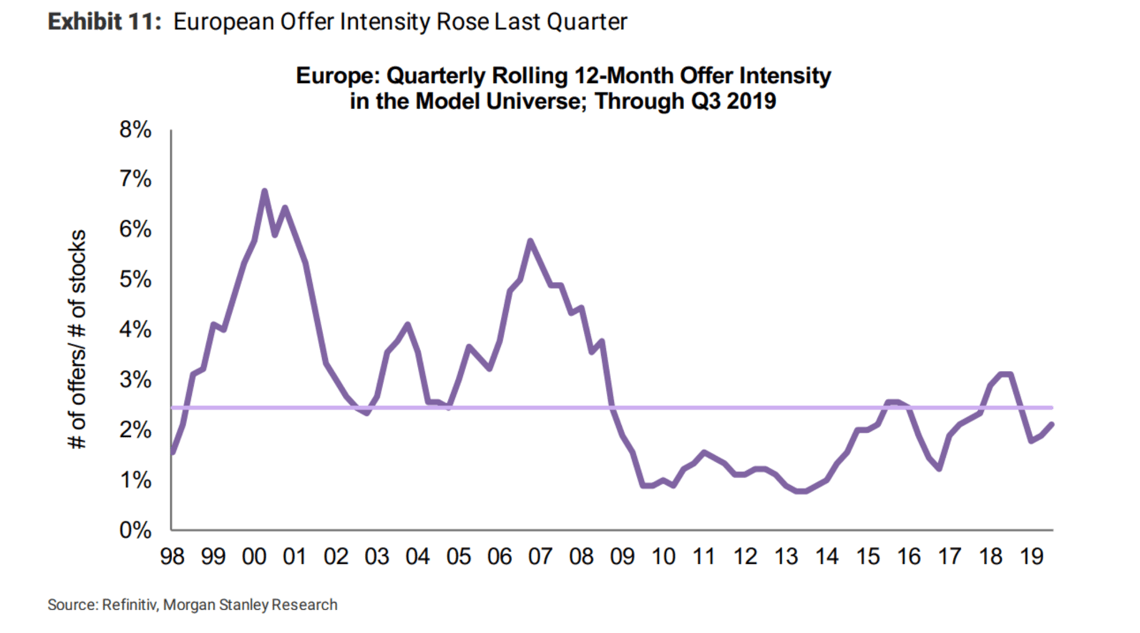

In 4Q18, the m&a activity slowed down as well as the launch of IPOs, said research papers of Morgan Stanley, PwC, and Refinitiv (see here a previous post by BeBeez). Morgan Stanley estimated that in 3Q19, the offer intensity ratio, number of bids over the total amount of listed companies, for the US went 50 basis points down to 2.5% while between 1Q18 and 2Q19 this ratio ranged between 2.77% and 3.16%. The offer intensity ratio for Europe climbed by 22 bps to 2.1%, but still below the 2.4% median value for the last 20 years. According to Morgan Stanley, the perspective of low earning per share keep the oir low as well as the uncertainty of the consequences of Brexit and the trade war of USA to China. However, the oir for ICT companies reached a peak of 7.7% in Europe and of 6.8% in the US. IPO Watch Europe, a report of PwC, said that in 3Q19, global ipos allowed to raise 125.7 billion US Dollars (223.5 billion yoy). In Europe the IPOs value dropped by 40% to 15.9 billion euros for 69 deals (26.5 billion in 3Q18 for 154 deals). Refinitiv said that the companies that launched an ipo in 3Q19 raised 113.2 billion US Dollars (-29% yoy). Nexi, the listed Italian paytech company, of which Advent International, Bain Capital, and Clessidra own a controlling stake, raised 2.3 billion euros with its lPO on Milan stock market. Refinitiv says that since mid October 2019, private equity funds kept a good level of global m&a activity worth 381.9 billion US Dollars (-2% yoy). However, the global m&a activity dropped by 11% in 3Q19 and amounted to 2.9 trillion US Dollar.

