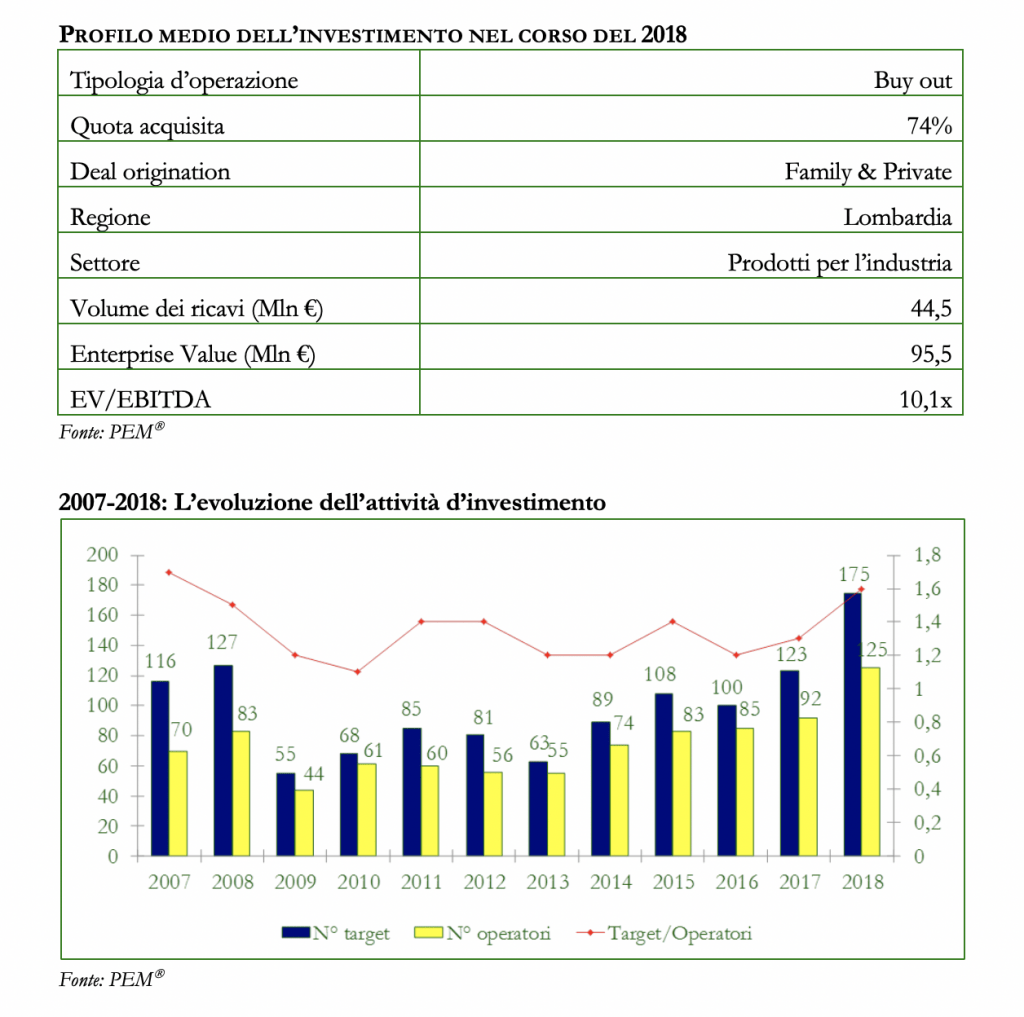

Private equity funds paid a median price of 10.1x ebitda for Italy’s targets in 2018, with higher peaks for buyouts (10.4x) and lower prices for minorities (9.3x), the Private Equity Monitor (PEM) of Liuc University says in its last Pem Report 2018 published a few days ago, with the support of EOS Investment Management, EY, Fondo Italiano di Investimento sgr, McDermott Will & Emery, and Value Italy (see here a previous post by BeBeez) The report was commented by Anna Gervasoni and Francesco Bollazzi, respectively the chairman and the coordinator of PEM. The median enterprise value for Italian targets of private equity funds in 2018 was 95.5 million euros (90.1 million in 2017 and 81.5 million in 2016).

