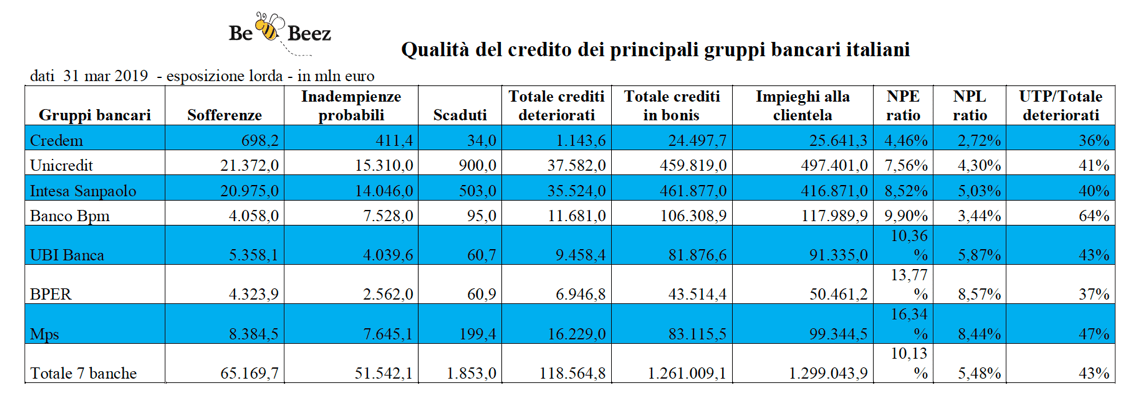

According to an analysis by BeBeez on Q1 2019 results for Unicredit, Intesa Sanpaolo, Mps, UBI Banca, Banco Bpm, BPER, and Credem, on March 31st the first seven Italian banks had on their books non performing exposures for 118 billion euros (121 billions at the end of 2018), while UTPs account for 43% of such amount (see here a previous post by BeBeez). TMA Italia, the Italian association of turnaround managers, shared such data in its newsletter made for the association by BeBeez. BeBeez News Premium subscribers can read the survey here (find out here how to subscribe).

According to an analysis by BeBeez on Q1 2019 results for Unicredit, Intesa Sanpaolo, Mps, UBI Banca, Banco Bpm, BPER, and Credem, on March 31st the first seven Italian banks had on their books non performing exposures for 118 billion euros (121 billions at the end of 2018), while UTPs account for 43% of such amount (see here a previous post by BeBeez). TMA Italia, the Italian association of turnaround managers, shared such data in its newsletter made for the association by BeBeez. BeBeez News Premium subscribers can read the survey here (find out here how to subscribe).

Unicredit sold a portfolio of SMEs corporate distressed credits worth 1.1 billion euros to a securitization vehicle that US investor SPF Investment Management financed (see here a previous post by BeBeez). BeBeez News Premium subscribers may read here the Npl Report of BeBeez for the first seven months of 2019 (find out here how to subscribe).

Illimity acquired by Unicredit two portfolios of bad loans worth respectively 210 and 103 million euros (see here a previous post by BeBeez). Leasing credits account for 80 million of Unicredit portfolio, and the remaining 23 millions is a single-name corporate secured credit with logistic assets as collaterals. Unicredit also sold 450 million euros of large ticket mid-market corporate distressed credits to Illimity (240 million) and to Barclays Bank and Guber Banca (210 million) (see here a previous post by BeBeez).

By the end of 2019, the banks that are part of Iccrea Group will sell distressed credits worth 1.2 billion euros through a multitranche and multioriginator securitization that will ask for the Gacs warranty (see here a previous post by BeBeez). The deal has been expected for some months but it is now official as DBRS published the news in a report confirming its rating for the banking group. This would be the third securitization with Gacs for Iccrea. Last December the bank made the securitization of an NPLs 2 billion euro portfolio while in July 2018 the bank had securitized NPLs for one billion euros.

Italian construction company Pessina Costruzioni applied for a receivership procedure (see here a previous post by BeBeez). Carlo Pessina founded the company in 1954. Massimo Pessina and Guido Stefanelli are the current chairman and ceo. The company has a turnover of 67.7 million euros (-22% yoy) and an ebitda of 0.952 million (-92%).

Banco Santander, ING Bank, Mediocredito Italiano, and Natixis Sonnedix provided Sonnedix, a solar energy company that belongs to JPMorgan Asset Management, with new credit lines for 201.6 million euros (see here a previous post by BeBeez). In Italy Sonnedix owns plants that have a power capability of 186 MW.

Italy’s mid-market private debt fund Anthilia BIT received from Italian stock market regulator Consob the authorization to seek investors based in France, Belgium, Luxembourg, Denmark, Sweden, Finland, and Norway (see here a previous post by BeBeez). Antilia BIT has resources for 200 million euros and set for 2020 a fundraising target of 350 million.

Italian manufacturer of products for irrigation Irritec issued a 7 million euros minibond that Unicredit subscribed (see here a previous post by BeBeez). The company will invest the proceeds of this 7-years issuance in its organic development. Irritec has sales of 155.5 million, an ebitda of 24.7 million, and net debt of 57.4 million.

M&G Investments refinanced Le Corti di Baires, the real estate development project of Meyer Bergman (see here a previous post by BeBeez). M&G subscribed the three years bonds worth 117.75 million euros. The issuing of the bond had been announced some months ago but the investor had not been disclosed back then.

Banca Popolare di Bari made a synthetic securitization of mortgages and credits to SMEs amounting to 3 billion euros (see here a previous post by BeBeez). US fund Christofferson Robb & Company will be credit default swap counterpart for 260 million euros of eventual losses.

Fondo Strategico Trentino Alto-Adige, managed by Finint Investments sgr, entirely subscribed Trentino Minibond, a basket bond of 10.2 million euros that nine SMEs based in the North Eastern Italian Region of Trentino issued (see here a previous post by BeBeez).

People’s Bank of China, the Chinese central bank, authorised the issuance of yuan-renmimbi denominated bonds (Panda Bonds) of Cassa Depositi e Prestiti (CDP), for up to 5 billion renmimbi (650 million euros) (see here a previous post by BeBeez) Chinese agency China Chengxin International Credit Rating Co. Ltd assigned an AAA rating to such liabilities. CDP will channel the raised proceeds to Italian SMEs through the Chinese branches of Italian banks.