Negotiations between Cdp Equity and Poste Italiane, on the one hand, and F2i sgr and HAT sgr on the other hand, on the transfer of shares of Sia, the European group of services and payment infrastructures, are now at a very advanced stage. For months there have been rumors of possible mergers with the other paytech Milana-listed company Nexi or with some other subjects or of an ipo (see here a previous post by BeBeez).

MF Milano Finanza wrote about the acceleration of negotiations yesterday. According to BeBeez, the transaction would be conducted on the basis of an enterprise value of Sia of 3.2 billion euros.

More in detail, FSIA Investimenti, which today controls Sia with a 49.48% stake, and which in turn reports for 70% to Cdp Equity and 30% to Poste Italiane, has made an offer to buy the shares today owned by F2i sgr (at 17.05%) and HAT sgr (8.64%, distributed between the Fondo ICT and the Fondo Sistema Infrastrutture). In this way FSIA would rise its stake to 75.17%. But it’s not over. FSIA, F2i and HAT together have a call option that entitles each of them to purchase all the shares of Sia currently owned by Unicredit and Intesa Sanpaolo. That option, which was to be exercised by 27 May, therefore gives the right to purchase an additional 7.94% of the capital of Sia.

According to BeBeez, the option was exercised by FSIA some days ago, while F2i and HAT did not do so, precisely in view of the conclusion of the negotiation, thus leaving FSIA with the right to acquire all the further shares of the 7.94% and reach 83.11% of the capital of Sia, which for the rest would continue to report to Banco Bpm, Intesa Sanpaolo, Unicredit, Mediolanum and Deutsche Bank.

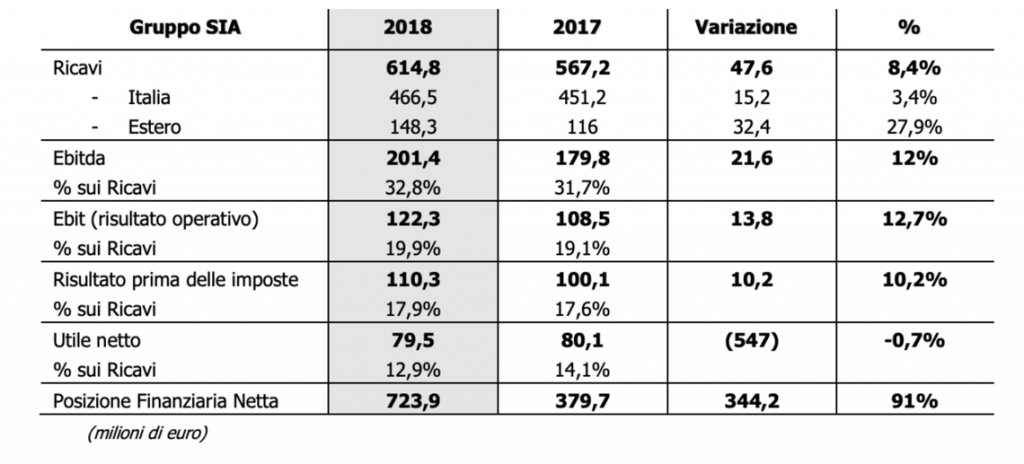

The purchase price envisaged by the call option is based on the ebitda multiple to which the original acquisition of Sia by the funds was made in 2013, for 765 million euro, when Sia had recorded consolidated revenues for 380.3 million euro, an ebitda of 106.5 million (see here a previous post by BeBeez). Instead, the sale of shares by F2i and HAT to FSIA would be based, as mentioned, on a valuation of 3.2 billion euros or 14.4 x the 2018 normalized ebitda of Sia in 2018 which was 222 million euros, after net revenues of 614.8 millions and a net financial position of 723.9 million euros (see here the press release on FY 2018 accounts), almost doubled from 379.7 millions in 2017, due to the acquisition of the US First Data assets in some countries of central and south-eastern Europe (see here a previous post by BeBeez). We are therefore talking about an equity value of around 2.5 billion euros for Sia.

Although the figure would lead to F2i and HAT funds for stellar returns, the valuation multiple is still well under 17x the ebitda on the basis of which Nexi was listed last April (see here a previous post by BeBeez). And this is because the transfer of shares concerns a minority of the capital of Sia, although the operation allows the FSIA to win an absolute majority of the group. As for the exercise of the call option at a much lower multiple, according to BeBeez, it had the preliminary go-ahead from Unicredit and Intesa Sanpaolo, which FSIA requested in advance, despite the fact that the exercise was in its rights, given that the two banks are also important customers of Sia.

The last transaction on the capital of Sia which provided an official assessment was the transfer of a portion of the shares of Cdp Equity to Poste Italiane in September 2016. The transfer was based on an equity value of Sia of 2 billion euro (see here a previous post by BeBeez). Poste Italiane, in fact, with a total investment of 278 million euros, had bought 30% of FSIA Investimenti, which is 100% controlled by FSI Investimenti (in turn controlled by Cdp Equity at 77.12% and at 22 , 88% from the Kuwait Investment Authority).

Once the absolute control of Sia is in the hands of FSIA Investimenti and then of Cassa Depositi e Prestiti, which controls both Cdp Equity and Poste Italiane, the dances will then open to understand what will be the next step in the direction of transforming Sia into the leader European digital payment system.

In recent years, Sia has already grown significantly and has given great satisfaction to its shareholders. Last March, it announced a dividend for 2018 of 60 million euros, after paying a similar dividend of 59.9 million for the year 2017, another of 44.55 million for 2016, one of 49.69 millions for 2015 and one of 35.68 millions for 2014. In total, the group has paid about 250 million euros of dividends over 5 years to its shareholders (see here a previous post by BeBeez).

In 2018 the Sia Group managed a total of 7.2 billion card transactions (+ 18.1% from 2017), 14 billion transactions for institutional services (+ 6.7%) and 3 billion payment transactions relating to transfers and collections (-2.4% for the lower volumes related to non-SEPA payments and the operations of branches of foreign banks in Italy). On the financial markets, the number of trading and post-trading transactions was 51.7 billion (-8% related to technological efficiencies of market logics that reduced the total number of orders). SIA handled more than 1,204 terabytes of data, an increase of 53.6% compared to 2017, out of 186,000 km. of the SIAnet network, with total infrastructure availability and 100% service levels.

Sia is one of the portfolio companies monitored by BeBeez Private Data

(find out how to subscribe to the Combo version that includes

the BeBeez News Premium 12 months reports and in-depth analysis

for only 110 euros a month)