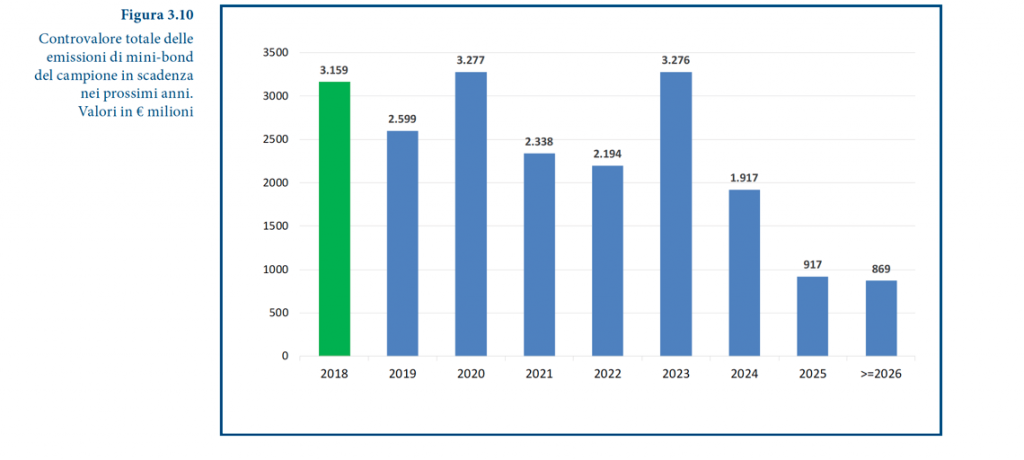

The fifth relation of Milan Polytechnic University’s Observatory for Minibond, says that in 2019 will come to maturity an amount of Italian corporate bonds worth 2.6 billion of euros (all these issuances are below 500 million and are not listed on markets available to retail investors) (see here a previous post by BeBeez). Giancarlo Giudici, the head of the observatory, said that in 2020 and in 2023, bonds worth 3.2 billion will come to maturity.

The fifth relation of Milan Polytechnic University’s Observatory for Minibond, says that in 2019 will come to maturity an amount of Italian corporate bonds worth 2.6 billion of euros (all these issuances are below 500 million and are not listed on markets available to retail investors) (see here a previous post by BeBeez). Giancarlo Giudici, the head of the observatory, said that in 2020 and in 2023, bonds worth 3.2 billion will come to maturity.

Magis, an Italian producer of tapes, issued a 7 million of euros minibond with a 7 years tenure, including a pre-amortizing term of 2 years (see here a previous post by BeBeez). Finint Investments, Fondo Rilancio e Sviluppo di Sviluppo Imprese Centro Italia, and Iccrea Banca Impresa subscribed the bond. Banca Finint and FISG (part of Gruppo Banca Finint) acted as the issuance arrangers. The company will invest the proceeds of this liability in its organic growth. Magis has sales of 50.2 million, an ebitda of 4.1 million, and net financial debts of 13.8 million.

The Italian association of shipping companies Confitarma held a meeting with sector focused private equity and credit funds and asked the Italian bank to communicate with more transparency the stages of the sale of NPLs to troubled borrowers (see here a previous post by BeBeez).

Eni Gas e Luce sold a portfolio of distressed credits worth 230 million of euros which were securitized (see here a previous post by BeBeez). Phinance Partners, the advisory firm of Enrico Cantarelli and Alessandro Mitrovich (two former directors of Royal Bank of Scotland) advised the Italian utility and acquired 10% of the asset-backed securities of the portfolio while DLA Piper provided legal counsel.

BCC Banca Centropadana sold to an undisclosed investor a portfolio of distressed credits worth 31.5 million euros (see here a previous post by BeBeez). Banca Akros, part of Banco Bpm acted as arranger through its platform Multiseller Npl.

By end 2019 Carige, the troubled listed Italian bank, will sell a further portfolio of distressed credits worth 2.1 billion of euros in order to cut its current 22% NPE ratio to 6.3%, said turnaround managers Pietro Modiano, Fabio Innocenzi, andRaffaele Lener (see here a previous post by BeBeez). The bank ha salso to raise 630 million through a capital increase. lnnocenzi said that for the portfolio SGA tabled a binding offer, and Credito Fondiario a non-binding bid. In 2H19, Carige will sell UTPs amounting to 300 million.