Gruppo Bonterre – Grandi Salumifici Italiani, O.P.A.S., Casillo Partecipazioni, and Intesa Sanpaolo tabled an unconditional bid for the acquisition of Ferrarini and Vismara, the troubled Italian food companies (See here a previous post by BeBeez). Bidders aimed to rapidly implement a strong turnaround, therefore asked to the shareholders of the troubled companies to provide quickly an answer before 6 November 2019, the scheduled deadline for the end of the receivership. However, Ferrarini and Vismara turned down this offer (see here a previous post by BeBeez). In February 2019, Gruppo Pini, an Italian producer of breasaola, made a ten million euros offer for a stake of 80% of Ferrarini, while Italian food company Amadori was interested in Vismara. Ferrarini and Vismara turned down this offer (see here a previous post by BeBeez). Ferrarini said that these bidders have not explained how would they pay the companies creditors. Ferrarini also applied again for a receivership plan of Vismara that would include the intervention of an industrial player, said Sido Bonfatti, the legal advisor of Ferrarini and Vismara. Bonfatti, furthermore said that Ferrarini could consider again the offer of Bonterre, Opas, Casillo and Intesa but only for Vismara. Ferrarini could still discuss the offer of Italian bresaola producer Gruppo Pini who in February 2019 announced to have reached an agreement for acquiring 80% of the asset for 10 million euros. Ferrarini previously ended the negotiations with turnaround investors Italmobiliare and QuattroR. Ferrarini went in financial distress when it increased its debt for acquiring shares of Veneto Banca that later bankrupted. At the end of July 2018, the company’s debt was in the region of 250 million with a turnover of 335 million, and an ebitda of 29.5 million. In April 2015, Ferrarini issued a bond of 30 million due to mature in April 2020 paying a 6.375% coupon. In December 2016, the company issued a bond of 5.5 million due to mature in December 2020 paying a 5.625% coupon that Duemme (part of Mediobanca) subscribed. Both liabilities are listed on Milan market.

Italian producer of suitcases Roncato sent to Milan Court an application for receivership (see here a previous post by BeBeez). Roncato owns the iconic brand Roncato Ciak. The company has sales of 8.7 million euros and an ebitda of 0.564 million.

Covisian, a provider of tools and software for CRM that belongs to Aksìa Capital, acquired Unitono Contact Center, Uniglobal Insurance Mediation, Avanza Colombia, and Avanza Assicurazione from Avanza (see here a previous post by BeBeez). Furthermore, Covisian Spanish subsidiary GSS acquired the Business process outsourcing unit of Avanza. Equita Private Debt subscribed a subordinated bond that Covisian issued. Covisian has sales of above 330 million euros.

Monza Court accepted the receivership plan of Castoldi, a shareholder of house appliances and consumer electronics retailer Euronics Italia (See here a previous post by BeBeez). The court accepted the company’s proposals for debt restructuring and settlement with the Italian Inland Revenue which initially asked Castoldi to pay 30 million euros and later reached an agreement for paying 6 million in more instalments. Castoldi will have to pay its creditors in 5 years. On the other hand, Nova, a shareholder of Euronics, expressed interest for buying Castoldi. Nova tabled a bid of 10 million euros for the company’s stores based in Lombardy. Stefano Caporicci is Nova’s chairman. After such buy, the company’s revenues will amount to about 300 million. Como’s tax authorities indicted Castoldi for having avoided 300 million of taxable income, 60 million of VAT, and 25 million of income taxes. After such allegation, Castoldi said it could not carry on its normal activities.

The shares’ price of Milan-listed investment company Tamburi Investment Partners (TIP) closed at 6.51 euros after it announced the sale of its stake in Italian fashion company Furla to Bloom for 35 million euros (See here a previous post by BeBeez). Bloom belongs to Furla’s executive chairman Giovanna Furlanetto and ceo Alberto Camerlengo. TIP’s shares in Furla had a book value of 17.9 million. Giovanni Tamburi and Alessandra Gritti will keep their role of Furla’s board members. TIP gained its shares in Furla after it subscribed a 15 million euro convertible bond that the company issued in 2016 ahead of the launch of an IPO. Furla has sales of 513 million (499 million yoy) and an ebitda of 84 million (80 million).

