Swiss fund Montana Capital, specialized in investments in the secondary market, won the auction to buy stake private equity funds originally subscribed by distressed Banca Popolare di Vicenza now in liquidation mode.

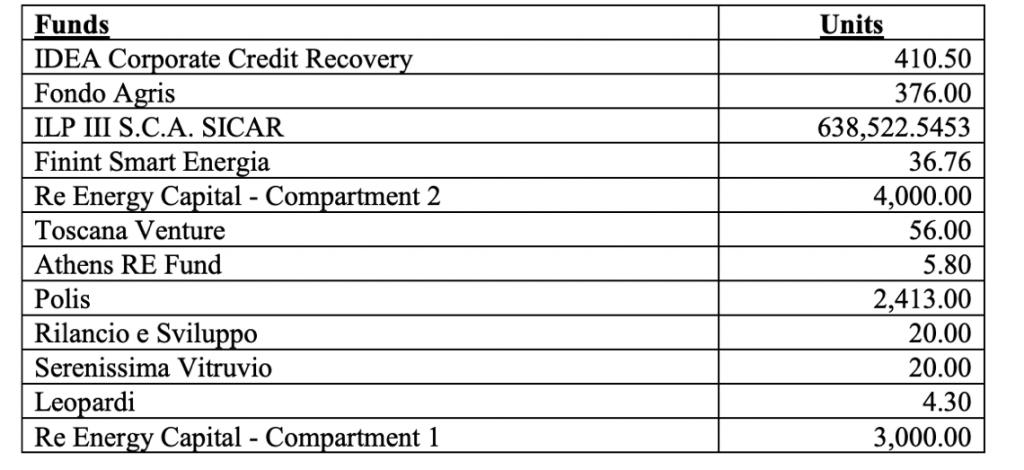

This was announced by liquidators Giustino Di Cecco, Claudio Ferrario and Francesco Schiavone Panni, at the end of March (see the press release here), stating that the stakes refer to the following funds: IDEA Corporate Credit Recovery, Agris Fund, ILP III S.C.A. SICAR, Finint Smart Energia, Re Energy Capital – Compartment, Toscana Venture, Athens RE Fund, Polis, Relaunch and Development, Serenissima Vitruvio, Leopardi, Re Energy Capital – Compartment 1.

More in detail, the stakes in those funds will be bought by MCP Opportunity Secondary Fund IV fund managed by Montana Capital Partners Jersey OSP IV and the closing of the deal will take place once the necessary authorizations have been obtained from the supervisory authorities.

As part of the operation, BPVI was assisted by the advisors Elm Capital Associates for the financial aspects and by Chiomenti for the legal aspects.

This comes after the stakes of the Nem Imprese, Nem Imprese II and Industrial Opportunity Funds, managed by Nem sgr (now renamed Alkemia sgr), were acquired by Montana Capital at the beginning of 2018 together with Nem sgr itself (see here a previous post by BeBeez). More in detail, back then, stakes of Nem Imprese I and II and Industrial Opportunity Funds were sold by the bank, which was the major investors in those funds, to a new fund managed by Nem sgr and named Nem Imprese III.

Montana Capital, however, was not the only investor in Nem sgr and in Nem Imprese III. On the quarterly report of F&C Private Equity Trust plc (now renamed BMO Private Equity Trust Plc), a listed private equity vehicle and part of the BMO Asset Management group, controlled by the Bank of Montreal, in fact, in March 2018, we read that a series of funds of BMO Asset Management and another specialized private equity operator (which we know to be Montana Capital, in fact) made the deal which as a whole has a value of 33 million euros, of which 4.3 million for the management company Nem sgr. In the subsequent quarterly reports of the BMO Private Equity Trust, the investment in Nem Imprese III always appears among the assets in the portfolio. So far, however, BMO’s involvement in the operation was never disclosed in Italy.