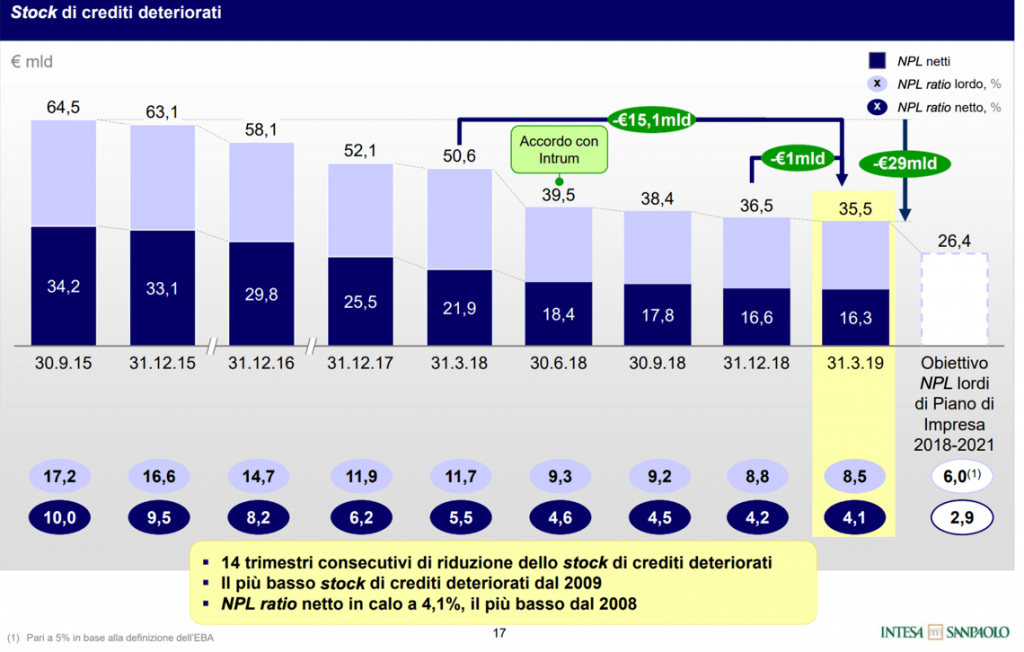

Intesa Sanpaolo said that in 1Q19 the amount of distressed credits on its books lowered to 35.5 billion euros from 36.5 billion recorded at the end of 2018. After adjustments, the figure lowered to 16.3 from 16.6 at the end of 2018 (see here a previous post by BeBeez). Carlo Messina, Intesa’s ceo, said that the bank aims to focus on selling its UTPs amounting to 14 billions (8.8 billions net value). Intesa Sanpaolo is reportedly dealing with Prelios on a portfolio of Utp of 10 billions: about 4 billions might be sold while the rest might be given to Prelios to be managed.

Intesa Sanpaolo said that in 1Q19 the amount of distressed credits on its books lowered to 35.5 billion euros from 36.5 billion recorded at the end of 2018. After adjustments, the figure lowered to 16.3 from 16.6 at the end of 2018 (see here a previous post by BeBeez). Carlo Messina, Intesa’s ceo, said that the bank aims to focus on selling its UTPs amounting to 14 billions (8.8 billions net value). Intesa Sanpaolo is reportedly dealing with Prelios on a portfolio of Utp of 10 billions: about 4 billions might be sold while the rest might be given to Prelios to be managed.

Unicredit is continuing to implement its derisking strategy through the sale of non core distressed credits, said ceo Jean Pierre Mustier (see here a previous post by BeBeez). At the end of 1Q19, Unicredit’s gross distressed credits amounted to 37.6 billion euroe (38.2 billion at the end of 2018). Core distressed exposition went down to 19.8 billion with the ratio of gross distressed credits to total gross credits of 4.1%, close to the median value of the European banking Authority, while the coverage rate is of 58.1%.

US Asset manager Blackrock withdrew its bid for Carige the troubled Italian bank for which are in charge extraordinary commissioners Pietro Modiano, Fabio Innocenzi and Raffaele Lener (see here a previous post by BeBeez). Sources said to BeBeez that Blackrock made such a decision for avoiding reputational issues that may arise with a clash with the bank’s unions. However, the Italian Ministry of Economy is prepared to start a procedure for a precautional recapitalization of Carige with an investment of up to one billion euros. This recap may not imply a bail-in. Press reports said that the bank is of interest to Warburg Pincus that may carry on a white knight deal (see here a previous post by BeBeez). Further potential bidders are Värde and Apollo.