Labomar, an Italian producer of cosmetic productc and dietary supplements, acquired Enterprises ImportFab, a Canadian competitor (see here a previous post by BeBeez). Labomar received the support of Simest, the Italian Government-backed financial firm that helps Italian companies that aim to develop abroad and that belongs to Italian foreign trade insurer Sace. Simest will have a minority of EIF. For this acquisition, Labmar invested its own resources and borrowed financing from Intesa Sanpaolo and Unicredit. EIF founder Sylvain Renzi will be part of the new project and hire a new coo and a cfo. Walter Bertin acquired Neuberger Berman’s 29.33% stake in Labomar in January 2019. Labomar has sales of 60 million euros.

Seco, the Italian computer tech company of which FII Tech Growth has a 20% since April 2018, acquired Maryland-based competitor Inhand Electronics (see here a previous post by BeBeez). The Comitee for Foreign Investments in the United States (CFIUS) has to authorize the transaction. Earlier in February, Seco acquired the majority of Fannal Electronics, a Chinese tech company. Daniele Conti and Luciano Secciani founded Seco, based in the Tuscany’s city of Arezzo, in 1979. FII Tech Growth invested 10 million euros in a capital increase of Seco which has sales of 54 million (35% generated abroad).

Chinese conglomerate Fosun aims to increase its stake in listed Italian Banco Bpm and becoming the bank’s main shareholder (see here a previous post by BeBeez). Fosun has 1.5% of Banco Bpm. The data of Consob, the Italian stock market authority, say that in June 2019, the main shareholders of Banco BPM are Capital Research and Management Company (4.99%) and Invesco (4.71%). The bank has to renew its board in April 2020. Fosun belongs to three Chinese businessmen and to Alibaba. The company is based in Shanghai and has a market capitalization of 10 billion euros with 14 billion of net cash. In July 2019 Fosun acquired from Massimo Figna the majority of Tenax Capital, a boutique asset management with a focus on investments in financial equity, private debt of SMEs, insurance link securities based in London. Before Fosun, People’s Bank of China, the Chinese central bank, acquired stakes of up to 2% stakes of Intesa Sanpaolo, Unicredit, Mediobanca, Generali, Eni, and Enel.

Financial holding Iri (Investimenti Rettifiche Industriali) Luxembourg acquired Cmd, an Italian steelwork company, and Tecnosteel, an Italian automatic precision turning business (see here a previous post by BeBeez). Tecnosteel generates abroad 35% of its 3.7 million euros turnover with an ebitda of 0.639 million. Paolo Ferrario and Guido Antonio Caccia head Iri Luxembourg that was born in 2013. IRI Luxembourg holds in its portfolio stakes in OLFA, a company that processes plastic materials, OLFA Immobiliare; RPA, and Samoro.

Dolciaria Acquaviva, a sweets producer of which Ergon Capital Partners holds a controlling stake, acquired Milanopane, a food company (see here a previous post by BeBeez). Giovanni Carlo Polin, Marilena Fregolent, Leonello Magnani, and Passerini sold their interest in the company. Pierluigi Acquaviva, the ceo of Dolciaria Acquaviva and Emanuele Lembo, a managing partner of Ergon, siad that the company aims to carry on further acquisitions. Milanopane has sales of 6.8 million euros, an ebitda of 0.646 million, and net cash of 0.925 million. Dolciaria Acquaviva has sales of 60 million (49 million yoy) and an ebitda of 15 million (9.6 million) and net financial debt of 2.9 million. In July 2019 the Acquaviva family sold a majority stake to Ergon Capital Partners after having attracted interest of BC Partners. Ergon Capital Partners raised resources in the region of 1.6 billion that invested in 23 companies (7 in Benelux, 3 in France, 3 in Germany, 8 in Italy, and 2 in Spain).

