The Italian startups that collect the most capital from venture capital investors are the ones that raise Serie B rounds, i.e. rounds that go to finance a first scale-up phase. It emerges from an analysis included in the last Report on Venture Capital in Italy by P101 sgr, in collaboration with BeBeez and published yesterday (see here the press release, here the Report P101-BeBeez 2018, here the BeBeez Report Venture 2018 and here the BeBeez’s first 4 months Venture Report 2019, the latter two with complete tables and links to articles, available for readers of BeBeez News Premium 12 months, discover here how to subscribe for just 20 euros a month).

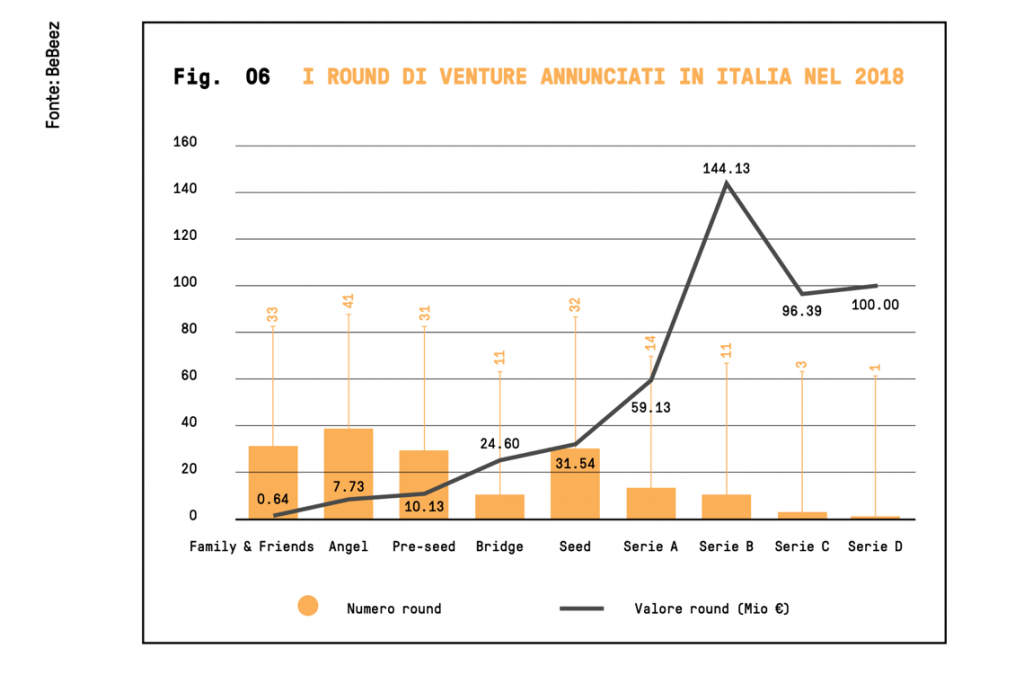

Taking as a base the 177 rounds announced in Italy in 2018, for a total of 480 million euros (the data of BeBeez differ from the official ones of Aifi, the Italian Association of private equity, venture capital e private debt funds, because BeBeez takes into account all venture capital operators, including equity crowdfunding rounds, and therefore not only of the investments of the funds), the largest number of rounds (41) is classifiable as “angel rounds” for amounts between 150 and 250k euros for a total of 7.7 million euros, followed by the rounds “Family & friends” (33) for single amounts less than € 150k and a total value of € 640k. On the other hand, considering the cumulative value of the rounds, the category that raised the most is classifiable as “Serie B” with 11 deals for a total of over 144 million euros, all between 7 and 20 million euros. Between 20 and 25 millions registered only three rounds, classified as “Serie C”, for around 96 millions, while the “Serie A” rounds, between 3 and 7 million, were 14 for a total of little over 59 million. We finally had just one Serie D round worth 100 million euros.

A result that is essentially found similar to the one shown in the aggregate data calculated at European level for 2018 by Invest Europe (see here a previous post by BeBeez) and which show that out of total investments of 8.2 billion euros of venture capital, 4.9 billions well concern the start-up phase, after the seed (2.6 billions) and previous to the later stage (700 millions).

A result that is essentially found similar to the one shown in the aggregate data calculated at European level for 2018 by Invest Europe (see here a previous post by BeBeez) and which show that out of total investments of 8.2 billion euros of venture capital, 4.9 billions well concern the start-up phase, after the seed (2.6 billions) and previous to the later stage (700 millions).

The classification, made by BeBeez for P101 on the basis of the size of the round, does not fully correspond to the reality of the development phase of the startups that announced the round, because to tell the truth in 2018 there were startups in the first phases of their life that have announced first rounds of very important dimensions, which rank for this reason among the Serie A rounds, that are the rounds that by definition define fundraiings that serve to support a subsequent development phase after that of seed.

In this situation, for example, Aileens is a biotech startup that was founded in June 2018, that is only 10 days before the 3 million euro round signed by the funds of Panakes sgr and Invitalia Ventures sgr (see here a previous post by BeBeez). And even Prima Assicurazioni, which had never announced funding rounds until 2018, even announced a 100 million euro round, which could already be classified as a Serie D, as said before, although there is no record of previous series rounds announcements (see here a previous post by BeBeez).

Andrea Di Camillo, managing partner of P101 sgr, commented: “2018 was the turning point for Italian venture capital. First of all, for the first time, we observed an interesting volume that far exceeded the 100 million around which we moved in the last six years. Estimates place the market above half a billion, which indicates an important qualitative leap. But 2018 will be a year to remember above all because the conditions have finally been created to build a solid investment activity on innovation in Italy and for Italy. In the wake of these results, 2019 promises to be a favorable year, thanks also to the new Budget law that supports investments in startups and innovative SMEs “.

EdiBeez srl