BeBeez will be the media partner of the Italian Private Equity Conference of Private Equity Insights that will take place in Milan on the next 24 October at the Four Seasons Hotel (see here a previous post by BeBeez). More than 250 Italian professionals will attend and there will be 11 discussion panels. BeBeez readers may get a 20% discount if they add the promotional code PEI_BeBeez during the registration for the event. Further information available on https://pe-insights.org/italy/ or at info@pe-insights.com

BeBeez will be the media partner of the Italian Private Equity Conference of Private Equity Insights that will take place in Milan on the next 24 October at the Four Seasons Hotel (see here a previous post by BeBeez). More than 250 Italian professionals will attend and there will be 11 discussion panels. BeBeez readers may get a 20% discount if they add the promotional code PEI_BeBeez during the registration for the event. Further information available on https://pe-insights.org/italy/ or at info@pe-insights.com

BeBeez invites you to join the presentation of the book Search funds that will take place in Milan at Palazzo Mezzanotte on 14 October, Monday, at 4PM (see here a previous post by BeBeez). You can register here for the event that BeBeez arranged together with Eversheds Sutherland and the London Stock Exchange.

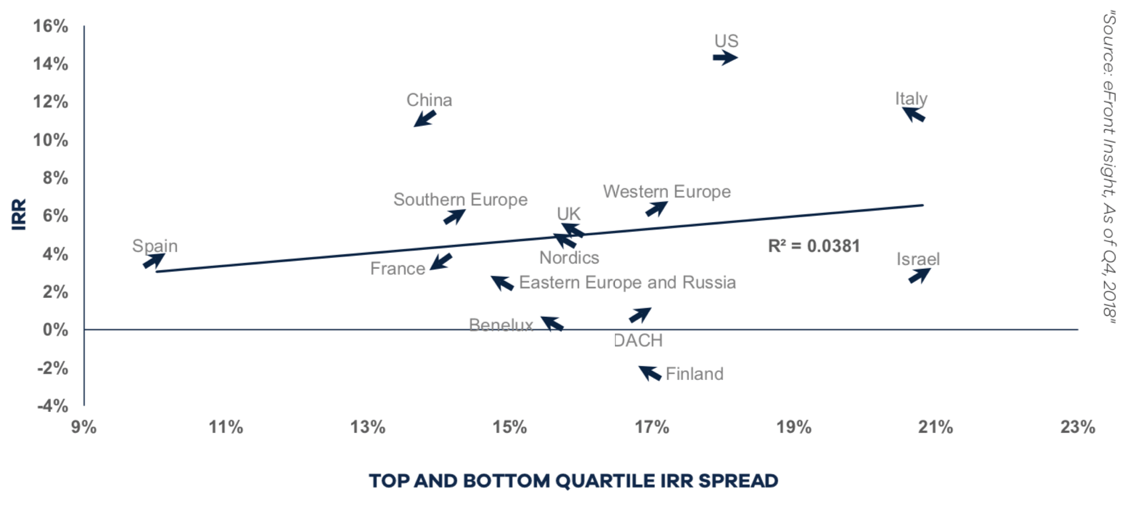

Italian venture capital and private equity funds posted an Irr of 11.41% and resulted as the most lucrative in Europe, said eFront, a tool for alternative investments that belongs to BlackRock (see here a previous post by BeBeez). The figures that eFront provided are slightly lower than the IRR of 16.9% that Kpmg elaborated on the ground of the data of Aifi, the Italian Association of investors in private equity, private debt and venture capital Italia. The database BeBeez Private Data filed 119 transactions for private equity and 128 for venture capital in 1H19 (see here the BeBeez Report for H19 private equity deals and the BeBeez Report for H19 venture capital deals that are available to subscribers to BeBeez News Premium 12 months or the Combo version of BeBeez Private Data). The Quarterly European Venture Capital Report 3Q19 of Dealroom ranked the Italian venture capital funds in 9th position in Europe in terms of investments (200 million euros) and for the number of rounds (21) (See here a previous post by BeBeez). The Private Equity Monitor (PEM) of Liuc University said that in 2019 Italian private equity transactions will hit a new peak (see here a previous post by BeBeez). PEM said that in 3Q19, private equity funds closed 144 deals compared to 110 deals in 3Q18.

Unigestion, a Swiss firm with 22.9 billion Dollars of Assets Under Management, will close two investments in Italy by the end of 2019 (see here a previous post by BeBeez). Francesco Aldorisio, Private Equity Partner of Unigestion and head of fund investments in Italy for Unigestion said to BeBeez that EMS Group, a portfolio company of the Swiss asset manager, is close to buying Italian competitor Zecchetti and another company while it is studying a deal in the food sector which will aggregate a number of SMEs.

The shareholders of listed Italian contractor Salini Impregilo finally approved the announced 600 million euros capital increase for acquiring the listed troubled competitor Astaldi and starting Progetto Italia, a merger of several Italian construction companies (see here a previous post by BeBeez). Pietro Salini, the ceo of Salini, reportedly said that Progetto Italia, which will receive the support of Cdp Equity, will have revenues of 14 billions and a portfolio of orders for 62 billions.

BCPartners started again a sale process for Cigierre – Compagnia Generale Ristorazione, the holding that owns restaurant chains Old Wild West and Temakinho (see here a previous post by BeBeez). BCPartners owns 85% of Cigierre since November 2015, while the company’s founder Marco Di Giusto and other investors have 15% of the business. Cigierre has sales of 306.6 million, and an ebitda of 45.57 million, a loss of 15.65 million, and a banking debt of 256.9 million.