Sator, the investment company of Matteo Arpe, aims to try again to change the governance of listed Italian online retailer ePrice (see here a previous post by BeBeez). Sator has 20.85% of the company that will hold on 12 November an EGM for the approval of a 20 million capital increase. Sator aims to discuss whether to sue ePrice chairman and ceo Paolo Ainio. In February 2015, ePrice launched an IPO at 6.75 euros per share for a market capitalization of 279 million. The company’s share price currently stands at 0.59 euros per share with a capitalization below 25 million euros. Sator investment in ePrice is worth 15.8 million less than the book value of 21 million. The company has sales of 164 million (-12% yoy), an ebitda of minus 8.8 million (15.3 million yoy), and a net loss of 14.6 million (24.7 million yoy). In 1H19, the company posted revenues of 63 million (-15.8% yoy), an adjusted ebitda of minus 4.5 million (-4.3 milioni), a net loss of 23.8 milkion (5.7 million) and a net financial debt of 13 million.

The Italian Government aims to change the regulation for Pir funds, which are financial instruments for channelling the Italian savings towards investments in SMEs (see here a previous post by BeBeez). The Government aims to cancel the obligation for PIR managers to invest in at least 3,5% of their resources in Aim-listed SMEs and to review the obligation of investing 3.5% of their assets under management in venture capital funds. Furthermore, the Government aims to introduce a cap on the commissions on PIRs. Sestino Giacomoni, an Italian MP of Forza Italia Party who is also the vice president of the Finance Commission, aims to lower the current taxes on savings and to introduce fiscal incentives for investments in SMEs.

Italian Spac Industrial Stars of Italy 3 (Indstars 3) signed the contract for its merger with Salcef, an Italian railway system and technology company (See here a previous post by BeBeez). Indstars 3 filed with the Italian stock market the application for a listing of Salcef on Milan AIM. Indstars will carry on the business combination with Salcef on the ground of the target’s enterprise value of about 325 million euros, or 5.2X the company’s ebitda, an equity value of 285 million, and 9.7 X the profits. Salcef has a net financial debt of 39.9 million. In 1H19 Salcef posted sales of 154.6 million; an ebitda of 34.3 million (+4.8% yoy); net profits of 18.9 million (+4.6%), and net cash of 21.7 million.

Jakala, the Italian martech company, acquired a 25% of GeoUniq, a French-Italian Mobile Location Intelligence company (see here a previous post by BeBeez). Jakala will consolidate its stake in 3 years. In September 2014, Antonino Famulari, Kevin Dolgin, and Martin Hogan founded the London-based company. GeoUniq has been the only Italian startup that joined Station F, the biggest European incubator based in Paris. In March 2016, GeoUniq raised a seed round of 0.4 million euros. In June 2019, Jakala acquired Volponi, a company that provides loyalty services for big distribution companies. Stefano Pedron is the ceo of Jakala, while Antonino Famulari is the ceo of GeoUniq.

Celli, an italian manufacturer of systems and accessories for tapping beer, soft drinks and water, acquired UK competitor MF Refrigeration (see here a previous post by BeBeez). In February 2019, Ardian acquired from Consilium Private Equity Fund a 70% of Celli, while the eponymous family sold a 30% stake. Celli has sales of 110 million. Michael Filmer, is the managing director of MF Refrigeration, while Mauro Gallavotti is the ceo of Gruppo Celli.

