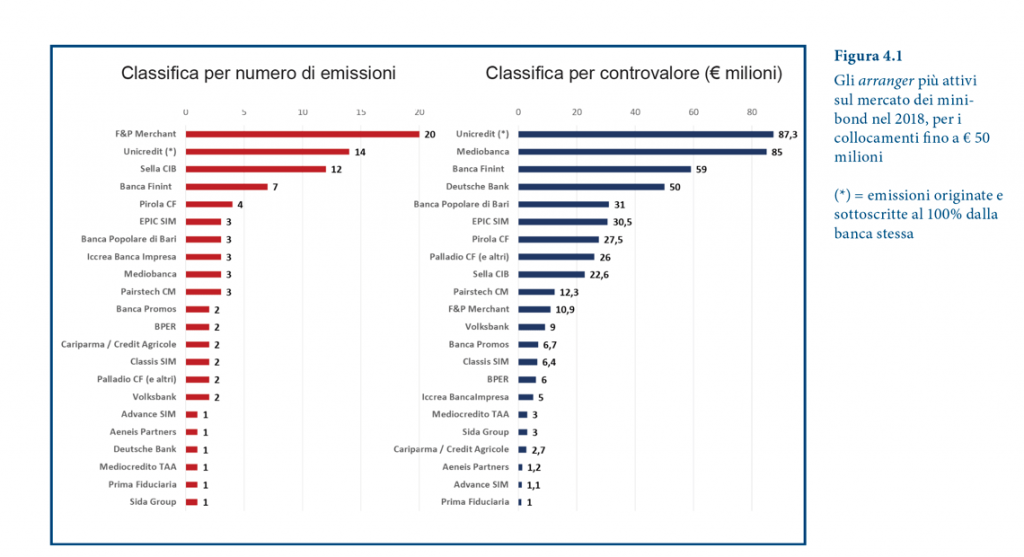

For the third consecutive time since 2016, Frigiolini & Partners Merchant tops the table of minibond arrangers that Milan Polytechnic School of Management drawn up with its Osservatorio Minibond (see here a previous post byBeBeez). F&P advised for 20 issuances. The table includes firms that advised unlisted Italian companies for issuances of bonds worth below 50 million of euros. Giancarlo Giudici heads the scientific committee of the Osservatorio. Unicredit ranks second after having advised for 14 issuances worth in total 87.3 million. Sella Corporate & Investment Banking provided advisory for 12 deals worth 22.6 million. Mediobanca ranks second after having advised for issuances worth a total amount of 85 million, Banca Finint closed deals worth 59 million. Further advisory firms in the table are ADB Corporate Advisory, Borghesi & Associati, CDS Associati, Deloitte Financial Advisory, Eidos Partners, Envent Capital Markets, Eukleia Group, Falcio & Associati, Financial Innovation Team, Fiordiliso & Associati, Linklaters, Pwc, SBA Business Advisor, Studio Mazzei Commercialisti e Revisori, TCO Innovation, and Vitale & Co. Top law firms and fiscal advisors who provided counsels for issuances of minibonds are Orrick, Chiomenti, Ashurst, CMS, DWF, NCTM, R&P Legal, Segre, Simmons & Simmons, and Studio Rinaldi. Private debt reports of BeBeez include the issuance of bonds worth above 500 million, as well as those of securitisation SPV and those for financing buyout transactions. Bebeez reports do not include small issuances of Italian subsidiaries of foreign companies, those of financial holdings, nor those of companies listed on Mta and Aim Italia or those of Government-owned companies.

For the third consecutive time since 2016, Frigiolini & Partners Merchant tops the table of minibond arrangers that Milan Polytechnic School of Management drawn up with its Osservatorio Minibond (see here a previous post byBeBeez). F&P advised for 20 issuances. The table includes firms that advised unlisted Italian companies for issuances of bonds worth below 50 million of euros. Giancarlo Giudici heads the scientific committee of the Osservatorio. Unicredit ranks second after having advised for 14 issuances worth in total 87.3 million. Sella Corporate & Investment Banking provided advisory for 12 deals worth 22.6 million. Mediobanca ranks second after having advised for issuances worth a total amount of 85 million, Banca Finint closed deals worth 59 million. Further advisory firms in the table are ADB Corporate Advisory, Borghesi & Associati, CDS Associati, Deloitte Financial Advisory, Eidos Partners, Envent Capital Markets, Eukleia Group, Falcio & Associati, Financial Innovation Team, Fiordiliso & Associati, Linklaters, Pwc, SBA Business Advisor, Studio Mazzei Commercialisti e Revisori, TCO Innovation, and Vitale & Co. Top law firms and fiscal advisors who provided counsels for issuances of minibonds are Orrick, Chiomenti, Ashurst, CMS, DWF, NCTM, R&P Legal, Segre, Simmons & Simmons, and Studio Rinaldi. Private debt reports of BeBeez include the issuance of bonds worth above 500 million, as well as those of securitisation SPV and those for financing buyout transactions. Bebeez reports do not include small issuances of Italian subsidiaries of foreign companies, those of financial holdings, nor those of companies listed on Mta and Aim Italia or those of Government-owned companies.

On December 2018, Italian banks recorded 29.5 billion of euros of distressed credits, the amount same amount that they had in May 2010, said ABI (Italian Banks Association) (see here a previous post by BeBeez). In November 2018, distressed credits were worth 38.3 billion (64 billion yoy), mentre un anno prima erano oltre i 64 miliardi. In early February this year, Ignazio Visco, the governor of Banca d’Italia, said that the health of lenders was improving since mid 2015.

Publishing firm Edizioni Master applied for receivership (see here a previous post by BeBeez). Edizioni Master has sales of 10.4 million of euros, an ebitda of one million, net profits of 1.5 million, and net financial debts of 5.1 million. Massimo Sesti founded Edizioni Master in 1997, while in 2004 MPVenture Sud fund acquired a stake in the business. MPVenture Sud 2 fund subscribed a convertibile a bond worth 3.5 million that Edizioni Master issued. Assietta Private Equity owns a stake in the business since 2007 as it acquired Intermonte BCC Private Equity sgr.

Pillarstone Italy acquired from Intesa Sanpaolo and Unicredit distressed credits amounting to 300 million of euros (350 million of US Dollars), as BeBeez Insight view reported on 18 February (find out here more about a subscription to BeBeez News Premium 12 months for only 20 euros per month) (See here a previous post by BeBeez). Italian shipping companies Perseveranza di Navigazione, Elbana di Navigazione, Morfini, Finaval and Motia Compagnia di Navigazione borrowed these UTPs loans. Sources said to BeBeez that on 21 February, Thursday, a group of representatives of Confitarma met in Brusselles delegates of the European Community Shipowner Association (ECSA). Confitarma representatives will meet on 28 February, Thursday, representatives of turnaround and restructuring investors. On 7 March, Thursday, Confitarma delegates will meet representatives of the main six Italian banks at ABI (Italian Banks Association) for discussing performing and non-performing loans for the shipping sector.

Only 100 creditors out of 700 expected, attended the meeting at Genoa Court for the bankruptcy of Italian food company Qui! Group (see here a previous post by BeBeez). The list of creditors includes US buyout firm KKR which entirely subscribed a bond of 50 million of euros that Qui! issued in February 2018 and listed on Vienna’s Third Market. As a collateral, KKR had a 91.8% stake of Qui! Group and 95% of the companies subsidiaries. Gregorio Fogliani, the founder of Qui!, applied for bankruptcy also for Moody and Pasticceria Svizzera, two food and catering companies that he controls.