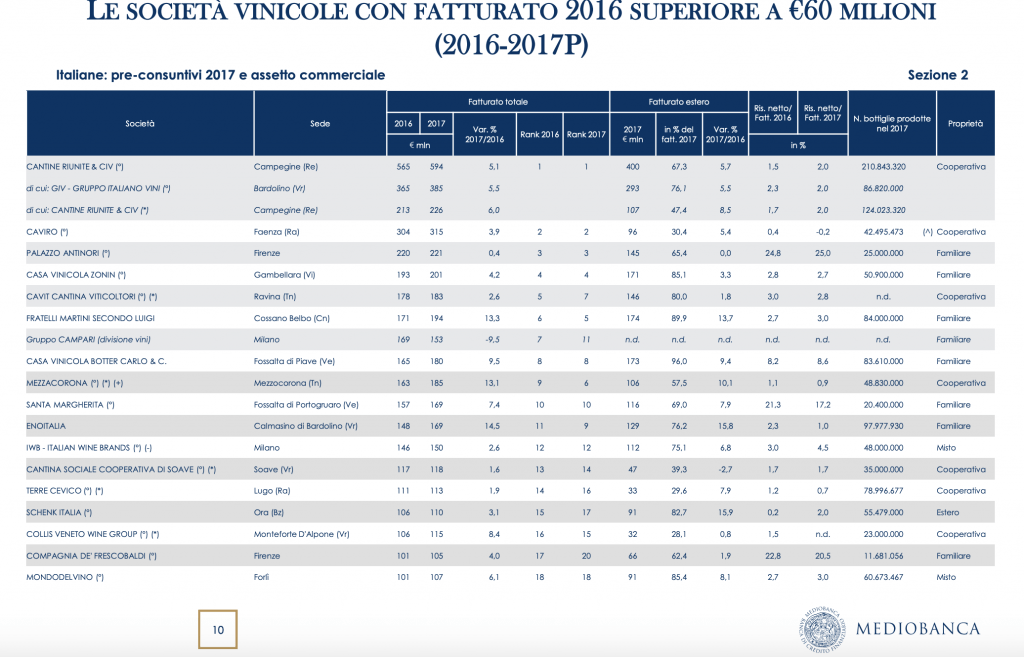

Zonin 1821 is about to sell a 21 Invest, the investment holding of Alessandro Benetton, a 36% stake to for 65 million of euros through the launch of a capital increase (see here a previous post by BeBeez). Zonin has sales of 201 million and aims to launch an ipo and post revenues of 300 million in the next five years. Mediobanca acted as the company’s financial advisor while Bain & Co. outlayed the business plan. Zonin also attracted interest of funds with a specific focus on agro-food business such as Idea Taste of Italy, managed by Dea Capital Alternative Funds, or Fondo AgroAlimentareI and Cerea, both sponsored by French group Unigrains.

Canepa, an Italian producer of high-end fabrics, applied for receivership before Como’s Court (see here a previous post by BeBeez). The company is also looking for an industrial partner. Idea Corporate Credit Recovery (ICCR), part of Dea Capital Alternative Funds, previously announced that it would have acquired a 67% stake in Canepa after having reached a restructuring agreement with the company’s creditors as well as being willing to provide further 19 million of euros for relaunching the business. ICCR appointed Luca Belenghi, the former ceo of Gruppo Tessile Monti who previously worked for Mantero Seta, Salvatore Ferragamo, and Emanuel Ungaro, as Canepa CEO. However, Luca Peli replaced Belenghi, who resigned in September 2018. Canepa has sales of 106 million, an ebitda in the region of 10%, and net financial debt of 80 million.

Giovanni Maggi, the chairman of Assofondipensione, the Italian association of pension funds, said that the firms that are part of his group aim to invest more in the real economy (see here a previous post by BeBeez). Italian pension funds are currently investing in sovereign bonds (75.8%), bonds (6.4%), equity shares (3.8%), shares of collective investment undertakings (0.5%), and banking deposits (13,5%). At present, Italian pension funds invest 1.2 billion of euros in the equity or debt of Italian companies. Maggi said that the funds aim to review their asset allocation as the only associate firms that have started to invest in the real economy are Alifond, Byblos, Eurofer, Laborfonds, Pravaer, Priamo, and Solidarietà Veneto (as for a report published by Assofondipensione last year).

