Players of the Private debt and NPL markets are hectically active. Intesa Sanpaolo aims to support SMEs, said Stefano Barrese, head of Banca dei Territori (see here a previous post by BeBeez). Barrese said that the bank poured 1.6 billion of euros in SMEs in 2018. Intesa Sanpaolo also issued 1.3 billion for financing the 4.0 Industry; allocated 5 billion for the circular economy Sace (part of Cdp), and 100 million for financing internationalization processes of SMEs.

Players of the Private debt and NPL markets are hectically active. Intesa Sanpaolo aims to support SMEs, said Stefano Barrese, head of Banca dei Territori (see here a previous post by BeBeez). Barrese said that the bank poured 1.6 billion of euros in SMEs in 2018. Intesa Sanpaolo also issued 1.3 billion for financing the 4.0 Industry; allocated 5 billion for the circular economy Sace (part of Cdp), and 100 million for financing internationalization processes of SMEs.

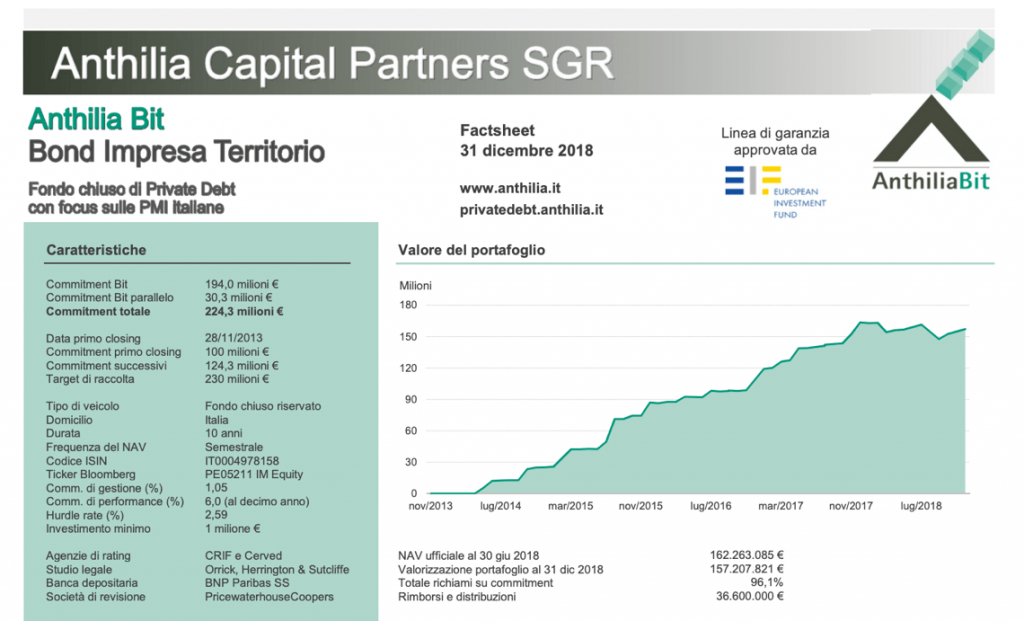

Microcast, an Italian producer of industrial components, listed a 3 million of euros minibond due to mature on December 2023 and paying a coupon 5.4% that the two private debt funds managed by Anthilia Capital Partners sgr subscribed (see here a previous post by BeBeez). Microcast has sales of 18.7 million, an ebitda of 1.64 million and net financial debt in the region of 7 million will invest such proceeds in its organic growth and M&A. The company recently acquired ATS–Microfund, Mec.Pi, and F.lli Bucciol. Barbara Ellero, Anthilia Capital Partners’ investment manager and head of private debt investment, said that the two private debt funds portfolios have a gross yield of 5.6% with a 4 years residual life and a median duration of 2.5 years as all subscribed issuances have an amortizing structure. Furthermore, the European Investment Fund provided a guarantee for 7% of the value of the fund portfolio. The next private debt fund of Anthilia may raise 300 million and will invest up to 20% of such resources in the securitization of invoices sold on fintech platforms like Credimi, with which there is a commitment for investing further 12 million is asset backed securities.

