The Apax Partners and NB Renaissance funds are studying the sale of Engineering spa, a group specializing in software development and technologies for public and private companies, delisted from the Italian Stock Exchange in the Summer of 2016 (see here a previous post by BeBeez).

NB Renaissance and Apax today control in equal parts 88% of the capital of the group, while the remaining 12% (with the right to vote at 6%) is headed by the family of the founder Michele Cinaglia.

According to Reuters, which revealed the rumor last Friday, March 8, the dela is still in its first stage, so much so that the advisors have not appointed yet. The private equity funds are said to have decided to start a sales process, after some expressions of interest from some large international private equity funds such as Permira and BC Partners. It is possible that NB Renaisssance and the Cinaglia family will reinvest for a minority.

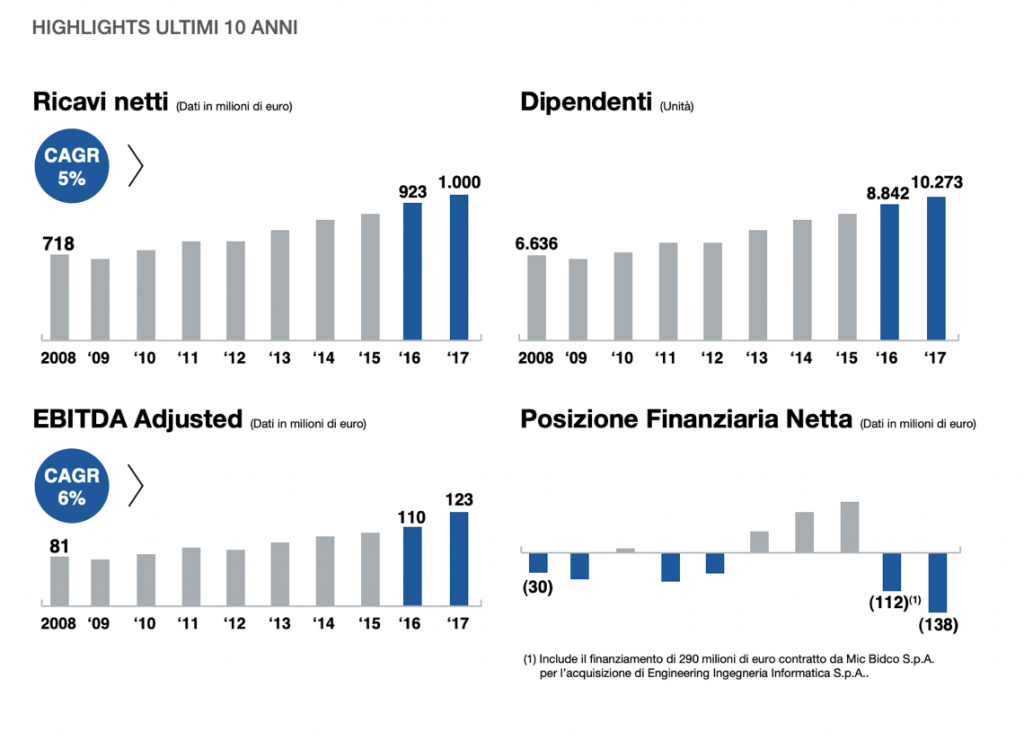

Engineering closed 2017 with around one billion euros of revenues (+ 10.1% from 2016), 123 million euros of adjusted ebitda (+ 13.5%) and 138 million euros of net financial debt (see here FY 2017 Financial Statement). It is said that the group can be valued at least 1.5 billion euros.

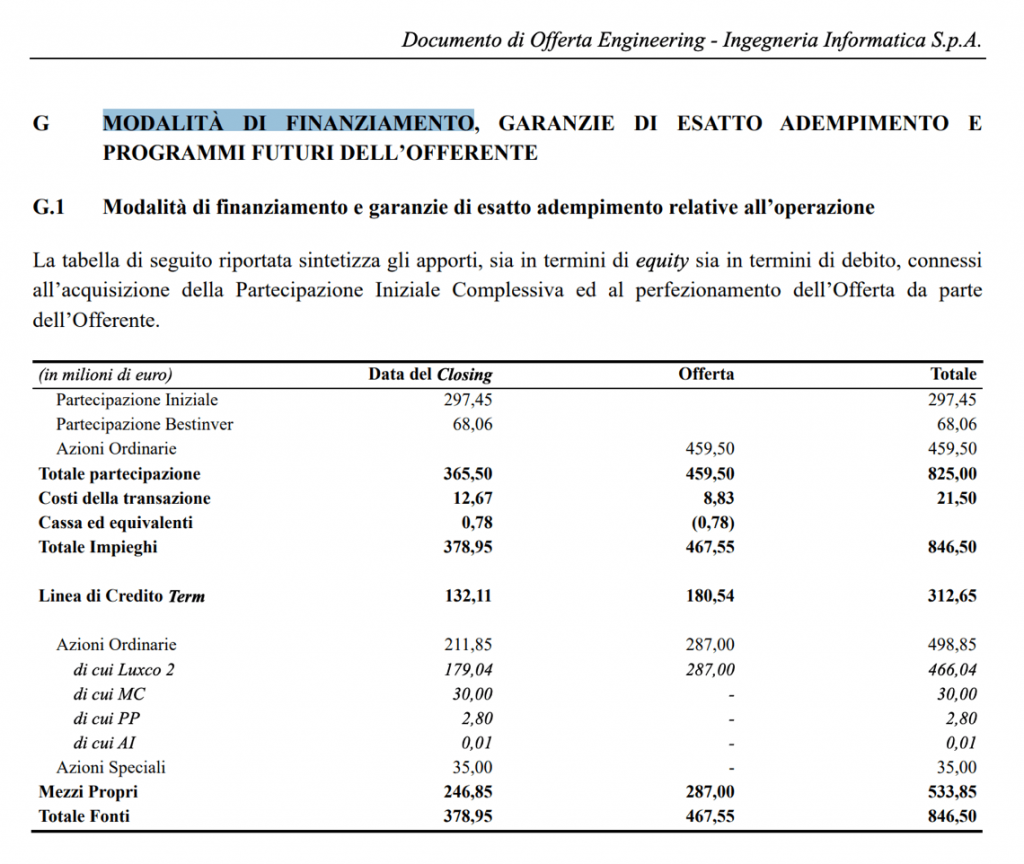

At the time of the tender offer in July 2016, the group had been paid 846.5 million euros, of which 533.85 millions paid by the funds with their own equity and the rest with recourse to medium-long term credit lines (see here the Offering Document). Engineering had closed 2015 with 105.5 million euros of ebitda.