Italian private equity firms have big plans for exits and keep on buying add-on assets for their portfolio companies

Italian private equity firms have big plans for exits and keep on buying add-on assets for their portfolio companies

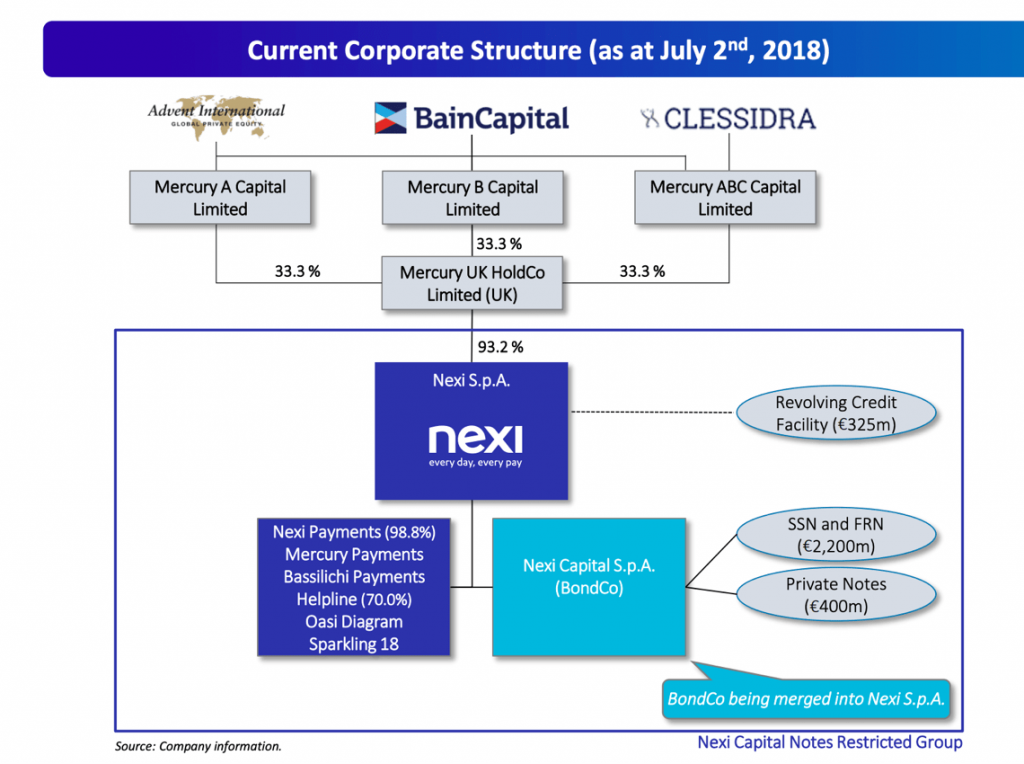

Italian payments system company Nexi board of directors are filing the Italian market Authorities in the next few hours for an ipo on the ground of an enterprise value up to 7.5 billion of euros, or 15X ebitda (see here a previous post by BeBeez). Franco Bernabè, who is about to work with Tim, will leave his role of Nexi chairman and Michaela Castelli will replace him. Giuseppe Capponcelli and Paolo Bertoluzzo will keep their roles as vicepresident and ceo. Bain Capital, Advent and Clessidra own 93.2% of Nexi, while Banco Bpm, Credito Valtellinese, and Popolare di Sondrio have the remaining stake. The company’s shareholders may launch an ipo through a capital increase and the sale of shares for listing 35% of the business.

Turnaround firm QuattroR closed the acquisition of 60% of iconic but financially distressed Italian fashion company Trussardi (see here a previous post by BeBeez). The fund will inject 48.5 million of euros as a capital increase, while banks agree to freeze their loans till the end of the new strategic plan. The investors aim to sell the business in 2022. If QuattroR will dispose Trussardi for an enterprise value of 11 – 72 million, it will cash 80% of the fetched amount while lending banks will get 20% of it. If Trussardi sale value will be above 72 million, 54% of the raised resources will go to investors, while lending banks will get 46%. Creditors will receive the full amount of their dues if investors will manage to sell Trussardi for 140 million.

Green Arrow Capital, an alternative asset management firm, acquired two photovoltaic plants with a power of 11 MWp from Orizzonte Solare, a company that belongs to HAT Orizzonte (80%) and Green Utility Lucca (20%) (see here a previous post by BeBeez). The acquisition was made by Green Arrow’s Radiant Clean Energy Fund sca Sicav Sif. Daniele Camponeschi, co-founder and cio of Green Arrow Capital said that the fund raised 100 million of euros since its launch 3 years ago and that it is targeting 150 million in fundraising by next Summer.

Equity Partners Investment Club (Epic), the club deal platform of Mediobanca, is in exclusive due diligence for acquiring a minority of La Bottega dell’Albergo, a supplier of cosmetic and beauty products for hotel chains (see here a previous post by BeBeez). NB Aurora and Andera Partners were also interested in the asset. Umberto Pacini founded La Bottega dell’Albergo in 1981. The company has sales of 80 million of euros with an ebitda in the region of 10 million.

Although the European Commission authorised troubled Italian construction group Condotte to receive a guarantee of the Italian Government worth 190 million of euros, the Italian Ministry of Economics and Finance provided only 90 million (see here a previous post by BeBeez). Giovanni Bruno, Alberto Dello Strologo and Matteo Ugetti are the commissioners that the Italian Government appointed for managing Condotte. Market rumours say that listed Italian contractor Salini-Impregilo is interested in Condotte.

Chequers Capital has put on sale its portfolio company Phoenix International, a producer of moulds for the extrusion of aluminium (see here a previous post by BeBeez). Vendors hired Ethica Corporate Finance for selling the asset on the ground of an enterprise value of 200 – 250 million of euros. Chequers acquired Phoenix from Opera sgr, Quadrivio sgr and the company’s managers in January 2016. Phoenix ceo Roberto Rusticelli and the other managers acquired a minority of the firm. Private equity funds Ambienta and Portobello and trade buyers are interested in the asset. Phoenix has sales of 85.8 million of euros, an ebitda of 18.9 million, and net financial debts of 23.9 million.

Rhenus, a German logistic company, acquired Italy’s peer Cesped (see here a previous post by BeBeez). Rhenus has sales of 4.8 billion of euros and acquired Cesped from chairman Rodolfo Flebus (66.67% owner), ceo Giorgio Flego (15.56%), Roberto Lucia (11.11%), and Ermes Coradazzi (6.67%). Guido Restelli, chairman of Rhenus Logistics Italia, will join Cesped board.

Rhiag, an Italian aftermarket company for the automotive sector that since 2015 belongs to Nasdaq-listed LKQ Corporation, acquired Italian competitor 72D, owner of Gruppo BM Ricambi (see here a previous post by BeBeez). Gruppo BM Ricambi has sales of 20 million of euros, an ebitda of 0.153 million, and net financial debt of 4.1 million. Luigi Botter and Eugenio Micheletto founded BM Ricambi in 1979. Enrico Botter, Luigi’s son controlled the business together with Micheletto. Sources said to BeBeez that the transaction value has been of 4 million of euros. LKQ bought Rhiag out of the portfolio of Apax Partners.