GWC Italia, the operative holding of Gruppo GWC, issued a 7.5 million of euros minibond with a 5.5 years tenuer that Antares AZ1 fund, managed by Azimut Libera Impresa sgr, subscribed (see here a previous post by BeBeez). GWC is a producer of industrial valves. In March 2015, Roberto Bartolena and B4 Investimenti acquired GWC through a Buy-In Management Buyout (BIMBO). Fabrizio Baroni founded B4 Investimenti. GWC has sales of 60 million with an above 10% ebitda. Paolo Antonio Palella, the chairman and ceo of GWC Italia, said that the company aims to increase and consolidate its presence in USA and Canada, as well as setting a footprint in the Far and Middle East. Antares AZ has invested 90 million out of its 130 million worth resources.

In 2018, October (fka Lendix) financed 190 companies with loans amounting to 111.3 million of euros (see here a previous post by BeBeez). Of that total, Italian companies including sail boats producer Grand Soleil, Cantiere del Pardo and food company Petti received more 28 million. P2P Lending Italia said that the sector in Italy experienced a 125% year-on-year growth. Oliver Goy founded October in 2015, while Sergio Zocchi heads the company’s Italian operations.

Finint Investment announced the closing for its private debt fund PMI Italia (see here a previous post by BeBeez). PMI has a fundraising target of 150 million of euros and will focus on companies generating sales of up to 300 million, reliable management, transparent governance, and solid financials. Finint Investments ceo is Mauro Sbroggiò. PMI senior fund manager are Vania Serena and Luca Novati. On another side, Finint Investments’s Fondo Strategico Trentino – Alto Adige, a private debt fund with a regional focus, invested 176 million for the subscription of 45 bonds that 40 companies issued (see here a previous post by BeBeez). Cristiano Menegus is the fund manager of Fondo Strategico, which in 2018 subscribed the bonds of Niederstätter, Tratter Engineering, Lavanderie dell’Alto Adige, IFI, Dolomiti Fruits, and Cipriani Profilati amounting to almost 22 million. Lavanderie dell’Alto Adige, the industrial laundry company, issued a 3 million of euros minibond with a 6.5 years tenure and will invest such proceeds in supporting its organic growth. IFI’s minibond issued a 5.4 million worth minibond with a five years tenure. IFI is the holding of the Staffler Family that has diversified business interests.

Acaya, part of Aligros and owner of Acaya Golf Resort & spa, signed a restructuring agreement for its 20 million of euros debt with SC Lowy PI, the Italian subsidiary of Hong Kong’s SC Lowy, which acquired such credit from Mps, Mps Capital Services, and Bnl Bnp Paribas (see here a previous post by BeBeez). Acaya will sell the resort for entirely paying back its debt and develop further operations. Aligros, is a real estate company that belongs to the Montinari Family and restructured its debt of 35 million with Mps, Banca Popolare Pugliese, Mediocredito Italiano, Bnl, and UBI Banca

Equita Private Debt Fund subscribed a minibond worth 15 million of euros that Italian frozen fish distributor Panapesca, a portfolio company of Xenon Private Equity, issued (see here a previous post by BeBeez). The Panati Family owns the company that has revenues of 157.8 million of euros, an ebitda of 12.4 million, and net financial debt of 44.7 million. This is the nineth investment for the fund managed by Lemanik Asset management and of which Equita is advisor, with Paolo Pendenza as investment manager. Equita sim also announced the launch of its second private debt fund which is aiming to raise more than the 100 million euros raised by the first one.

Green Arrow Capital aims to raise 200 million of euros for its fund Special Credit Situations, that will focus on Npls and performing credits (see here a previous post by BeBeez). Eugenio de Blasio, ceo of Green Arrow Capital, said that the firm wants to manage assets for 2.6 billion of euros by 2024 from current 1.3 billion.