CVC Capital Partners and its co-investors are placing a 1.28 billion euros bond in two tranches in order to finance their acquisition of a 51.8% stake in Italian pharma group Recordati, as announced last July (see here a previous post by BeBeez).

CVC Capital Partners and its co-investors are placing a 1.28 billion euros bond in two tranches in order to finance their acquisition of a 51.8% stake in Italian pharma group Recordati, as announced last July (see here a previous post by BeBeez).

Newco Rossini Acquisition sarl, controlled by CVC, started a roadshow yesterday ending next Thursday for launching the bond which will come in the form of two senior secured notes with 7 years maturity, one with a fixed rate coupon non callable for 3 years and the other with a floating rate coupon non callable for one year. Global coordinator and joint bookrunners are Deutsche Bank (B&D), Credit Suisse e Jefferies; joint bookrunners are also UniCredit, Banca Imi, Credit Agricole-Cib, Natixis, Sociétée Generale and Ubi.

Standard&Poor’s assigned yesterday a preliminary rating B with stabkle outlook to both Rossini Acquisition sarl and its senior secured bonds maturing in 2025.

Standard&Poor’s assigned yesterday a preliminary rating B with stabkle outlook to both Rossini Acquisition sarl and its senior secured bonds maturing in 2025.

The S&P’s report reminds that CVC Capital Parnters and its coinvestors are acquiring FIMEI spa, the holding company of the Recordati family which owns a 51.8% stake in the Milan-listed Recordati group (on a fully diluted basis). The acquisition will be made through Rossini Acquisition sarl for a 3.03 billion euros price (28 euros per share.

As annouced, CVC Fund VII and its coinvestors will pay 2,3 billion euros cash to the Recordati family and will issue 750 million euros of subordinated debt notes. The Recordati management will reinvest 78 million euros in the business.

CVC will then launch a cash tender offer on the rest of Recordati shares without aiming at delisting the group. The deal will be partly financed by a consortium of banks made by Deutsche Bank, Credit Suisse, Jefferies and Unicredit.

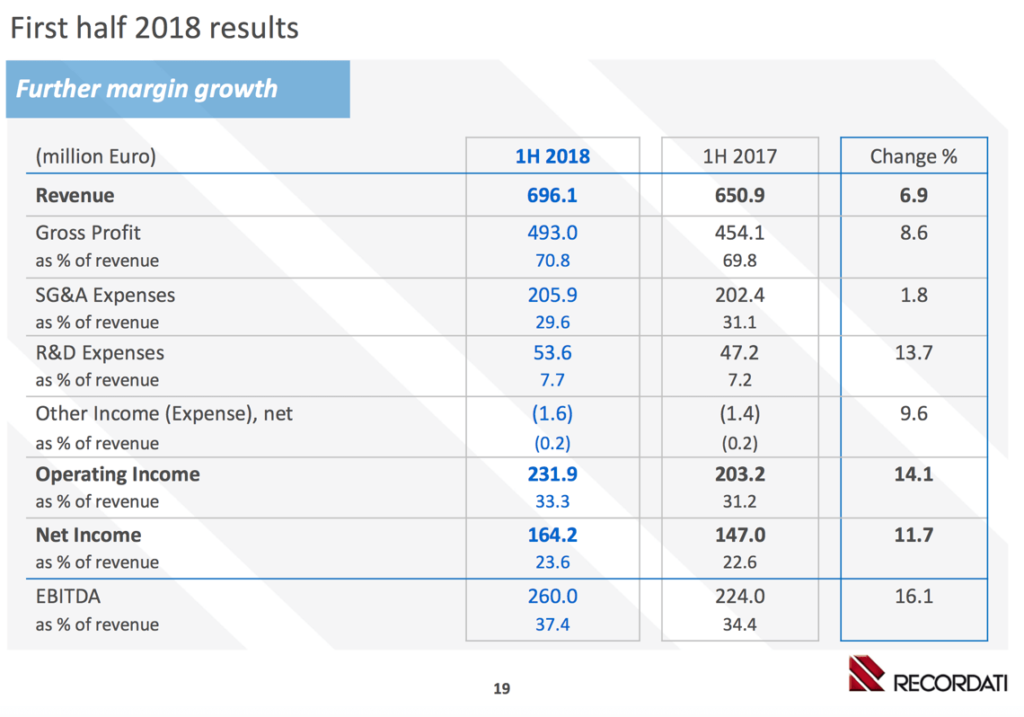

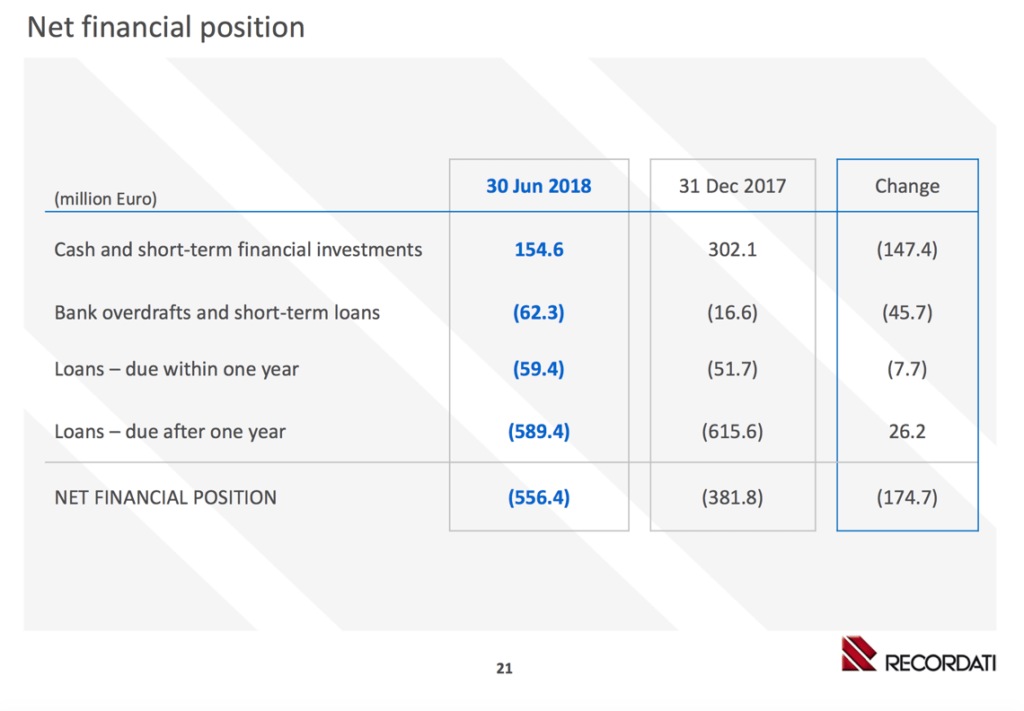

Recordati reached 696.1 million euros in revenues in H1 2018 (+6.9% from H1 2017), 260 million euros in ebitda (+16,1%) eand a net financial debt of 556.4 million euros (+ 174.7 millions from end 2017) after a share buyback, dividend distribution and the acaquisition of Natural Point srl. Recordati had reached 1.288 billioneuros in revenues in 2017, with 454.7 million euros in ebitda and a net profit of 288.8 millions. S&P’s sees Recordati’s ebitda at 475-480 million euros at the ed of 2018 and up to 505 millions at the ebd of 2019.