NB Renaissance Partners (NBRP) signed a binding agreement with Mandarin Capital Partners and Atlante Private Equity for acquiring Hydro Holding, a producer of oleodynamic circuits (see here a previous post by BeBeez). Sources said to BeBeez that NBRP will buy 80% of Hydro Holding, while the families Vaghi, Facondini, Cerase, and Brivio, founders of the business, will keep the remaining 20%. Mandarin Capital Partners acquired the business in 2014 and carried on several add-on acquisitions together with Atlante Private Equity. Nicola Carminucci, the ceo of Hydro Holding, will hold a minority. The company has sales of 60 million of euros with a 25% ebitda margin. NBRP has resources worth in the region of 1.5 billion.

RCF Group, an Italian producer of hardware and systems for the professional addition of sound and audio, acquired high – end Danish peer DPA Microphones from The Riverside Company, which invested in the business in 2013 (see here a previous post by BeBeez). Palladio Holding and Amundi Private Equity owns 30% of RCF since May 2017. The company has sales of 130.6 million of euros, an ebitda of 24.8 million, and net financial debt of 31.6 million. International music stars Stevie Wonder, Katy Perry, Metallica, Coldplay, Paul McCartney, and Céline Dion, British media group BBC, and bespoke Broadway shows Les Misérables and Phantom of the Opera are some of the clients of DPA, of which Kalle Hvidt Nielsen, previously ceo of Bang and Olufsen, is the head.

Italmatch Chemicals, the chemical company that belongs to Bain Capital, acquired UK based competitor BWA Water Additives from US Family Office Berwind Corporation (see here a previous post by BeBeez). Parties expect to sign the closing of the transaction in 1Q19. Seera Investment Bank, a Bahrein bank, sold the business to Berwind in 2011 for 185 million of British Pounds. Italmatch will finance this buy with a mix of equity and of debt. Sergio Iorio is the ceo of Italmatch that has sales of 400 million of euros and an ebitda of 65 million.

Ambienta acquired a controlling stake of iMage S, a distributor of artificial vision systems, through Next Imaging (see here a previous post by BeBeez). Milena Longoni, Marco Diani, and Paolo Longoni, the target’s founders, will keep their management roles and a minority of the business, while Fabrizio Ricchetti will be the ceo of Next Imaging. iMageS has sales of 30 million of euros.

The price of the 350 million of euros bond of Kedrion, the Italian producer of blood products that belonga to the Marcucci family and to Cdp Equity (25.7%), fallen below 0.8 euros. (see here a previous post by BeBeez). This liability is due to mature in July 2022 and pays a 3% coupon. According to market rumours, Kedrion is of interest to financial investors Italmobiliare, Edizione holding, Canadian fund PSP, US family office Koch, and to Chinese conglomerate. In 3Q18, Kedrion posted sales of 438.6 millioni (+7% yoy), an adjusted ebitda of 104.8 million (+7,9%), and net financial debt of 520.1 million (507 million at the end of June).

CVC Capital Partners delivered to Consob, the Italian stock market regulator, the prospectus for the public offer for Recordati, the pharma company in which the eponymous family holds a controlling interest (see here a previous post by BeBeez). CVC co-investors are PSP Investments, Stepstone, and Alpinvest. GTB Capital Partners (Morgan Stanley), HL International Investors (Cathay Life Insurance), and HarbourVest may join later the current group of buyers. CVC will pay cash at 27.55 euros per share or 2.77 billion for Recordati’s 48.209%. Buyers will finance the transaction with equity (1.07 billion) and debt without delisting the company. In 3Q18 Recordati posted sales of 1.013 billion (+5,1% yoy), an ebitda of 380.1 millioni (+11,1%), and net financial debts of 462.7 million.