Mirco Dilda left his role of Italian co-Head of private equity at Argos Wityu and joined Swiss private equity Gyrus Capital (see here a previous post by BeBeez). Alyson Greenwood, formerly cfo of Argos, joined Gyrus Capital with a role of partner and coo. In May 2019 Cédric Perlet, a former senior investment executive of Argos, joined Gyruss as a partner. Guy Semmens, a former managing partner Argos, founded Gyrus at the end of 2018 together with Robert Watson, the former managing director of Altaris Capital Partners. Nino Lo Bianco, the founder of Business Integration Partners (BIP) a consulting firm that Argos sold to Apax France in May 2018, is part of Gyrus Capital advisory board. Gyrus Capital aims to focus on the sectors of healthcare and consultancy and closed its first deal by supporting the spin-off and the management buyout of DuPont Sustainable Solutions (DSS) that ceo Davide Vassallo led. Argos Wityu is an independent European private equity funds with bureaus in Bruxelles, Frankfurt, Geneve, Luxembourg, Milan, and Paris and 1 billion of assets under management.

Neopharmed Gentili, an Italian pharmaceutical company that belongs to Ardian, acquired Italian competitor MDM from the Trognoni and Monico families (see here a previous post by BeBeez). Neopharmed Gentili was born in 2011 after Gentili, that Mediolanum Farmaceutici acquired in 2009, merged with Neopharmed. The Del Bono family founded Mediolanum Farmaceutici in 1972 and sold a controlling stake of Neopharmed Gentili in November 2018. Neopharmed has sales of 133.7 million, an ebitda of 32.7 million, and net cash of 6.5 million. MDM has sales of 21.4 million, an ebitda of 3.86 million, and a net cash of 3.3 million.

Building Energy sold to SR Investimenti a portfolio of nine photovoltaic plants built on the roof of buildings with a power amounting to 7,5 MW (see here a previous post by BeBeez). The plants are active in Lombardy, Marche, and Emilia-Romagna since 2012 and get the incentives of the Italian Government. Fabrizio Zago founded Building Energy in 2010 together with other experienced managers of the utilities sector. In August 2015, the company issued a 30 million euros bond listed on Milan that The Three Hills entirely subscribed. In June 2014, Building Energy launched a capital increase of 8.5 million that Synergo subscribed for increasing its stake to 32.2%. In July 2017, Building Energy raised 70 million from Hong Kong-listed private equity ZZ Capital International Limited. In May 2019, British fund Zouk Capital acquired through the subscription of a capital increase 51% of Building Energy’s subsidiaries Be Power, the digital utility active in the sector of electric mobility, Be Charge, a demand response business, and 4Energia.

F2i and HAT sold to Cdp Equity their stakes in SIA, the IT infrastructures provider for the financial services sector, while Unicredit and Intesa Sanpaolo sold their stakes to FSIA Investimenti, a company that belongs to Poste Italiane (30%) and to FSI Investimenti (70%), which belongs to Cdp Equity (77%) and to Kuwait Investment Authority (KIA) (see here a previous post by BeBeez). Cdp Equity acquired from F2i 17.05% of SIA and a stake of 8.64% of the asset from Hat. Earlier in May sources said to BeBeez that the parties closed the transaction on the ground of an equity value of SIA of 2.4 billion euros and an enterprise value in the region of 3.2 billion, or 12.5X the company’s expected ebitda for 2019 and 14.6X the normalised ebitda for 2018, which is of 222 million, for a turnover of 614.8 million. HAT cashed 209 million of equity, while F2i gained more than 412 million. Cdp Equity now owns 83.19% of Sia, while Banco Bpm, Intesa Sanpaolo, Unicredit, Mediolanum, and Deutsche Bank hold the remaining interest. Nicola Cordone, the ceo of Sia, reportedly said that the company aims to launch an IPO and act as a consolidator in its sector. In March 2019, Sia announced the payment of a 60 million divident (59.9 million yoy; 44.55 million for 2016; 49.69 million for 2015; 35.68 million for 2014). Sia is a company monitored by BeBeez Private Data (find out how to subscribe for only 110 euros a month).

Farmaceutici Dottor Ciccarelli, the owner of iconic Italian consumer brands, hired Pirola Corporate Finance for finding a minority partner (see here a previous post by BeBeez). Marco Pasetti is the owner of the company and the grandson of the founder Nicola Ciccarelli. The company has sales of 26.6 million euros, an ebitda of 1.3 million, and a net financial debt of 0.8 million. The company could attract the interest of Equinox, China’s Nuo Capital, who recently acquired a minority of Ludovico Martelli, an Italian competitor of FDC.

