No news from the private debt market in italy in the last few days. There were instead two significant news on the NPLs side.

No news from the private debt market in italy in the last few days. There were instead two significant news on the NPLs side.

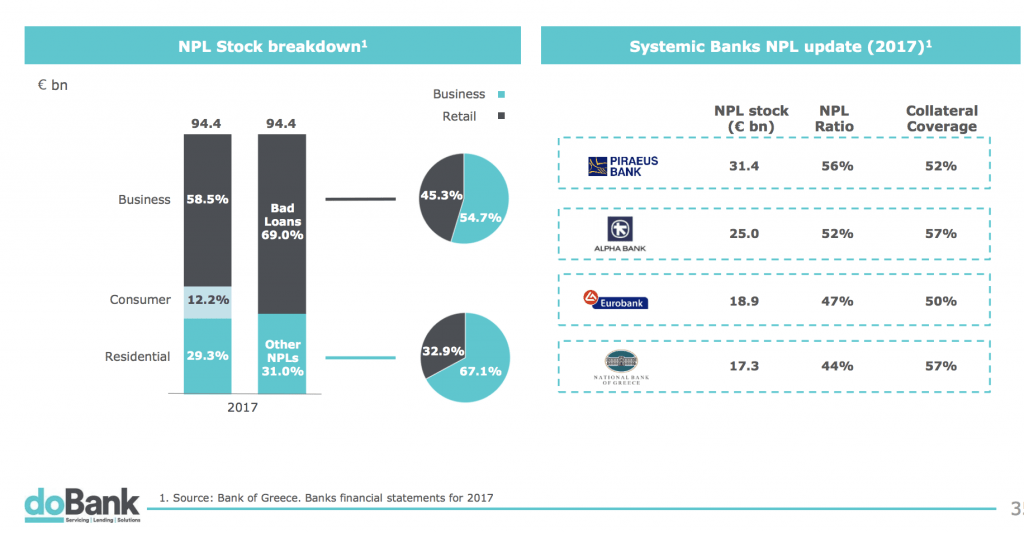

Italian NPLs servicer Dobank will manage a portfolio of NPLs worth 1.8 billion of euros of Greek systemic banks Alpha Bank, National Bank of Greece, Eurobank, and Piraeus Bank (see here a previous post by BeBeez). Dobank’s business plan for 2018-2020 set a raising target of further 15 billion of NPLs on top of the 87.8 billion amount that is currently managing.

UBI Banca announced its had closed the expected securitization of an NPLs portfolio for which the bank is going to ask the Italian Government guarantee (Gacs) (see here a previous post by BeBeez). The bank has securitized a 2.75 billion euros portfolio made by unsecured (53.4%) and secured (46.7%) loans. UBI Banca also said that between the end of 2018 and the beginning of 2019 it will sell an other NPLs portfolio (this time 90% unsecured) for a lower amount and without a securitization. The actual securitization has been made thorugh the special purpose veichle Maior SPV srl. The deal is on a lower amount of loans than expected as last April rumors were that the bank was working at a 3-4 billion euros securitization (see here a previous post by BeBeez).