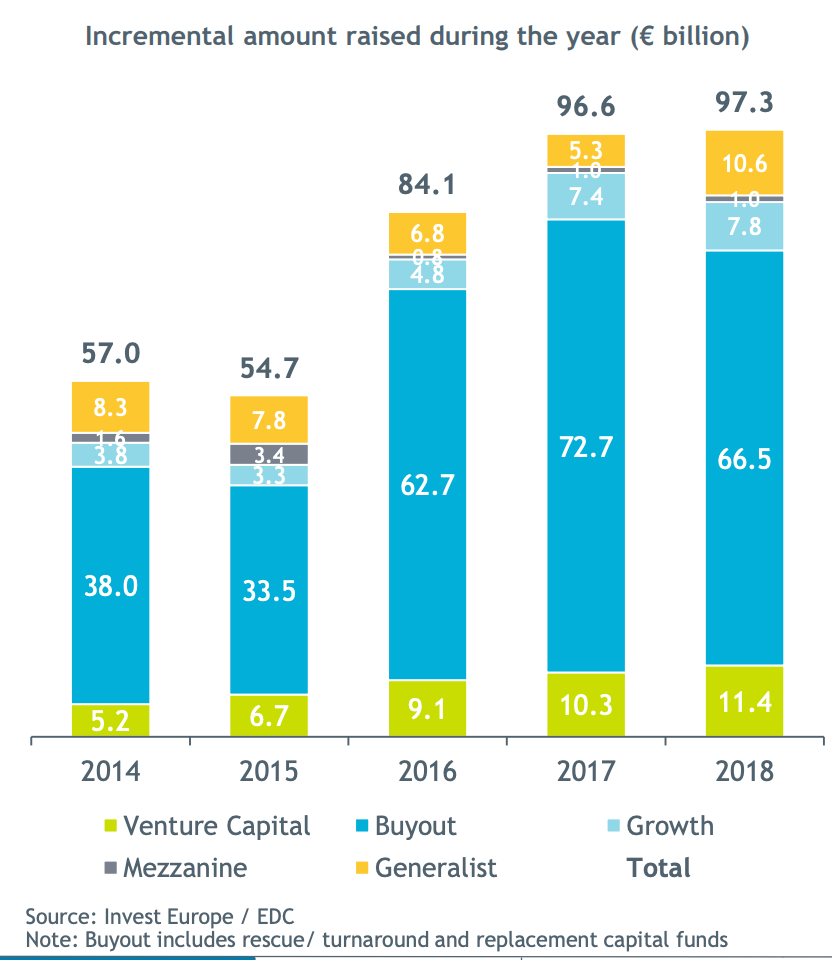

The investments of private equity and venture capital funds in Europe reached 80.6 billion euros in 2018, the highest ever level recorded by Invest Europe, the European association representing private equity and venture capital funds, in addition to that their investors. The new data were presented yesterday and are contained in the European Private Equity Activity 2018 report which also states that in 2017 investments had stopped at 77 billions. Also the fundraising activity remains very strong, replicating again in 2018 the approximately 97 billion euros of 2017, a figure which is second only to the peak of 112 billions raised in 2006.

On the fundraising front, the funds that announced total or partial closings were 581, of which 229 were venture capital funds and 108 buyout funds. A total of 374 management companies, of which 174 specializing in venture capital, announced partial or final closings of their funds in 2018. Most private equity funds (101) manage less than 100 million euros and only 17 have assets in excess of one billion. As usual most of the funding in terms of volumes went to buyout funds (66.5 billions), although in 2018 the percentage was reduced (from 72.7 billions in 2017). Venture capital funds, on the other hand, increased funding to 11.4 billions (from 10.3 billions).

On the fundraising front, the funds that announced total or partial closings were 581, of which 229 were venture capital funds and 108 buyout funds. A total of 374 management companies, of which 174 specializing in venture capital, announced partial or final closings of their funds in 2018. Most private equity funds (101) manage less than 100 million euros and only 17 have assets in excess of one billion. As usual most of the funding in terms of volumes went to buyout funds (66.5 billions), although in 2018 the percentage was reduced (from 72.7 billions in 2017). Venture capital funds, on the other hand, increased funding to 11.4 billions (from 10.3 billions).

The major financiers were pension funds, from which one third of the fundraising (31%) comes, followed by funds of funds (18%), family offices and private investors (11%), insurance companies (11%) and sovereign wealth funds (9%). Non-European investors contributed 46% to funding and were mainly from North America (25.5% from 25.6% in 2017) and Asia and Australia (15.1% from 15.6%). In Europe the most active investors were the British (7.9% from 11.7%), while the lowest flows came from Italy, Spain, Portugal and Greece (3.3% from 3.9%).

Returning instead to investments, the 80.6 billion euros went to over 7,800 companies, of which 86% are SMEs. Of this total, 8.2 billions were invested by venture capital funds (from 7.2 billion in 2017) spread over 4,400 companies. The ICT sector was the sector that most attracted venture investments (47% of the total), followed by biotech and healthcare (28%) and consumer goods and services (9%).

Returning instead to investments, the 80.6 billion euros went to over 7,800 companies, of which 86% are SMEs. Of this total, 8.2 billions were invested by venture capital funds (from 7.2 billion in 2017) spread over 4,400 companies. The ICT sector was the sector that most attracted venture investments (47% of the total), followed by biotech and healthcare (28%) and consumer goods and services (9%).

Total investments include 51.2 billion euros of European funds that have invested in the same country in which the management company is based, 25 billions cross-border investments within Europe, 4.5 billions investments by non-European funds in Europe and 4.2 billions in investments of European funds outside Europe. As for the venture capital investment flows, 4.9 billions were domestic, 2.2 billions cross-border in Europe, 1.2 billions went out of Europe and 1.1 billions arrived in Europe from extra-EU funds.

Private equity investments in Italy in 2018 amounted to 0.312% of GDP, below the European average of 0.471%. In particular, investments in venture capital in Italy are equal to 0.08% of GDP, below the European average of 0.049%. For official Italian Aifi-PwC 2018 data, see here a previous post by BeBeez. For a focus on all Italian operations, here is the BeBeez Report on the first four months of private equity 2019, here the BeBeez Report on venture capital 2018 and here the BeBeez Report on venture capital in the first months of 2019 (only for BeBeez News Premium 12 months readers, discover here how to subscribe for only 20 euros a month).

“European risk capital is mature thanks to a combination of strong returns, a growing number of start-ups in the technology and life sciences sector, and a series of high-profile exits, including the listing of the streaming service “Spotify music and the sale of the iZettle mobile payment platform. There are strategic buyers and open markets around the world for high-quality European start-ups,” said Nenad Marovac, chairman of Invest Europe. “The result is a growing appetite among global institutional investors, who see European risk as the way to invest in some of the most dynamic and entrepreneurial companies in the world”.