La Perla Fashion Holding nv, the Italian luxury lingerie brand headed by the Dutch Tennor Holding (formerly Sapinda) of the financier Lars Windhorst, is about to launch a 200 million euro capital increase without option rights (see here press release), after having landed last September 6th on the Euronext Growth market in Paris, dedicated to SMEs.

The announcement was made a few days ago by the company, also stating that “investors have committed on a binding basis to fully subscribe the capital increase” and that “La Perla has appointed Invest Corporate Finance as Sole-Coordinator and Invest Securities as Lead Manager and Underwriter of the capital increase”, whose net proceeds will be used “to repay a certain amount of the group’s financial indebtedness, thereby strengthening the capital structure, fund future acquisitions and for general corporate purposes”. Among the innovations on the business development front there is for example the project of diversification in beauty. According to reports by MF Fashion in recent days, in fact, the subsidiary La Perla Beauty was created for the development of luxury fragrances, cosmetics and skin care products and will try to get in touch with a wider consumer audience.

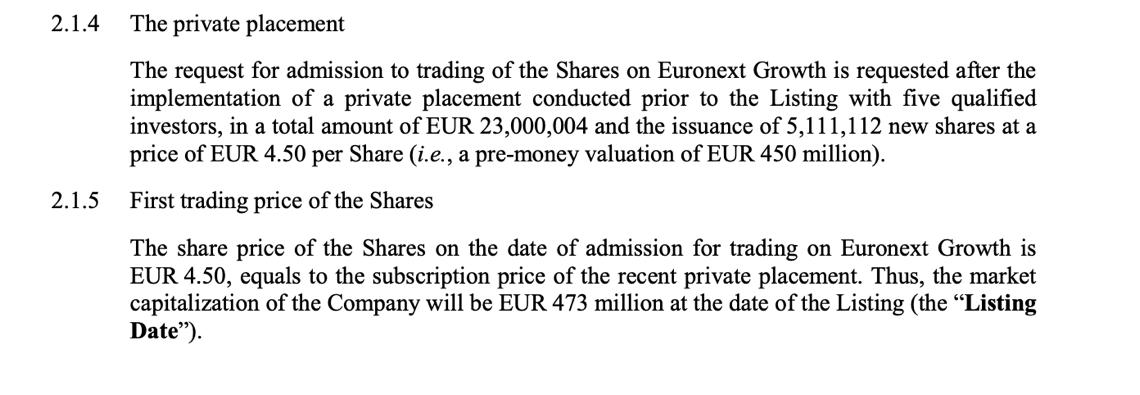

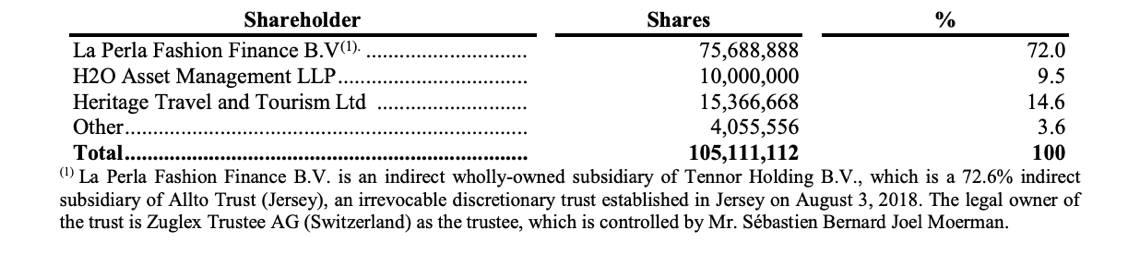

La Perla landed on Euronext with a so-called direct listing, ie a listing without shares being sold either in capital increase or in the hands of the current shareholders (see here a previous article by BeBeez and here the Information Document). The price was set at 4.50 per share equal to a market capitalization of 473 million euro, after the company had raised 23 million euros in a capital increase in private placement with five new investors last May. Investors included Heritage Travel & Tourism and above all H2O Asset Management, the asset manager of the Natixis group whose funds had been the subject of a a big outflow by investors last June, precisely because it was revealed that funds had a potential conflict of interest with a Windhorst-related companies while the funds were invested in illiquid bonds issued by those companies, including La Perla. Which could now be repaid thanks to the announced capital increase. Windhorst, through La Perla Fashion Finance, 100% controlled by Tennor Finance, had raised a 500 million euro bond maturing in March 2023 and paying a 7,25% coupon, for the acquisition of La Perla in 2018, with H2O exposed to the issue for over 300 millions.