Salcef Group, an Italian railway system and technology company that is implementing a business combination with the Spac Industrial Stars of Italy 3 (Indstars 3), posted sales of 154.6 million euros for 1H19 (see here a previous post by BeBeez). Salcef ebitda is of 34.3 million (32.7 million yoy), profits of 18.9 million (18.1 million yoy) and net cash of 21.7 million.

Newlat Food, a multi-brand food company, will launch its ipo on Milan markt at 5.8 – 7.3 euros per share, for an equity value of 157 – 197 million euros (See here a previous post by BeBeez). Newlat aims to list 41% of the business on the Star segment of the Italian stock exchange by the end of October and invest the proceeds in its organic growth and m&a. Angelo Mastrolia, the company’s chairman and ceo, will keep a majority of the business. Newlat has sales of 305 million, an ebitda of 26.9 million, and a net financial debt of 39.2 million.

Micromed, an Italian producer of electromedical devices that belongs to French fund ArchiMed, acquired Belgium’s software house OSG BVBA (see here a previous post by BeBeez). OSG has sales of 7.4 million euros, an ebitda of one million, and net cash of 2 million.

Italian furniture producer Calligaris, a portfolio company of Alpha Private Equity since August 2018, acquired lighting producer Luceplan (see here a previous post by BeBeez). Signify, fka Philips Lighting, sold the asset. Luceplan generates abroad 80% of its 20 million euros turnover. Calligaris has sales of 142 million. Alpha Private Equity has resources of 2 billion. Alpha Private Equity is one of the investors that BeBeez Private Data monitors. Find out here how to subscribe for the Combo version that includes BeBeez News Premium.

Sapio, an Italian producer of medical devices, acquired Spain’s Contse da Carburos Metàlicos (see here a previous post by BeBeez). Sapio has sales of 500 million euros.

Italian private equity firm IGI sgr raised 140 million euros for its last fund ahead of a target of 150 million to reach by December (see here a previous post by BeBeez). IGI is one of the investors that BeBeez Private Data monitors. Find out here how to subscribe for the Combo version that includes BeBeez News Premium.

Chinese geothermic energy player Nanjing Tica Thermal Solution won the auction for acquiring Exergy, the renewable energy company of troubled Gruppo Maccaferri (see here a previous post by BeBeez). The asset costed 16.5 million euros. Exergy has sales of 23.4 million euros, an ebitda of minus 0.6 million, and net financial debt of 28.7 million.

Mandarin Capital Partners acquired 67% of coffee and tea capsules producer Neronobile (see here a previous post by BeBeez). EOS Investment Management sold the asset. The Furia family has 33% of the business and Giampaolo Furia is the ceo. Neronobile has sales of 20 million euros and an ebtida of 3.2 million.

Made in Italy, the private equity fund that belongs to Quadrivio Group and Pambianco Strategie d’Impresa, acquired 52% of MOHD, an Italian online vendor of high-end furniture (see here a previous post by BeBeez). Gianluca Mollura, the target’s founder, will keep his role of chairman and ceo. MOHD has sales of 30 million euros (+20% yoy).

Italmatch Chemicals acquired a non-controlling stake US-based FRX Polymers, the owner of the flame retardant brand Nofia (see here a previous post by BeBeez). Italmatch co-invested in FRX together with the company’s current shareholders Citic Capital, Evonik Venture Capital, Triton Systems, Capricorn Venture Partners, Israel Cleantech, PMV, Mubadala, RobecoSam, and BASF Ventures. Italmatch Chemicals controlling shareholder is Bain Capital.

Scrigno, an Italian producer of doors that belongs to Clessidra sgr, acquired Costruzioni Chiusure Ermetiche from the Geron family (see here a previous post by BeBeez). Luigi Geron is the chairman and founder of the company which has sales of 11 milion euros. Scrigno has sales of 71.5 million (+2.5% yoy) and a 20% ebitda margin.

Atlantia, the listed Italian motorways operator, frozen the sale of a minority of Telepass, a provider of payment tools (see here a previous post by BeBeez). The stop to the sale came after the resignation of the ceo Giovanni Castellucci. Telepass enterprise value is of 2 billion euros.

Route Capital Partners and Ainvest, acquired women fast fashion company Susy Mix together with a club deal of investors (see here a previous post by BeBeez). Sources said to BeBeez that the company sold a majority stake. Susy Mix founders Michela Beccaletto, Gianluca Santolini, Pier Paolo Comandini, and Carlo Comandini sold the asset but will keep their roles as the company managers. Susy Mix has sales of 30 million euros and an ebitda of 5 million. Marco Ferra, Nicola Carminucci, and Giuseppe Altieri founded Route Capital Partners in 2014. Milan-based private equity Ainvest was born in 2001.

NB Renaissance Partners aims to sell its majority stake in wine producer Farnese Vini (see here a previous post by BeBeez). Press reports say that Lazard is handling the sale of the asset that NB acquired in 2016 from 21 Investimenti. Farnese has a turnover of 75 million euros (68.7 million yoy) and an ebitda of 18.8 million. The company’s enterprise value could be above 130 million.

Kedrion, an Italian maker of hemoderivative products of which the Marcucci Family owns a controlling stake and FSI Investimenti has 25.06%, may sell a 10% to FSI Mid-Market Growth Equity Fund (see here a previous post by BeBeez). Once completed the acquisition of the stake, FSI Mid-Market would subscribe a 50 million euros capital increase and increase its stake up to 20%, while FSI Investimenti, which belongs to CDP Equity (77.12%) and 77.12% Kuwait Investment Authority, would dilute its holding to below 25%. Kedrion is a company monitored by BeBeez Private Data (find out how to subscribe for only 110 euros a month)