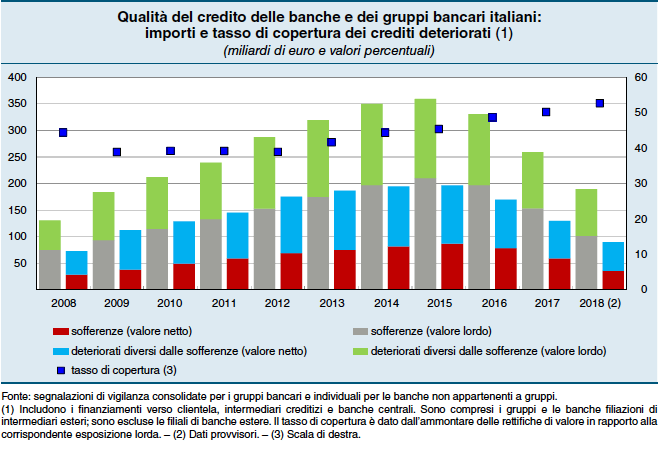

Ignazio Visco, the governor of Banca d’Italia, said at the annual meeting of the central bank that Italian banks have to focus on their NPEs, even though they decreased their distressed credits (see here a previous post by BeBeez). Furthermore, Italian banks have to develop further their fintech assets and activities. Private capital and non-banking financial channels are still underdeveloped, Visco added.

Ignazio Visco, the governor of Banca d’Italia, said at the annual meeting of the central bank that Italian banks have to focus on their NPEs, even though they decreased their distressed credits (see here a previous post by BeBeez). Furthermore, Italian banks have to develop further their fintech assets and activities. Private capital and non-banking financial channels are still underdeveloped, Visco added.

Italy’s proptech Casavo raised 25 million euros through a venture debt round (see here a previous post by BeBeez). The startup signed a revolving credit contract and provided real collaterals. Picus Capital and 360 Capital Partners, Kervis Asset Management, Boost Heroes and Rancilio Cube are other investors in Casavo. Giorgio Tinacci and Simon Specka founded Casavo in 2017.

Italian credit servicer GMA aims to double its turnover, said the company founders and owners Emanuele Grassi (ceo of NPL unit), Mauro Miletto (ceo of Real Estate), and Michele Bartyan (head of Finance and Treasury) (see here a previous post by BeBeez). For the next five years, GMA aims to expand its Reoco (Real Estate Owned Company) activity and take advantage of Italian fiscal incentives for securitizations (see here our Insight View on the issue for our BeBeez News Premium readers, discover here how to subscribe at just 20 euros per month), increase the number of workers, keep the focus on special situation credits and on smaller portfolios (with a GBV of up to 50 million), sign property management partnerships for further focusing on the NPL core business.

Italian industrial company Iselfa issued a 5 million euros minibond that Unicredit wholly subscribed (see here a previous post by BeBeez). The liability will mature in 7 years and pay a quarterly coupon linked to Euribor rate. Ernesto Carabelli founded Iselfa in 1932. The company has sales of 17.1 million, an ebitda of 1.93 million, and a net financial debt of 8 million. The company will invest the proceeds of the issuance in its organic development.

Alternative energy investor Caab Energia issued a Milan-listed senior secured green bond for 8.35 million euros (see here a previous post by BeBeez). The bond pays a biannual coupon amounting to a 4.695% rate plus 25% of 6 months euribor rate, it has an amortizing structure and is due to mature on 30 June 2033. Caab, based in Naples, belongs to Filizola (37%) and to Pagano e Ascolillo Società Benefit (63%), two alternative energy companies. Caab has sales of 1.59 million, net profits of 30,000 euros, and net cash of 1 million.

Abramo Customer Care, an Italian BPO company, issued a 20 million euros bond that Tenax Capital Private Debt entirely subscribed (see here a previous post by BeBeez). Abramo has sales of 136 million and an ebitda of about 10 million.

Bologna Court accepted the application for receivership of four companies that belong to Gruppo Maccaferri, who hired to this end Rotschild Italia, BonelliErede, and Ltp (see here a previous post by BeBeez). Maccaferri applied for receivership for Seci holding, Seci Energia, Enerray, and Exergy. The other assets of Maccaferri are Samp, Sigaro Toscano, and Officine Maccaferri. However, Moody’s didn’t rule out the possibility for a downgrade of the current B3 rating of Officine Maccaferri, that in June 2014 issued a Milan-listed bond worth 200 million due to mature in 2021, paying a 5.75% coupon and that has still to reimburse 187.5 million.Gaetano Maccaferri is the chairman of Gruppo Maccaferri, Lapo Vivarelli Colonna is the ceo. The company generates sales of above 1 billion, an ebitda of 118 million, while debts stand at 750 million. Intesa Sanpaolo, Banca Imi, Unicredit, and Banco Bpm are the company’s main lenders.

Intermediate Capital Group (ICG) and its coinvestor Mérieux Equity Partners are preparing a 400 million euros bond issue for financing their buyout of pharma group DOC Generici (see here a previous post by BeBeez). The company’s enterprise value is of 1.1 billion euros. The company may issue such bond and give up the acquisition financing facilities that Unicredit, Bnp Paribas, Credit Agricole, and Barclays provided. DOC Generici has sales of above 200 million, an ebitda of 67.7 million, and net financial debt of 266 million. ICG and Merieux acquired the asset from CVC Capital Partners, which in turn purchased the asset from Charterhouse.

EdiBeez srl