Italian private equity firms acquire foreign companies with iconic brands and keep a steady level of activity.

Italian private equity firms acquire foreign companies with iconic brands and keep a steady level of activity.Investindustrial acquired British iconic car producer Morgan Motor Company from the Morgan Family, which will hold a minority of the business together with the company’s managers and workers (see here a previous post by BeBeez). The transaction is debt free. Morgan has sales of 33.8 million euros and net profits of 3.2 million.

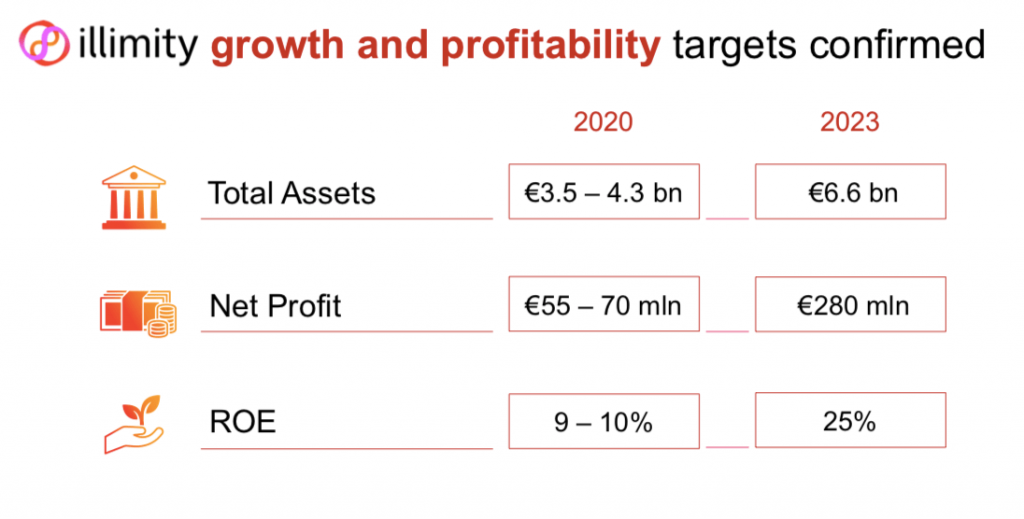

Illimity Bank, the bank that Corrado Passera created after a business combination between Banca Interprovinciale and the Special Purpose Acquisition Company Spaxs, listed on Milan stock market on Tuesday March 5 (see here a previous post by BeBeez). Passera said that by 2020, the company set a target of 3.5-4.3 billion worth of assets and of 6.6 billion by 2023. Profits may be of 55-70 million in 2020 and of 280 million in 2023, while Roe should be of 9-10% in 2020 and of 25% in 2023 (see here a previous post by BeBeez). All Illimity shareholders have stakes of below 10%. The company attracted resources from Sdp Capital Management; Atlas; Tensile-Metis Holdings, and Azimut. Andrea Clamer heads Illimity’s Npl Division, while Enrico Fagioli Marzocchi, is responsible for the SMEs unit. Carlo Panella is the head of IT and of the Retail division.Francesco Mele is Illimity’s CFO.

Illimity also acquired a stake of distressed loans towards Calvi Holding and refinanced part of Calvi Holding debt in the framwork of a deal that saw Idea CCR II fund converting part of the distressed loans towards Calvi itself into equity for a 26% stake. Idea CCR II fund is the turnaround fund managed by Dea Alternative Funds sgr. Both Idea CCR II and Illimity also invested new finance into Calvi (see here a previous post by BeBeez).

Listed Italian clothes retailer Oviesse increased its market capitalization to 347 million of euros after Tamburi Investment Partners announced to have paid 1.85 euro per share or 74.9 million of euros for Gruppo Coin’s 17.835% stake of the business (see here a previous post by BeBeez). TIP now holds 22.7% of the Oviesse. Three board members of Oviesse that private equity BCPartners (the major owner of gruppo Coin) previously appointed now resigned. Investindustrial, Ontario Teachers Pension Plan, and Coin’s management own the company.

Ethica Global Investments acquired 90% of automotive components producer Osar from Nicola and Silva Salvi (see here a previous post by BeBeez). Vendors will keep 10% of the company and their management roles. Osar has sales of 26.8 million euros, an ebitda of 5.1 million, and net cash of 12 million. EGI is an investment company that Cosimo Vitola and Fausto Rinallo founded and to which further investors poured resources for 50 million.

