Bper Banca announced the closing of a securitization deal on a 1.9 billion euros NPLs portfolio named Aqui (see the press release here).

Bper Banca announced the closing of a securitization deal on a 1.9 billion euros NPLs portfolio named Aqui (see the press release here).

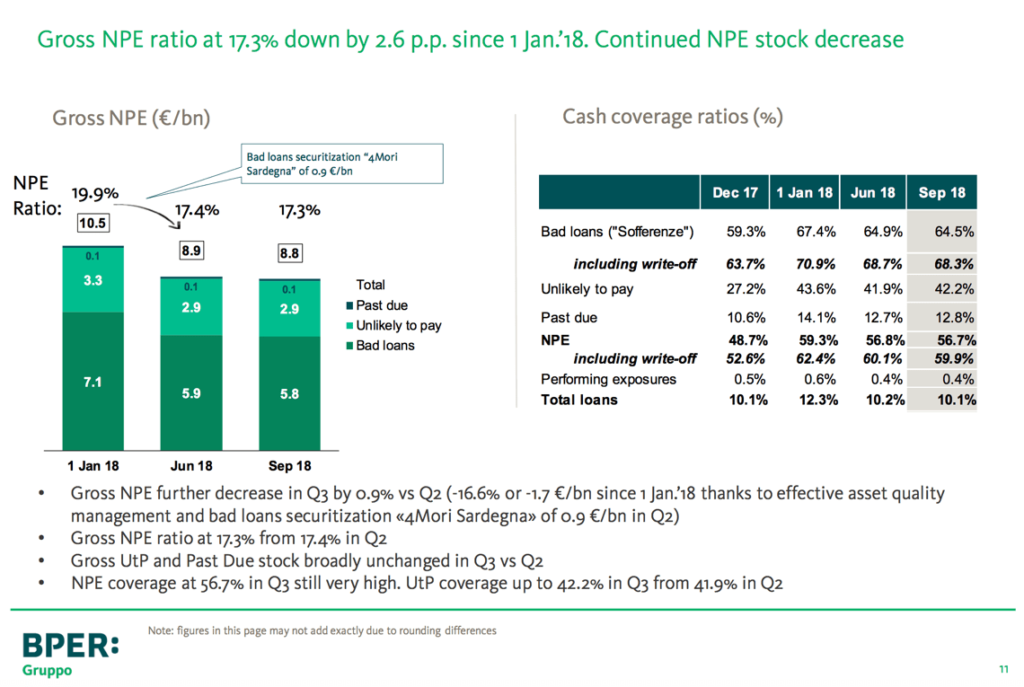

The sale was included in the bank’s strategic plan for 2018-2020 which outlined bad loans sales for 3.5-4 billion euros in the period, of which about 3 billions thorugh two securitization deals by the end of this year. So after a first securitization last June of a 900 million euros portfolio by subsidiary Banco di Sardegna (ssee here a previous post by BeBeez), a 2 billion euros deal was expected by the market.

More in detail, the portfolio includes a 59.5% of secured loans and a 40.5% of unsecured loans and was sold to the Italian securitization veichle Aqui spv srl, which has issued three different classes of notes for a total of 618.4 million euros: a 544.7 million senior tranche senior or 28.7% of the gross book value, with an investment grade rating of Baa3 by Moody’s and BBB- by Scope Ratings, paying an euribor 6 months plus 50 bps floating coupon and to be subscribed by Bper Banca itself which is going to ask the Italian Government for public guarantee (Gacs); moreover Aqui issue a mezzanine tranche (62.9 million euros) and a junior tranche (10.8 millions) which are going to be sold to institutional investors to allow the bank to benefit of the recognition for those loans on its books. After that the NPE ratio for the bank will drop to 14.4% from 1.73% at the end of September.

In the meantime yesterday Bper Banca ceo Alessandro Vandelli, commenting Q3 results for the bank, said that the bank is already working at a new sale of a one billion euros NPLs portfolio and that another one billion euros NPLs portfoliomight be put on sale just after that.

Prelios Credit Servicing (Gruppo Prelios) will act as master and special servicer for the Aqui securitization and will then being managing 11 out of a total of 16 Italian NPLs securitizations that have received Gacs. Today Prelios Credit Servicing has a total of 24 billion euros under management (see the press release here).