The rescue project for Italy’s Genoa-based distressed bank Carige put forward by funds managed by BlackRock and a couple of co-investors is taking shape, Il Messaggero reports this morning.

On Tuesday April 24th, actually, a meeting was held in Bank of Italy‘s headquarters in Rome aimed at discussing the conditions of a binding offer to be presented by May 17th. The meeting was conducted by the deputy general manager of Bankitalia, Fabio Panetta, and was attended on the one hand by the team of representatives of the alternative special situation fund of BlackRock and its co-investors, led by Brendan Galloway (director of BlackRock Alternative Advisors) and Claudio Casnedi (partner of Recipero), and on the other hand by the top managers of the Voluntary Scheme of the Deposit Protection Fund, Salvatore Maccarone and Giuseppe Boccuzzi. The meeting was also attended by the extraordinary commissioner of Carige Pietro Modiano. A 720 million euros capital increase was discussed, higher than the 630 million euros one that the bank said it was needed in its Strategic Plan presented at the end of February (see here a previous post by Beez).

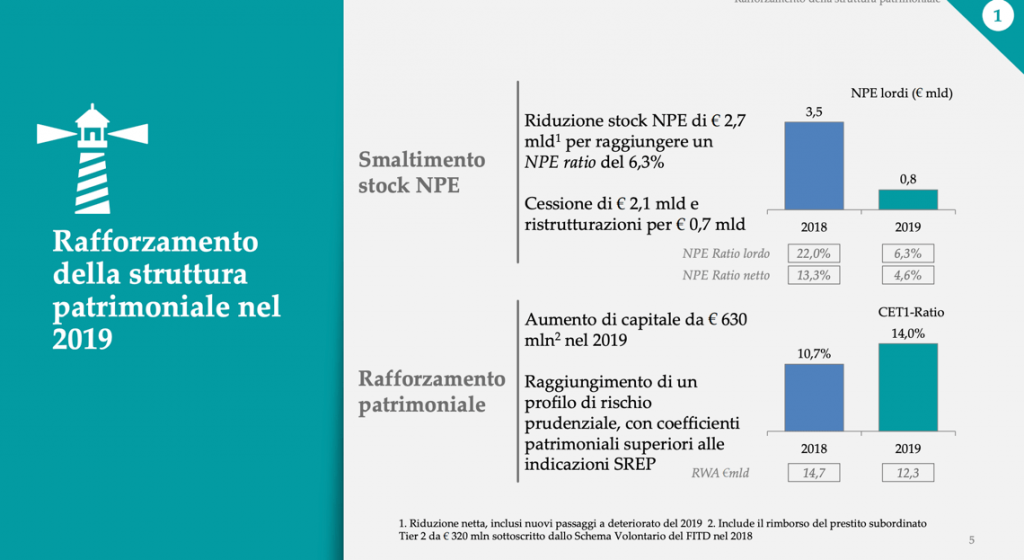

In essence, on the one hand the Voluntary Scheme on May 6 should approve the conversion into capital of the 320 million euros subordinated Tier 2 bonds subscribed by the Scheme in 2018, and subsequently on the other hand the funds would subscribe the rest of the capital increase, also involving the Malacalza family, which currently owns 27.8% of the bank and which could commit 70-80 million euros. After the operation, the funds managed by BlackRock and its co-investors would have 45% of the bank, the Voluntary Scheme 35%, the Malacalza 10% and the remaining 10% would be floating at the Milan Stock Exchange.

Crucial issues to be faced were times and ways of disinvestment of the Voluntary Scheme from the bank’s capital. According to Il Messaggero, in a first version of the proposal a call option was expected from BlackRock to be exercised within three years, while now the time would have fallen to one year. The strike price would also have been adjusted in favor of the Scheme: from an initial cap (maximum cap) of a 125% in case of an increase in the stock price, even if the value doubled, now the agreement is said to be for a 150% cap and a 75 floor % (it was from 50% down) even with the price at zero. As for governance, Blackrock and the co-investors would have a majority on the board of directors with independent members. The Banks Fund would not participate in the management, while the Malacalza would have one or two places.

Finally, the details of the sale of the 1.9 billion euros portfolio of non-performing exposures will be refined soon, of which around half are bad loans and the other half area unlikely-to-pay loans, for which there is a binding offer by SGA, it is said to a price around 21-22% of the nominal. According to BeBeez, on this front Blackrock would not be interested in taking over the Npl with its funds, while the corporate Utp could instead be the object of interest, in a perspective of restructuring and re-launching the debtor companies.