Private equity funds paid a median price of 10.1x ebitda for Italy’s targets in 2018, with higher peaks for buyouts (10.4x) and lower prices for minorities (9.3x), the Private Equity Monitor (PEM) of Liuc University says in its last Pem Report 2018 published a few days ago, with the support of EOS Investment Management, EY, Fondo Italiano di Investimento sgr, McDermott Will & Emery, and Value Italy (see here a previous post by BeBeez) The report was commented by Anna Gervasoni and Francesco Bollazzi, respectively the chairman and the coordinator of PEM. The median enterprise value for Italian targets of private equity funds in 2018 was 95.5 million euros (90.1 million in 2017 and 81.5 million in 2016).

Oaktree is interested in investing in Costa Edutainment, the Genoa based company that manages theme parks and Genoa Aquarium where now Vei (Palladio Finanziaria) has a minority stake (see here a previous post by BeBeez). Giuseppe Costa and Giorgio Bertolina are the chairman and the ceo of Costa that has a turnover of 60.2 million euros, an ebitda of 10 million, and net financial debt of 33.6 million.

British Private Equity Zouk Capital acquired 51% of Italian digital utility Be Power through a capital increase (see here a previous post by BeBeez). Be Power owns 4Energia and BeCharge. Building Energy will keep 49% of the asset. Zouk appointed Paolo Amato and Paolo Martini as chairman and ceo. Building Energy has sales of 16.57 million euros and losses of 13 million. Building Energy bought 4energia in February 2017 and in July 2017 cashed in a 70 million euros investment by Hong Kong-listed private equity firm ZZ Capital International Limited and by Zhongzhi Capital. In August 2015 issued a 30 million euros bond listed on the Italian Stock Exchange ExtraMot Pro which was fully subscribed by The Three Hills fund.

Italian chemical company SICIT Group completed the business combination with Milan’s AIM listed Spac SprintItaly (see here a previous post by BeBeez). Fineurop, Gerardo Braggiotti, Matteo Carlotti, and Francesco Pintucci launched SprintItaly in July 2017 and raised 150 million euros. SICIT’s equity value is of 160 million for an enterprise value of 7 times the company’s ebitda of 2017, that was of 22.2 million. SprintItaly shareholder invested 100 million for 54% of the combined entity. Intesa Holding, which belongs to 33 shareholders, will keep 46% of the business. The 50 millions left will return to SprintItaly’s shareholders after having paid fees and withdrwals. SICIT Group’s share price was of 11.40 euros and at the closure of trading of 20 May, the stock value went up 3.06%. Carlotti said to BeBeez that the company aims to generate sales of above 100 million after 2022

Consilium Private Equity aims to raise 200 million euros for its fourth fund that will target Italian businesses with an enterprise value of 50 – 80 million (See here a previous post by BeBeez). Stefano Iamoni and Antonio Glorioso founded Consilium in 2006 after a spin off of private equity activities of Kairos. Consilium Private Equity sgr is one of the private capital investors monitored by BeBeez Private Data, discover here how to subscribe to 110 euros per month to the Combo version, which includes BeBeez News Premium 12 months.

Tapì, the Italian producer of corks for the spirits industry that belongs to Wise Equity, acquired French competitor Les Bouchages Delage whose shareholders will reinvest part of the proceeds in the buyer and join its board of directors (see here a previous post by BeBeez). After such acquisition, Tapì will have a turnover of 80 million euros. Stefano Ghetti, senior partner of Wise Equity, carried on the transaction with the fund’s investment manager Marco Mancuso.

The Equity Club (former Equity Partners Investment Club, the club deal that Mediobanca private banking launched) invested in La Bottega dell’Albergo (LBA), a producer and distributor of cosmetics for luxury hotels (see here a previous post by BeBeez). The Equity Club will support the Benni and Pacini families for the international expansion of the company which has sales in the region of 80 million euros and an ebitda of 10 million.

BofA Merrill Lynch, Banca IMI, Credit Suisse, Goldman Sachs International, and Mediobanca, the coordinators for the IPO of Italian electronic payments company Nexi converted their greenshoe option for the company’s shares that listed on 16 April 2019 (see here a previous post by BeBeez). Nexi said that on 31 May, Friday, it will reimburse earlier its 1.375 billion euros senior secured bond with floating rate and due to mature on 1 May 2023. The company will reimbourse the bond at a 101% price or 1.389 billion. Mercury UK Holdco, the holding that groups Advent International, Bain Capital, and Clessidra will receive 28,483,968 shares of Nexi.