Mediocredito Italiano, part of Banca Intesa, sold to Sagitter a portfolio of Npl of 565 corporate unsecured loans (see here a previous post by BeBeez). Each of the ticket is worth up to 50,000 euros. Milan law firm Magrì & Magrì created Sagitter.

Unipol may sign a partnership for handling its distressed credits, said the company’s ceo Carlo Cimbri (see here a previous post by BeBeez). Moreover Unipol is open to evaluate a partial sale of UnipolRec, its distressed credits management platform, as part of a partnership. At the end of 2018 UnipolRec handled gross distressed credits worth 2.59 billion euros (490 million net) with a coverage ratio of 81%.

The board of Trevi Finanziaria Industriale (Trevifin) voted the launch a capital increase worth up to 440 million euros and submit a debt restructuring plan to its lending banks (see here a previous post byBeBeez). The company will also sell Drillmec and Petreven, two Oil&Gas subsidiaries of Trevi, to India’sMEIL (Megha Engineering & Infrastructures Limited).

EVA Renewable Assets listed a bond on Vienna Stock Market (see here a previous post by BeBeez). The company is part of Eva Energie Valsabbia and will invest the proceeds of the issuance in its organic growth. EVA issued in July 2018 on Vienna exchange a bond paying a 5.9% coupon and due to mature on 31 December 2029. The company has sales of 13 million euros, an ebitda of minus 2.5 million, and a net debt of 51.72 million.

Vegagest, a distressed credits investor that belongs to Europa Investimenti spa, which in turn is controlled by London listed Arrow Global Group, will start soon its new activity as a management company with a specific focus on disrtressed assets (see here a previous post by BeBeez). Its new name is Sagitta sgr, recalling the name of Arrow Global, who will be anchor investor in the new funds and said that it is readay to invest 100 million euros in those funds in 2019 (see here a previous post by BeBeez). Claudio Nardone is the ceo of the company.

Illimity, the listed Italian challenging bank, generated 745 million euros of business developed through its divisions for SMEs and NPL Investment & Servicing since its started activity in September 2018 and till the end of April (see here a previous post by BeBeez). Of this total, 291 million euros are loans granted by SMEs, also taking into account the stock of 132 million euros of loans to customers existing on the books of Banca Interprovinciale (the bank that the Special purpose acquisition company Spaxs bought and then merged giving birth to Illimity bank), while the other 454 million euros are the business that originated from the beginning of operations by the NPL Investment & Servicing division, of which 318 millions for acquisitions of NPLs and 136 millions for loans to third parties for the acquisition of NPLs portfolios.

International real estate investor Meyer Bergman issued a secured bond worth 117.75 million euros for refinancing the debt it made for acquiring the Milan based development Le Corti di Baires (see here a previous post by BeBeez). The Vienna-listed secured bond pays a floating rate coupon with a partly paid structure.

Aim-listed digital marketing company Prismi made a securitization worth 20 million euros for its commercial credits (see here a previous post by BeBeez). Primi aims to lower its net debt to ebitda ratio from 7X recorded at the end of 2018 to 4.12 X by the end of 2019 and to 1.27 X by the end of 2023. The company has sales of 21 million, an ebitda of 2.76 milion, and net debts of 25.33 million.

Antonio Zamperla, the Italian producer of hardware for amusement parks, issued minibonds for 1.5 million euros (see here a previous post by BeBeez). Mediocredito Trentino Alto Adige entirely subscribed these liabilities. Antonio Cecchetto, the company’s cfo, said that the proceeds of these issuances will support the company’s organic growth. Sources said to BeBeez that these bonds will mature on 15 April 2024. This is the fourth issue of minibonds by the company. Zamperla generates abroad 99% of its sales of 95.65 million, an ebitda of 9.43 million, and a net financial debt of 9.37 milioni

Solo Sole, a renewable nergy company that belongs to Archimede, listed on Milan stock market a minibond worth 5.3 million euros that Forsight Group Sicav Sif entirely subscribed (see here a previous post by BeBeez). These bonds will mature on 30 June 2042 and pay an up to 6% annual floating coupon calculated on the ground of 6 months Euribor rate and the mid-swap rate. The company will invest such proceeds for acquiring an energy plant based in Sicily with a power of 4 MWt. Solo Sole belongs toGianluca Tumminelli (47.5%), Gaetano Tuzzolino (47.5%), who are the owners of Archimede, and Antonio Cammalleri (5%).

EdiBeez srl