Unicredit is going to sell three bad loans portfolios for a total value of 2.4 billion euros, MF- Milano Finanza reported, adding that loans include the Rome portfolio, with 1.4 billion unsecured loans; the Matera portfolio, with 750 million secured loans; and the Capri portfolio, which includes 300 million euros secured.

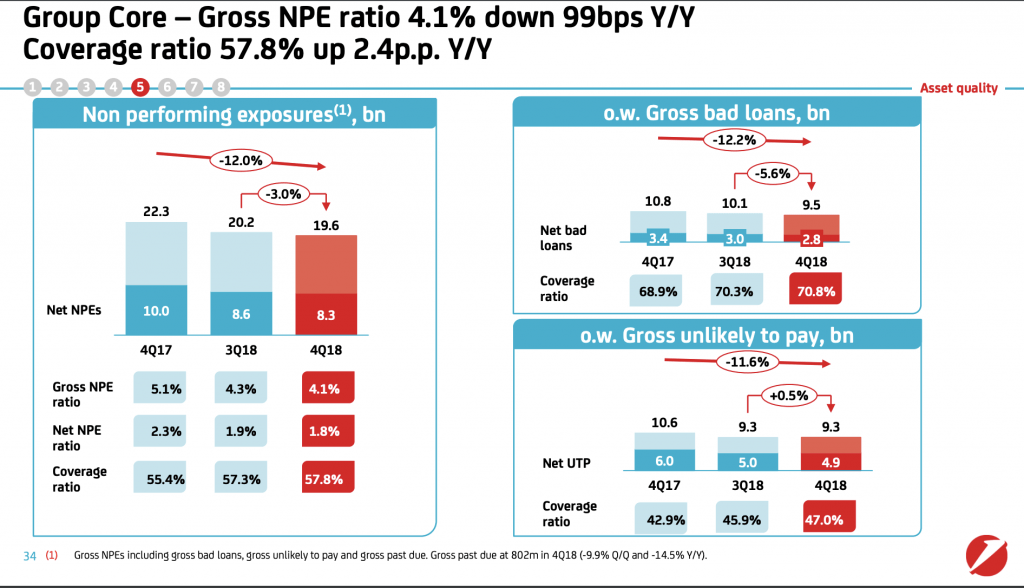

The banking group at the end of 2018 had 38.2 billion in gross non performing exposures, equal to 7.7% of the total loans, with a coverage ratio of as much as 61%, down from 48.3 billions at the end of 2017, when the NPE ratio was 10.3%. This was announced by the bank at the presentation of the results of FY 2018 last February, stating that the divestments of the NPE portfolio considered “non-core” continued in line with the Transform 2019 plan, presented at the end of 2016 (see here a previous post by BeBeez).

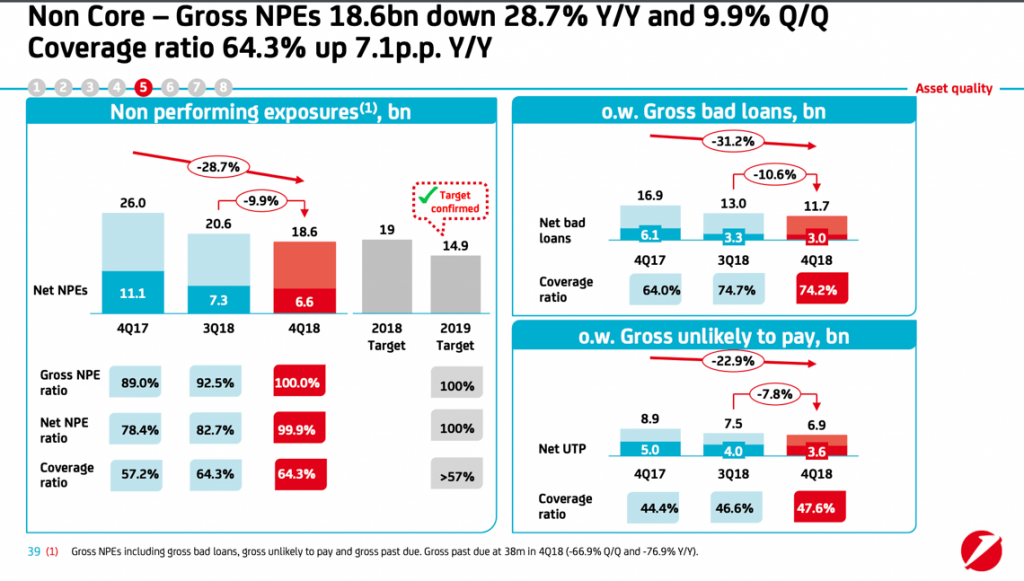

In particular, gross non-core non-performing exposures fell by € 7.5 billion to € 18.6 billion, therefore below the target of € 19 billion set for the end of 2018 (see the presentation to analysts of the 2018 results here) , while the target for the end of 2019 was confirmed, so the bank will have to reduce them by another 3.7 billion between disposals and management.

Group gross non-performing loans fell to € 21.2 billion at the end of 2018, gross probable defaults of € 16.2 billion and past due impaired exposures amounted to € 840 million.

In terms of bad debts, in 2017 Unicredit had completed the Fino project, ie the sale of a stock of over 17 billion Npl to Fortress and Pimco, then subject to a securitization with public guarantee (see here a previous post by BeBeez). Also in 2017, the Florence portfolio of € 715 million gross from unsecured and mortgage credit agreements with small and medium-sized Italian companies that had been transferred to MBCredit Solutions and Cerberus Capital Management (see here a previous post by BeBeez) was sold. Last year it was the turn of the Turin project, consisting of three portfolios of unsecured non-performing loans for a total of 1.26 billion euros, transferred to Banca Ifis (see here a previous post by BeBeez). And also in 2018 two other portfolios were also sold. One is the Milan project, worth 675 million euros of Npl secured sold to Fortress and the other is the Amalfi project worth 590 million euros of Npl unsecured to SMEs, which were sold for 384 million to a securitization vehicle managed by J-Invest spa and for 206 million to an Illimity managed securitization vehicle (see here a previous post by BeBeez). The other deal concerned a secured and unsecured mixed portfolio of 537 million sold to Banca Ifis (see here a previous post by BeBeez). As for the Utp, they were instead sold prevalently one by one (single name mode).

Meanwhile the Sandokan 2 operation is proceeding, that is the sale of a portfolio of impaired loans made up mainly of unlikley to pay real estate, therefore secured, which would be the re-issue of the Sandokan project, launched in autumn 2015, which then brought the banking group to securitize a € 1.3 billion portfolio. This time, however, the portfolio in question would have a larger size, between 2 and 3 billion euros. The institute led by Jean Pierre Mustier should not launch a tender but address directly the interlocutors of the first transaction concluded at the end of 2016, ie Pimco, Gwm and Finance Roma, through the newco Aurora Recovery Capital (see here a previous post by BeBeez).