Finproject’s shareholders hired UBI Banca for exploring a dual track ipo (see here a previous post by BeBeez). Eni is interested in the asset, however, the company’s shareholders may favour an ipo or a business combination with a Spac, that could be Vei1. Vei Capital owns 40% of Finproject since June 2015 when it acquired the asset from Xenon Private equity. Maurizio Vecchiola is the ceo of Finproject, that has sales of 200 million euros and an ebitda of 35 million.

Salcef Group, an Italian railway systems and technology company, discovered details for the business combination with Aim-listed Spac Industrial Stars of Italy 3 which is going to haappen by November 2019 in view of listing on Milan Star segment after a further 12-18 months (see here a previous post by BeBeez). Spac’s promoters Giovanni Cavallini, Attilio Arietti, Davide Milano, and Enrico Arietti and Salcef shareholders said that the company will invest the proceeds in acquisitions. Industrial Stars of Italy will carry on the business combination with Salcef on the ground of an enterprise value of 325 million euros, or 5.2 X ebitda, with an equity value of 285 million. Salcef currently belongs to Titania srl (41%), Fidia srl (41%), and Ermes Gestioni (18%), that in turn belongs to Gilberto and Valeriano Salciccia, the company’s chairman and ceo. Salcef has sales of 319 million, an ebitda of 64.6 million (adjusted ebitda of 62.6 million), net profits of 29.4 million.

Banca Imi, Banco BPM, Crédit Agricole Italia, and UBI Banca supported Ambienta for the acquisition of Phoenix Group, an Italian industrial company (see here a previous post by BeBeez). The enterprise value of the transaction is of 200-250 million euros. Vendors Chequers Capital will hold a minority of Phoenix together with the company’s managers. The company generates abroad more than 50% of its 91 million turnover and an ebitda in the region of 20 million. Ambienta is one of the private capital investors monitored by BeBeez Private Data, discover here how to subscribe to 110 euros per month to the Combo version, which includes BeBeez News Premium 12 months.

Charme Capital Partners sold 63% of ATOP to IMA, a producer of industrial components for the e-mobility (see here a previous post by BeBeez). IMA now has 84% of Atop. ATOP’s founders and chairman Amedeo Felisa will have 6% of the business. ATOP has sales of 89 million with an ebitda of 25 million. Charme is one of the private capital investors monitored by BeBeez Private Data, discover here how to subscribe to 110 euros per month to the Combo version, which includes BeBeez News Premium 12 months.

Assietta Private Equity acquired a majority in Effegilab, a producer of cosmetics and food integrators, for 2.8 million euros (see here a previous post by BeBeez). Effegilab has sales of 1.6 million. Assietta is one of the private capital investors monitored by BeBeez Private Data, discover here how to subscribe to 110 euros per month to the Combo version, which includes BeBeez News Premium 12 months.

Lactalis joined the race for Nuova Castelli, the Italian dairy company that belongs to Charterhouse and is looking for an investor that may pour 40-50 million euros in the business (see here a previous post by BeBeez). Charterhouse reportedly hired Rothschild for exploring all options, including a full sale of the asset. Market rumours say that Capvest, Oxy Capital,QuattroR, Granarolo, and Italmobiliare are interested in Nuova Castelli, which has a turnover of 460 million, an ebitda of 27 millioni, and net financial debts for 190 million (for 100 million of these, the company provided parmigiano Reggiano cheese as collateral). Charterhouse acquired 80% of Nuova Castelli in 2014 for 350 million, while Dante Bigi kept 20%.

Marco Artesani, the owner of Italian hair care products manufacturer Cotril, said that he has no intention of selling the whole business, but he would rather consider proposals for a minority investor that would boost the company in view of the launch of an ipo (see here a previous post by BeBeez). Artesani said to BeBeez that he still wants to keep Cotril despite the approaches he received from private equity funds on the ground of 10 – 12x ebitda. The entrepreneur said that he hired PWC finding a minority investor. Cotril has sales of above 20 million euros, and an ebitda of 4 million. Cosmetics is one of the industrial sectors that BeBeez Private Data monitors, discover here how to subscribe to 110 euros per month to the Combo version, which includesBeBeez News Premium 12 months.

EdiBeez srl