Obton A/S, a Dutch financial investor, paid 70 million euros for a stake of Real Energy, an investor in photovoltaic energy assets (see here a previous post by BeBeez). Palladio Finanziaria, Cattolica Assicurazioni, and some banking foundations sold the asset. Real Energy has plants based in Italy with a power of 23.7 MW. Serenissima, which belongs to Centrale Finanziaria, will keep its role of management company of the fund. Obton has gross profits of 19.5 million and has world wide assets under management worth 1.150 billion, for a total power of 637 MWp. In Italy, Obton has plants in the areas of Venice and Potenza. In August 2019, Obton acquired from Belgium Enfinity photovoltaic plants based in Apulia and Sardinia with a power in the region of 15 MWp. After the acquisition, Obton took over the banking debt towards Unicredit, Banca Ifis, and Bper.

Tikehau Capital acquired a 23.43% of Assiteca through the subscription of a 25 million euros worth capital increase at 2.5 euros per shares as it was announced last August (see here a previous post by BeBeez). Assiteca’s main shareholder and chairman Luciano Lucca now has 60.38% of the Aim-listed insurance broker. In 1H19, the company posted a gross turnover of 70.7 million, and net revenues of 63.7 million with an ebitda of 11 million (15.6% of the gross sales), and a net profit of 5.4 million (+18.1% yoy). Assiteca will pay a dividend of 0,07 euros per share. Tikehau will support Assiteca’s M&A plans. In Italy, Tikehau previously invested in Dove Vivo. Tikehau is a Paris-listed financial services company with asset under management worth 23.4 billion.

Banca d’Italia authorized Entangled Capital, a financial services company that Roberto Giudici and Anna Guglielmi launched, to start its private equity activities (see here a previous post by BeBeez). Giudici and Guglielm previously worked for Green Arrow Capital (fka Quadrivio). The first fund of Entangled Capital will have a fundraising target of 100 million euros, with a hard-cap of 150 million. The fund aims to close 8-10 investiments in industrial companies and implement a buy & build strategy for them. Edoardo Guffanti is the chairman of Entangled Capital. Guglielmi previously worked for Alix Partners and in 2012 as risk manager and investitor relations manager of Quadrivio-Green Arrow. Giudici worked 5 years for the transaction services division of EY and since 2011 as senior investment manager of Quadrivio-Green Arrow.

Milan-listed Investment holding Italmobiliare has more than 500 million euros for new investments, said chairman Laura Zanetti and ceo Carlo Pesenti (see here a previous post by BeBeez). Italmobiliare’s Nav is worth in the region of 1.6 billion euros. The company aims to increase its focus on the sectors of food, domotics, high -tech, and non-cyclical sectors. Italmobiliare invested in private equity funds Clessidra, BDT Capital, and Iconiq. Isomer and Connect are the firm’s investments in the venture capital industry. Italmobiliare will directly act as venture capital investor through FT Ventures. In the last five years, the shareholders of Italmobiliare gained a 140% return. In 2019, Italmobiliare sold to Cinven for 100 million its stake in eProcurement company Jaggaer and acquired 40% of Iseo, a producer of digital and mechatronic solutions for the control of access.

Profamily, the non-captive consumer credit company of Banco Bpm, attracted offers worth in the region of 90 million euros (see here a previous post by BeBeez). However, by the end of November, the financial advisor Nomura may receive binding offers in the region of 100 million. Profamily is reportedly of interest to Apollo, Atlas, Alchemy, Christofferson, Robb & Co, and Chenavari, who previously acquired from Carige the consumer credit company Creditis. Profamily was born in 2010 and is part of Gruppo Banco Bpm since 2017. In June 2019, Banco Bpm sold to Agos Ducato (of which it holds a 39% stake together with 61% owner Crédit Agricole Consumer Finance) for 310 million the captive activities of ProFamily.