CVC Capital Partners, together with PSP Investments and StepStone will pay 28 euro per share for the 51.58% of Recordati group to the Recordati family for a corresponding enterprise value of 3.03 billion euros for the stake and a 5.8 billion euros equity value of the 100% of the group. The announcement came last Friday June 29th with two different press releases, by Fimei spa, the Recordati family holding (see here the press release) and by CVC (see here the press release).

CVC Capital Partners, together with PSP Investments and StepStone will pay 28 euro per share for the 51.58% of Recordati group to the Recordati family for a corresponding enterprise value of 3.03 billion euros for the stake and a 5.8 billion euros equity value of the 100% of the group. The announcement came last Friday June 29th with two different press releases, by Fimei spa, the Recordati family holding (see here the press release) and by CVC (see here the press release).

More in detail, the consortium of private equity funds led by CVC Fund VII will pay to the Recordati family 2.3 billion euros in cash at the closing of the deal plus about 750 million euros in subordinated long-term maturity debt instruments. Ceo Andrea Recordati will reinvest in the company. Fimei spa is now owned by HIllary, the widow of former ceo Giovanni recordati and by Giovanni Recordati brothers and sister Cristina, Alberto and Andrea.

Closing of the Fimei purchase is anticipated to take place in the last quarter of 2018 and is subject only to mandatory competition approvals. Following closing the consortium will make a mandatory tender offer to the remaining minority shareholders. The deal will be partly financed by a bank consortium made by Deutsche Bank, Credit Suisse, Jefferies and Unicredit.

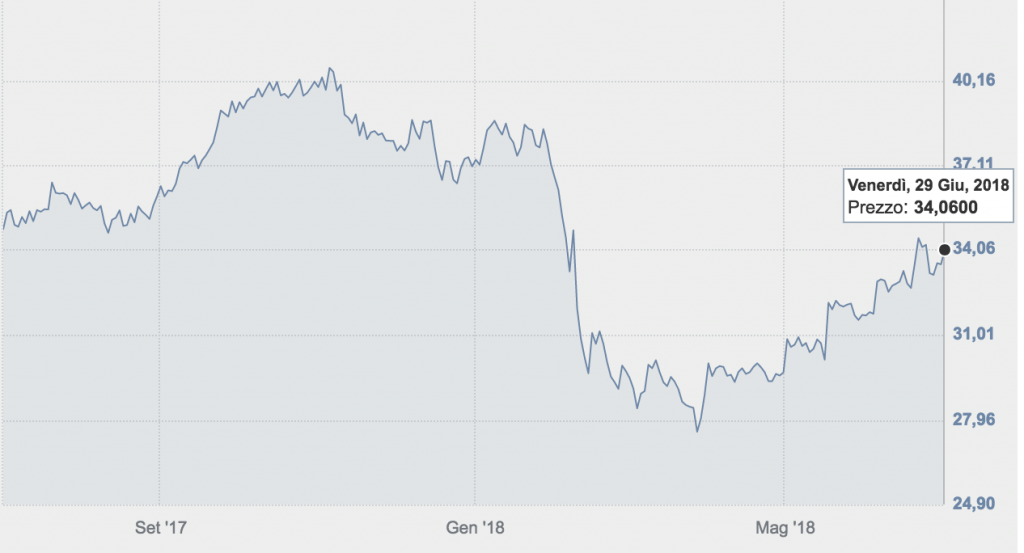

The full cash offer o the market at 28 euros per share implies a higher economic value than the cash and deferred payment made to the Recordati family. However that price is well below the market price. Actually Recordati closed at 34.06 euro (+1.55%) last Friday with a 6.9 billion euros market capitalization.

However the prices was biased by rumors about the coming deal which was confirmed by the Recordati family just a few days ago (see here a previous post by BeBeez).