Private equity firms and Spacs enliven Italian stock market and don’t pause yet the secondary market.

Private equity firms and Spacs enliven Italian stock market and don’t pause yet the secondary market.

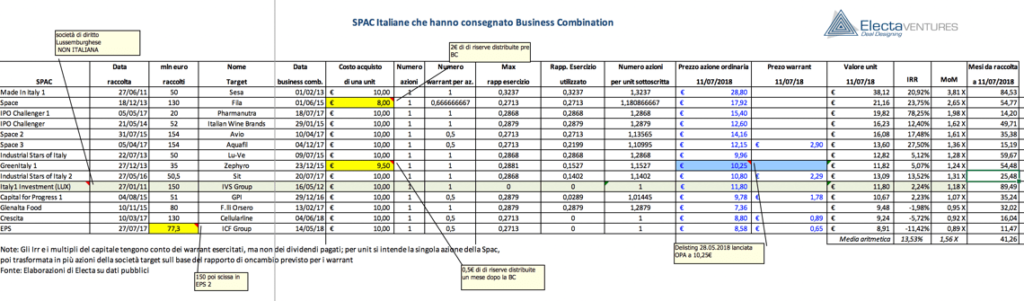

Since 2011 Spacs and pre-booking company raised resources worth in the region of 4 billion of euros, according to BeBeez database (see here a previous post by BeBeez). Such firms invested funds for 1.25 billions and announced business combinations worth 1.4 billions. Ten Spacs have a firepower of 1.7 billion still available to invest. On average, Spacs annual yield is of 14% or 1.6 the invested capital since the listing of the vehicle and the business combination, Electa Group calculated for MF Milano Finanza. Simone Strocchi, founder of Electa and chairman of Aispac, the Italian association of Spacs, said that a realistic target for investor is an annual Irr of 24% over four and a half years.

However, on the other side there isn’t shortage of potential targets. According to BeBeez data (powered by Leanus) there are 393 Italian manufacturing business with sales of between 15 – 50 million that grew by 7% and have a low risk profile (see here a previous post by BeBeez). Almost 75% of these businesses is based in the North of Italy. The aggregate sales of these companies are of 10 billion (+24% yoy) with an aggregate banking debt of 1.4 billion, and cash availability of more than 2 billion.

Mediaset and F2i, the Italian investor in infrastructures, launched a 57 euros per share public offer on Milan-listed Ei Towers, the company that manages Mediaset’s transmission towers (see here a previous post by BeBeez). The offer of the newco 2i Towers(40% Mediaset and 60% F2I) pays a 15.6% premium on the current share price for a total value of 1.61 billion of euros. Intesa Sanpaolo, Mediobanca, and Unicredit provided a 480 million credit line for financing the transactions. Ei Towers has revenues of 262.9 million, an adjusted ebitda of 133.6 million, and net financial debt of 317.7 mililon.

On another table, F2i is frontrunning the auction for acquiring Italian renewable energy company RTR Rete Rinnovabile from British private equity Terra Firma (see here aprevious post by BeBeez). Unicredit, JPMorgan, and Jefferies, the sell-side advisors, took into consideration only the binding offers of F2I and of trade buyer Sonnedix Power Holdings, which belongs to JP Morgan asset management – Global real assets. At the end of 2016, Sonnedix refinanced its portfolio of Italian plants with the issuance of a bond worth 95 million listed on Milan ExtraMot Pro. RTR is up for sale since late 2016 and has revenues of 158 million with an ebitda of 134 million and net financial debts in the region of 900 million. According to market rumours, Terra Firma received offers that valued the business 1.6 billion. Terra Firma acquired RTR from Italy’s listed Terna in 2011 for 755 million and an equity value of 641 million.

Italy’s fashion company Paci Group invested 5 million of euros or 30% of its sales in troubled competitor Via delle Perle in which private equity firm Argos Soditic had a 75% stake and founders Edmondo Tirelli, Nunziella Saltini, and Glauco Verrini had 25% (see here a previous post by BeBeez). Paci acquired Via Delle Perle from an Italian bankruptcy Court for 0.3 million of euros. Fabrizio Lenzi, ceo of Paci Group said that after such transaction, the company aims to generate 25-30 million in sales by 2019 from the current 15 million.

Bper, Banca Popolare di Sondrio and private equity houses are competing for acquiring 40% of Italian asset manager Arca sgr (see here a previous post by BeBeez). Milan m&a Boutique Vitale & Co is currently selecting offers for the stake that belongs to troubled Italian banks Banca Popolare di Vicenza and Veneto Banca. Bper and Pop Sondrio already own 32.752% and 21.137% of the target, therefore are working on a joint bid. The value of the stake up for sale is of between 120 and 160 million of euros. In November 2015 Banco Popolare sold its 19.9% holding in Arca to Bper and BPS for 95.5 million. Arca has assets under management worth 32 billion, a brokerage margin of 150 million and net profits of 61 million.

Friulia, the financial firm of the North Eastern Italian region of Friuli Venezia Giulia, invested further 1.9 million of euros in Friulchem, a third-parties producer of active ingredients and generic drugs (See here a previous post by BeBeez). Alessandro Mazzola founded the company in 1996. Friulchem has sales of 15.1 million.

Italian contractor Condotte declined the non-binding offer of UK turnaround firm Attestor Capital and applied for extraordinary administration for insolvency to Rome Tribunal (see here a previous post by BeBeez). The company has a banking debt of 461 million of euros and total liabilities of 767 million. Attestor has a co-investment agreement with Oxy Capital and offered to inject 50 million in the company and further 150 million once Condotte’s application for receivership was successful. In 2016, the company generated revenues of 1.3 billion, an ebitda of 98.3 million and net profits of 12.4 million.

Italian producer of preserves and food service company D’Amico, acquired HDS from Nem sgr (now renamed Alkemia sgr), a private equity firm that secondary market investor Montana Capital acquired from Gruppo Banca Popolare di Vicenza (see here a previous post byBeBeez). D’Amico has sales of 42 million of euros, while HDS revenues are of 30 million.

Alkemia (former Nem sgr) sold to the Bellin-Danieli family a 25.67% stake in Gibus, a producer of curtains for garden (See here aprevious post by BeBeez). The buyers now hold 100% of Gibus.

Melitta Group Management, the German manufacturer of products for coffee and the preservation of food, acquired 100% of Italian packaging company Cuki from financial firm Pillarstone Italy and majority shareholder and ceo Corrado Ariaudo, who will keep his executive role (see here a previous post by BeBeez). Melitta carried on this transaction for creating synergies with its portfolio asset Cofresco Frischhalteprodukte. Ariaudo acquired Cuki (fka Comital Saiag) in 2010 from Italian turnaround firm M&C. In late 2015 Pillarstone acquired the distressed debt that Cuki had with Unicredit and Intesa Sanpaolo. Cuki has sales of 200 million of euros. Melitta belongs to the eponymous family and has sales of 1.54 billion.

Private equity fund Idea Agro announced a first fundraising closing worth 80 million of euros (see here a previous post by BeBeez). The fund will invest in companies of the Italian agricoltural production chain that operate with an eco-friendly approach. Italian financial firm Dea Capital Alternative Funds sgr launched Idea Agro for allowing limited partners to diversify their investments, said Dea’s ceo Gianandrea Perco.