Year 2019 will be a complicated time for the financial markets in Europe, according to private equity operators, but they believe that they will be able to manage their portfolios well and reach interesting exit evaluations. These are the results from a survey conducted by IPEM between late October and late November 2018 among 383 members of the main European private equity associations which BeBeez is able to anticipate.

IPEM will bring together a large number of industry representatives in Cannes between 22 and 24 January and BeBeez will be present in force with its own booth to present BeBeez Private Data.

“European private equity is for sure expecting some turbulences in 2019. Interestingly though, the industry is very confident about its prospects – even more than ever perhaps! This proves that it is now a mature asset class, ready to take advantage of misvaluation opportunities”, commented Antoine Colson, managing director of IPEM, who oversaw the survey.

More in detail, 55% of respondents fear an important economic correction in 2019. Brexit and its consequences and protectionism and trade wars are the two main threats mentioned at the global level. The Brexit comes first for about 4 out of 10 respondents. In particular, there is fear of a slowdown in growth, concurrent with an increase in valuations and market volatility.

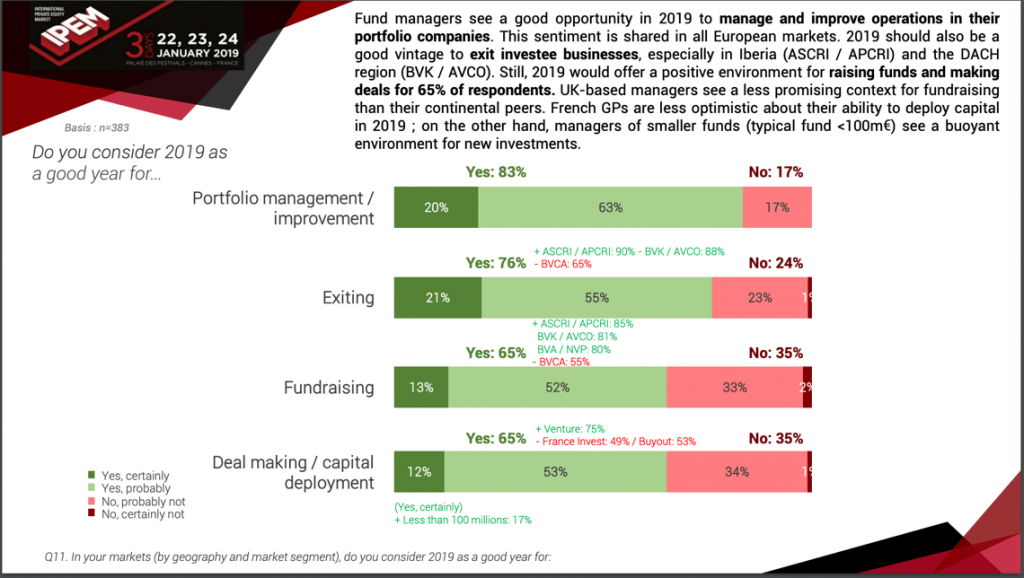

That said, fund managers believe that in 2019 there will be good opportunities to manage and improve the performance of the companies in the portfolio (83% of respondents) and that 2019 should also be a good year for divestments (73%). Not only. 2019 should also be a good year to raise new funds (65%), with the exception of funds established in the UK, which fear Brexit to bring a less promising fundraising context compared to their continental counterparts. In any case, however, only 50% of European fund managers expect to raise more capital than the last fund. Finally, 2019 is also considered a good year to make new investments (65%) and 61% of respondents expect to invest more than 2018.

It should be noted that the managers of smaller funds, ie those up to 100 million euro, seem to be more optimistic than their major colleagues on all fronts, in particular 69% of small managers believe that the business scenario will remain good in the year or even better than last year, 70% of them think that 2019 will be a good year to do deals and 27% of them expect to raise much more capital for their funds than they did with their previous funds.

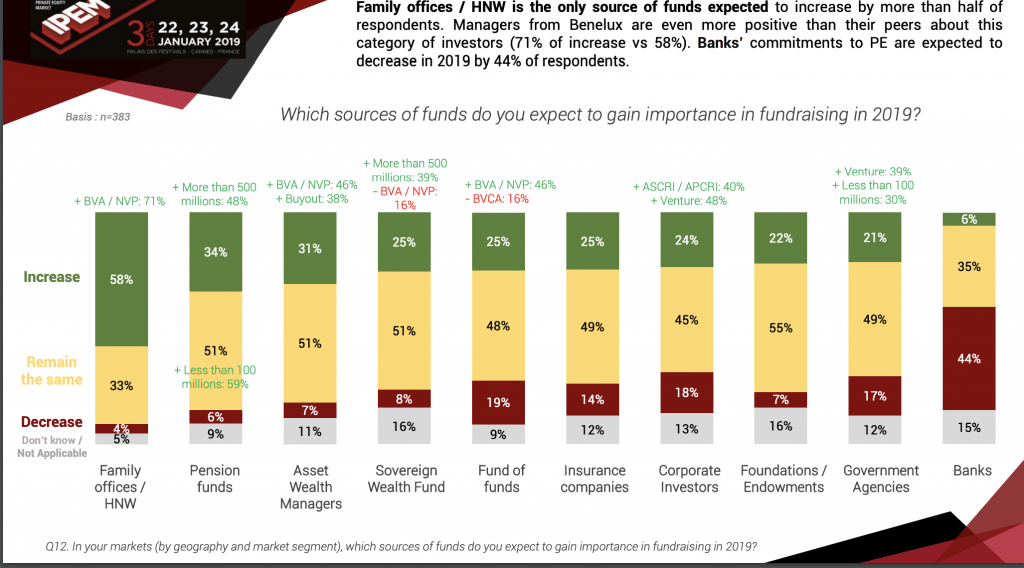

Coming back to the general survey, as for the sources of funding, 58% of the interviewees expect that the family offices and the high net worth individuals (HNWI) will increase their investments in private equity, while 44% of respondents expect banks to reduce them. In particular, this trend is expected to be more marked in terms of buyout funds, in which 63% of respondents believe that the family offices will invest more, while 50% of those interviewed believe that the banks will invest less. Venture capital will also attract more family offices and less banks this year, according to the survey.

Coming back to the general survey, as for the sources of funding, 58% of the interviewees expect that the family offices and the high net worth individuals (HNWI) will increase their investments in private equity, while 44% of respondents expect banks to reduce them. In particular, this trend is expected to be more marked in terms of buyout funds, in which 63% of respondents believe that the family offices will invest more, while 50% of those interviewed believe that the banks will invest less. Venture capital will also attract more family offices and less banks this year, according to the survey.

On the evaluations front, however, there is no consensus. 38% of respondents expect them to grow, 33% think they will remain stable, while 29% think they will fall. However, 41% of European managers believe that it will be more difficult to find attractive investment opportunities in 2019 compared to 2018. As for leverage, only 13% of respondents think it will increase, 35% think that it will remain the same as 2018, while 33% think it will shrink (there is a 20% of interviewed who did not respond).

In the buyout segment, the sectors considered most attractive for investments are business services, pharmaceuticals, and the ICT, while for venture capital the most promising sectors are considered artificial intelligence, medtech and software.

Finally, a reference to the issue of reputation in Europe, on which there are conflicting opinions: 52% of respondents believe that the industry has a negative image, especially in France (74%) and the United Kingdom (68%) while their German counterparts believe that private equity has a good image (60%).