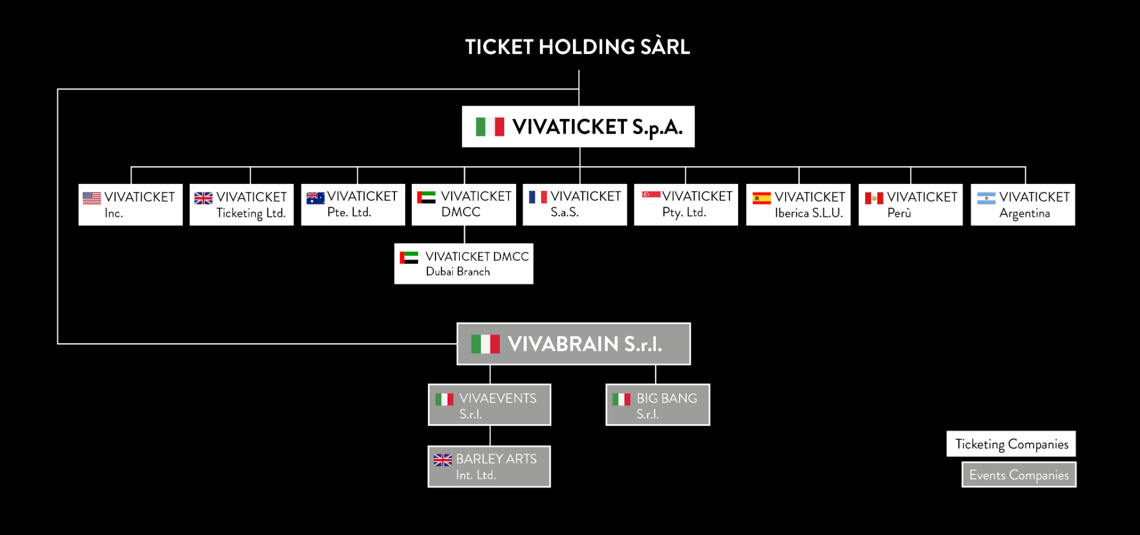

Bahrein’s Investcorp announced the acquisition of Vivaticket, an Italian ticketing company (see here a previous post by BeBeez). The fund acquired the asset from founders Luca Montebugnoli and Luana Sabattini, Giuseppe Camillo Pilenga, Stefano Landi, and Bravo Capital Partners.

Bahrein’s Investcorp announced the acquisition of Vivaticket, an Italian ticketing company (see here a previous post by BeBeez). The fund acquired the asset from founders Luca Montebugnoli and Luana Sabattini, Giuseppe Camillo Pilenga, Stefano Landi, and Bravo Capital Partners.

IPE (Investimenti in Private Equity), the investment holding Italian businessman Gianfilippo Cuneo and other investors, acquired a controlling stake in Valedo, a bartering company for the distribution of OTC drugs, from the founder Carlo Santoro who will hold a minority of the business and his chairman and ceo role (see here a previous post by BeBeez). In October Carlo Paolo Grossi will be in charge as ceo. Valedo has sales of 125 million euros, an ebitda of 14 million, and net debt of 7 million.

Indigo Capital and a club deal of investors that Orienta Partners arranged invested 15 million euros for acquiring Cristallina, the holding that owns mineral water brands Pejo and Acqua di Carnia and has a turnover 33 million (See here a previous post by BeBeez). Italian private equity AVM Associati sold the asset. Bnl Bnp Paribas, Crédit Agricole Cariparma and Crédit Agricole FriulAdria financed the transaction.

Bormioli Pharma, a packaging company that belongs to Triton Capital, acquired German competitor R&G Beteiligungs (see here a previous post by BeBeez). R&G has sales of 25.6 million euros and an ebitda of 4.1 million (16% margin).

L’Autre Chose, an Italian fashion firm that belongs to private equity fund Sator, acquired luxury shoe producer Giannico from the company’s founder Nicolò Beretta (See here a previous post by BeBeez). L’Autre Chose has sales of14.4 million euros, an ebitda of minut 1.6 million, net losses of 2.2 million, and net financial debts of 2 millioni.

Green Arrow hired Banca Imi for selling its 70% of Farmol, an Italian producer of cosmetics and pharmaceutical products (see here a previous post by BeBeez). The Innocenti Family owns the remaining 30%. The transaction value is in the region of 100 million euros. Farmol has sales of about 80 million and an ebitda of 10 million.

Ardian Infrastructure hired Rothschild for selling biomass plant Agritre (see here a previous post by BeBeez). The asset is worth 100 million euros and belongs to Ardian (52%) and gruppo Tozzi.

Design Holding, the holding that groups Italian high-end design furniture producers which is part of the portfolio of Investindustrial and Carlyle, appointed Gilberto Negrini and Giovanni Del Torchio as ceo and chairman of B&B Italia (see here a previous post by BeBeez). Design Holding has sales of above 500 million euros.

Marco Patuano, formerly ceo of Tim, launched MP Invest an investment and consultancy firm (see here a previous post by BeBeez). MP Invest will focus on advisory for the sectors of financial services, industrials, infrastructures, media, and digital technologies.

Spactiv, the Milan-listed Spac that raised 90 million euros and that Maurizio Borletti, Paolo De Spirt, and Gabriele Bavagnoli launched, announced the business combination with Betty Blue, the fashion brand that belongs to Italian designer Elisabetta Franchi (see here a previous post by BeBeez). Betty Blue has sales of 115.6 million euros, an ebitda of 19.3 million, a net profit of 15 million, and net cash of 9.25 million. Spactiv will buy at least 34.9% of the company for 63 million or up to 41.7% for 77.5 million.

Italian yachts producer Ferretti will launch its through a capital increase of 100 million euros and a sale of shares (see here a previous post by BeBeez). The company will carry on the listing through a private placement for institutional and qualified investors and the managers. The public traded equity of 35% – 40%. Chinese group Weichai (Shandong Heavy Industry), the owner of 86.2% of Ferretti previously converted in equity the 212 million financing it provided.

Sanlorenzo, an Italian producer of luxury yachts, aims to launch an ipo by the end of 2019 (See here a previous post by BeBeez). Massimo Perotti is the company’s chairman and main shareholder. Sanlorenzo has sales of 460 million euros.

Italian producer of yachts and megayachts Azimut Benetti posted a turnover of 900 million euros for 2019 (see here a previous post by BeBeez). Azimut belongs to the Vitelli Family and Milan listed investment firm Tamburi Investment Partners (TIP).

Italian independent corporate family office CFO sim acquired 52% of Italian wealth manager Alpe Adria Gestioni from Banca Credinvest (See here a previous post by BeBeez). Founders will keep 48% of the target that has above 2 billion euros of asset under management. Michelangelo Canova will keep his role of chairman of Alpe, while Felice Fort and Umberto Spadotto will remain in charge as ceos. Andrea Caraceni, Massimo Maria Gionso, and Corrado Pachera will join Alpe’s board of directors.

Brera Financial Advisory signed a partnership with Clearwater International, aglobal network of mid-market m&a advisors (See here a previous post by BeBeez). Francesco Perrini is the executive chairman of Brera, while Michael Reeves is the ceo of Clearwater International.