Sky Ocean Ventures, the fund that Sky Group launched for the safeguard of the marine environment, signed a partnership with Italian private equity Ambienta for investing in companies operating in the sector of eco-friendly plastic (see here aprevious post by BeBeez). Sky Ocean Ventures will share with Ambienta its methods for Environmental Impact Analysis (EIA) and Environmental, Social e Governance (ESG). Ambienta received for the second consecutive time the award of Firm of the Year in Italy from Private Equity International Awards.

Bomi Italia received a public offer of 4 euros per share from French private equity ArchiMed (see here a previous post byBeBeez). Bomi is a provider of logistic services for hospitals. Archimed launched an offer for Bomi’s convertible bonds worth 5.4 million. The total value of the private equity’s bid is of 73.7 million and aims to delist Bomi. The Ruini Family (50.4% owner of Bomi), Quaestio Capital Management (12.4%), and First Capital (5.6%) already expressed their agreement for the offer. André-Michel Ballester, partner of ArchiMed, will be the company’s chairman. In 1H18 Bomi had sales of 62 million.

Electronic payments solutions provider Nexi sold its contact centre PayCare to Comdata, a customer operations company that belongs to private equity fund Carlyle (see here a previous post by BeBeez). Massimo Canturi, is the ceo of Comdata Group, that has sales of one billion euros.

Roberto Meneguzzo and his son Jacopo together with Giorgio Drago carried on a re-organization of the activities of Palladio Finanziaria Holding (PFH) of which they hold 50.45% (see here a previous post by BeBeez). PFH’s private equity activities will have resources of 300 million. Drago will be the chairman of the unit, while Roberto Meneguzzo will act as vicechairman, while Nicola Iorio will be the firm’s coo. Vei Green will group the infrastructures and renewable energies investments and Enrico Orsenigo will be the firm’s ceo. Orsenigo said that the Vei has a fundraising target of 120 million. Chinese financial holding Nws is one of the investors in Vei.

FSI Mid Growth Equity Fund raised 1.4 billion of euros, said FSI sgr ceo Maurizio Tamagnini (see here a previous post by BeBeez). According to market rumours, the list of investors includes Mediolanum, UniCredit, Intesa Sanpaolo,Banco-BPM, Mediobanca, Fondazione Cariplo, Fondazione CRT, Cdp, Poste Vita, Tikehau Capital, Kuwait Investment Authority, European Investment Fund, and State Oil Fund of Republic of Azerbaijan. FSI chief investment officer is Barnaba Ravanne, while Marco Tugnolo and Carlo Moser are managing directors. Umberto della Sala, Michele Norsa,Eugenio Razelli, and Carlo Bozotti are FSI’s industrial advisors.

Italian Spac SprintItaly approved the business combination with chemical company SICIT 2000 (see here a previous post by BeBeez). SICIT 2000 belongs to Intesa Holding. SprintItaly shareholders are Fineurop spa, Gerardo Braggiotti, Matteo Carlotti, and Francesco Pintucci. The spac has resources for 150 million euros. Gruppo SICIT’s equity value is of 160 million euros. SprintItaly’s shareholders will hold 54% of the asset after the business combination.

Nyse listed ConAgra Brands hired Bnl Bnp Paribas for auctioning its Italian subsidiary Gelit, a frozen food producer (see here a previous post by BeBeez). Ralcorp Holdings acquired Gelit from Consilium Private Equity and IGI Private Equityin June 2012. In November 2012, ConAgra acquired Ralcorp. Gelit has sales of 41.2 million of euros, an ebitda of 8.5 million, and net cash of 13.9 million. The asset could be of interest to Mandarin Capital, who may integrate it with its portfolio company Italian Frozen Foods Holdings. Further potential bidders could be Peak Rock Capital, Rolli, Orogel, Surgital,Lanterna Alimentari Genova

Gradiente raised 135 million euros, ahead of a target of 120 million for its new private equity fund from Italian and foreign investors (see here a previous post by BeBeez). Pietro Busnardo is the ceo of Gradiente.

OreFin, fka Orefici Finance, and London merchant bank Method created Boutique Italia, an investment holding (see here a previous post by BeBeez). Banca Patrimoni Sella is one of the investors of Boutique that may raise 40 million of euros in debt and equity for carrying on investments. Boutique Italia will acquire minorities of Italian SMEs that aim to list on Milan Aim. Riccardo Foglia Taverna, partner of STLex, and Roberto Gatti will be Boutique’s chairman and ceo, while Andrea Vicari will provide legal counsel.

CRIF, the Italian credit intelligence services company, acquired a controlling stake of Inventia, a Milan based provider of biometrics and security solutions that owns proprietary software Phygital4X (see here a previous post by BeBeez). Andrea Cinelli founded Inventia in 2012.