The activity of angel and venture capital has been steady over the Summer, while equity crowdfunding platforms see an increase of the concluded campaigns.

The activity of angel and venture capital has been steady over the Summer, while equity crowdfunding platforms see an increase of the concluded campaigns.

Milan Polytechnic (PoliMi) and Italian venture capital 360 Capital Partners launched Poli360, an investment firm with resources worth 60 million of euros, for supporting innovative projects of the Italian University (see here a previous post byBeBeez). Ferruccio Resta, chancellor of Polimi, and Cesare Maifredi, senior partner of 360 Capital, said that this firm will start screening 120 startups that the polytechnic incubated. ITATech, an investment platform that European Investment Fund and Italy’s Cassa Depositi e Prestiti sponsored, is an anchor investor of Poli36, which is still open to raising funds, especially from corporations.

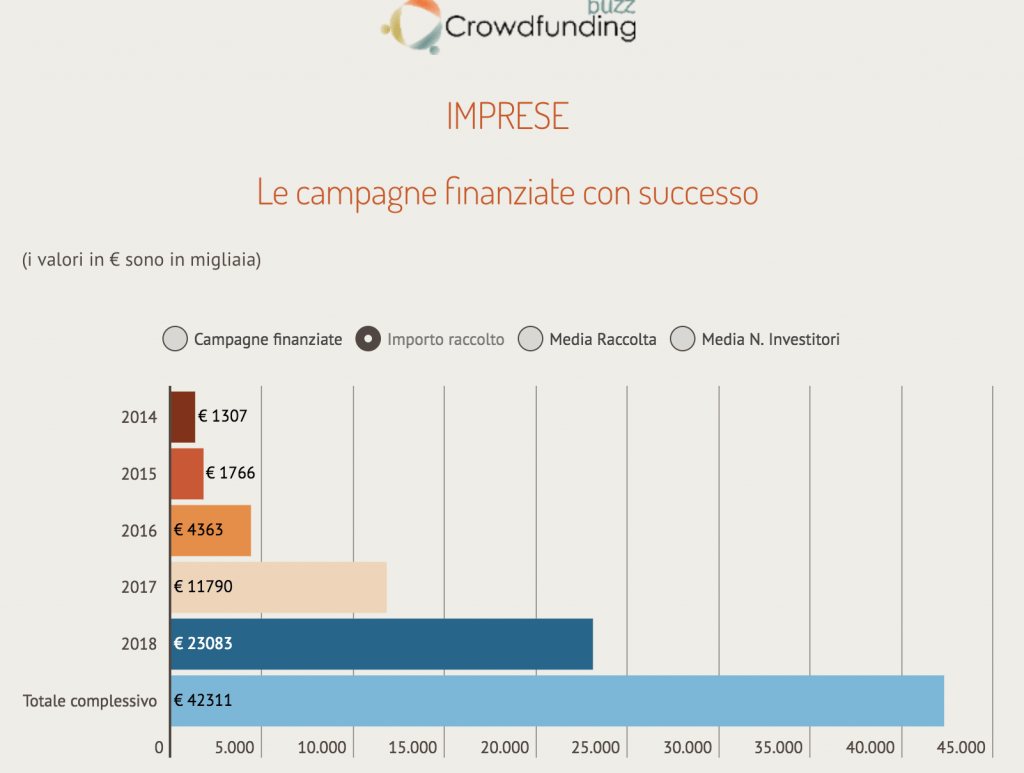

Between July and August, Italian equity crowdfunding platforms have allowed companies to raise 8.89 million of euros through 20 campaigns according to CrowdfundingBuzz portal (see here a previous post by BeBeez). Campaigns on platforms Mamacrowd, CrowdFundMe, and Next Equity have been quite successful. The following companies have concluded their campaigns in August:

- Aerotec, a producer of ultra-light planes, raised 0.7869 million from 49 investors on Next Equity.

- Fidelity House, a social content network (Mamacrowd, 0.652 million from 84 investors ).

- Supermicron, a producer of sensors for monitoring the solidity of infrastructures (0.422 million on Crowdfundme from 394 investors).

- eMotion, a logistic platform for e-commerce players, (0.3119 million on Mamacrowd from 50 investors)

- Revoilution, a manufacturer of appliances for producing olive oil (0.2307 million on Mamacrowd from 80 investors). Italian footballers Ciro Immobile and Antonio Nocerino injected resources in the business

- Edgar, an app for landlords (0.1965 million on Mamacrowd from 26 investors)

- inReception, a cloud platform for booking leisure accommodation (0.088 million on Mamacrowd from 25 investors)