La Perla landed on Euronext with a so-called direct listing, ie a listing without shares being sold either in capital increase or in the hands of the current shareholders (see here a previous article by BeBeez and here the Information Document). The price was set at 4.50 per share equal to a market capitalization of 473 million euro, after the company had raised 23 million euros in a capital increase in private placement with five new investors last May. Investors included Heritage Travel & Tourism and above all H2O Asset Management, the asset manager of the Natixis group whose funds had been the subject of a a big outflow by investors last June, precisely because it was revealed that funds had a potential conflict of interest with a Windhorst-related companies while the funds were invested in illiquid bonds issued by those companies, including La Perla. Which could now be repaid thanks to the announced capital increase. Windhorst, through La Perla Fashion Finance, 100% controlled by Tennor Finance, had raised a 500 million euro bond maturing in March 2023 and paying a 7,25% coupon, for the acquisition of La Perla in 2018, with H2O exposed to the issue for over 300 millions.

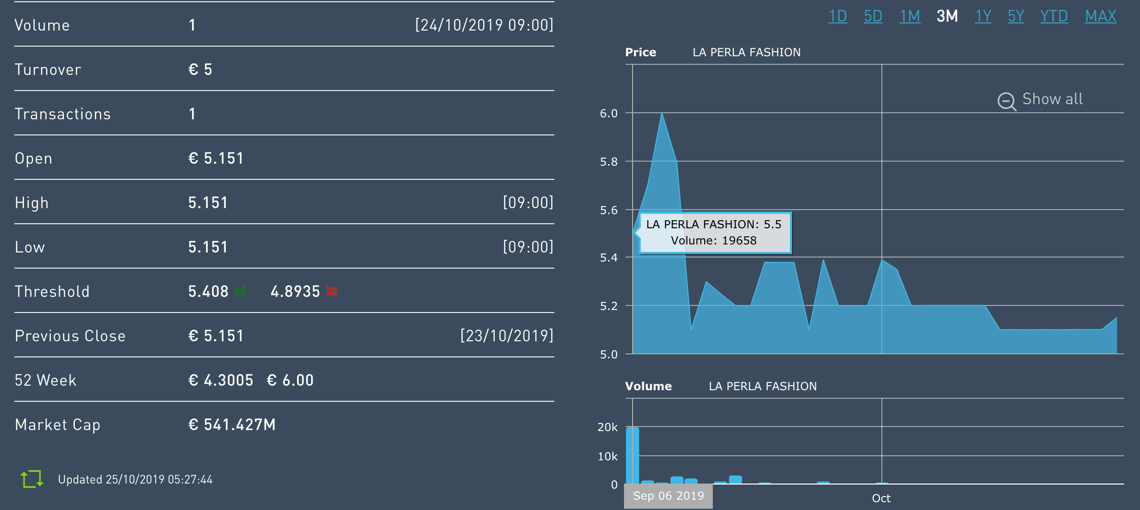

The private placement of 23 million in May took place on the basis of an equity value of 450 million. La Perla had debuted on the first day of listing in September up 22% to 5.50 euros, had then touched a maximum of 6 euros a few days later and since then it has retraced, to close yesterday at 5.151 euros per share. The purpose of the listing was to increase the company’s visibility and improve access to capital in order to re-launch it. “It is a brand of great value that was in danger of dying. The listing on Euronext is going well, so much so that now the company is planning a new capital increase,” Giovanni Vecchio, director of Italy for Euronext, commented to BeBeez yesterday , on the sidelines of ScaleIT, an event for matching Italian scaleups and international investors (see here a previous article by BeBeez).

The private placement of 23 million in May took place on the basis of an equity value of 450 million. La Perla had debuted on the first day of listing in September up 22% to 5.50 euros, had then touched a maximum of 6 euros a few days later and since then it has retraced, to close yesterday at 5.151 euros per share. The purpose of the listing was to increase the company’s visibility and improve access to capital in order to re-launch it. “It is a brand of great value that was in danger of dying. The listing on Euronext is going well, so much so that now the company is planning a new capital increase,” Giovanni Vecchio, director of Italy for Euronext, commented to BeBeez yesterday , on the sidelines of ScaleIT, an event for matching Italian scaleups and international investors (see here a previous article by BeBeez).

La Perla, founded in Bologna in 1954 by Ada Masotti as a craft workshop, has been in a state of crisis for years. The company was led and controlled by the founder’s son, Alberto Masotti, until October 2008, when it was sold to JH Partners, a private equity firm based in San Francisco and focused on investments in service companies and luxury brands . The group, however, had entered a crisis and ended up in a judicial auction in June 2013, after which it was taken over by SMS Finance, the holding company of Fastweb’s founder, Silvio Scaglia. The latter had relaunched the company, investing a total of 350 million euros. However the group had not yet managed to reach the breakeven and, against around 150 million euros of revenues, at the end of 2017 it still lost 80-100 million. In February 2018, after an exclusive and inconclusive negotiation with the Chinese conglomerate Fosun, the company was acquired by Sapinda Holding, an investment vehicle headed by the German financier Lars Windhorst(see here a previous article by BeBeez). La Perla closed its 2018 financial statements with 106.2 million euros in revenues (down from 133.9 millions in 2017), an operating loss of 91.3 millions (from 178.8 millions of loss in 2017) and a net debt of 70.6 millions (from 144.8 millions).