A 470 million euros senior secured bond has been listed on the italian ExtraMot Pro market to finance the buyout of DOC Generici by Intermediate Capital Group (ICG) in co-investment with Mérieux Equity Partners (see here a previous post by BeBeez). ICG and Merieux bought the pharmaceutical group last April, valued about 1.1 billion euros. The seller was CVC Capital Partners, which in turn had acquired control of the company from Charterhouse in March 2016 (see here a previous post by BeBeez).

That the funds intended to issue a bond to finance the deal on DOC Generici was known since last May, but at the time there was talk of a size just around 400 million euros (see here a previous post by BeBeez)

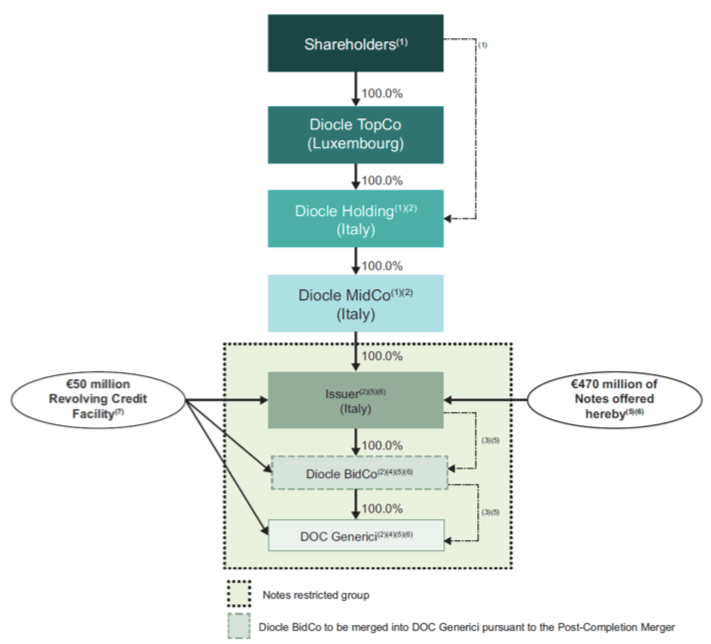

More in detail, the bond was issued by Diocle spa, the parent company of Diocle BidCo, which is the newco with which the funds bought DOC Generici. The bond, which was issued at par, expires on 30 June 2026 and pays a floting coupon equal to the 3-month Euribor rate plus 3.875% with a quarterly reset. The joint global coordinators and the joint bookrunners of the transaction were Bnp Paribas, Unicredit, with Crédit Agricole as another joint bookrunner. These are the same banks that provided Diocle spa with a 50 million euro revolving credit facility. Moody’s has assigned the bond a B2 rating (see the Moody’s report here), while S&P has assigned a preliminary rating B (see the press release here).

Diocle spa in turn reports to the Italian Diocle MidCo, controlled by the Italian Diocle Holding. The latter in turn is controlled by the Luxembourg holding company Diocle TopCo (see the diagram on the page and here the Offering Memorandum).

Diocle spa in turn reports to the Italian Diocle MidCo, controlled by the Italian Diocle Holding. The latter in turn is controlled by the Luxembourg holding company Diocle TopCo (see the diagram on the page and here the Offering Memorandum).

Diocle spa will use the 470 million euros raised with the bond and the injection of 601 million euros of equity from the funds to finance Diocle BidCo so that the newco can, on the one hand, refinance the existing senior debt of DOC Generic for a total of 221 millions and on the other hand to pay the purchase price, as well as the costs and commissions related to the transaction.

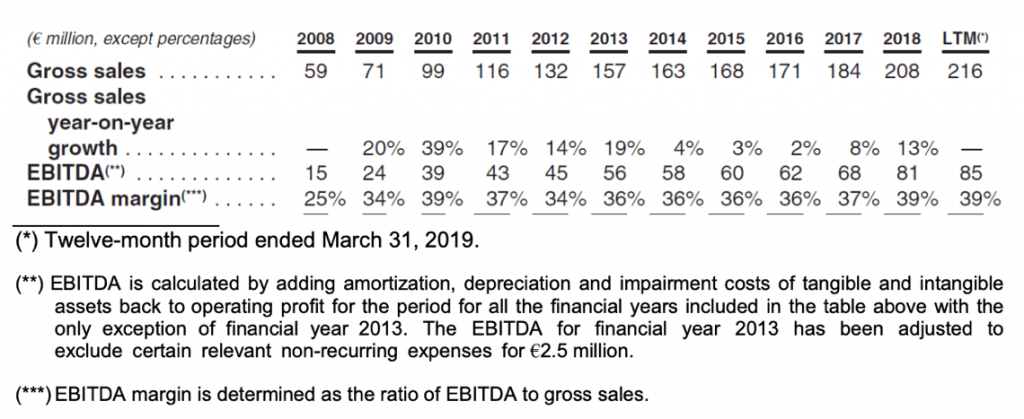

DOC Generici closed 2018 with gross revenues of 208 million euros (from 184 million in 2017) and an ebitda of 81 million (from 68 million), equal to an ebitda margin of 39% (from 37%), against a net financial debt of 223.2 millions.

EdiBeez srl