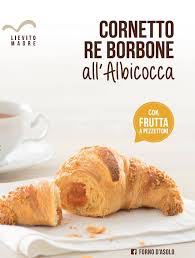

BC Partners won action for a majority stake of Forno d’Asolo, a leading company specialized in breakfast bakery products and frozen pastries. The management team led by ceo Alessandro Angelon will reinvest for a minority stake (see here the press release).

BC Partners won action for a majority stake of Forno d’Asolo, a leading company specialized in breakfast bakery products and frozen pastries. The management team led by ceo Alessandro Angelon will reinvest for a minority stake (see here the press release).

The company has been controlled by 21 Investimenti (56%) and its coinvestors NEIP III fund managed by Finint sgr and Quadrivio fund, today managed by Green Arrow Capital sgr, since Febraury 2014 when the private equity firms joined the Gallina founding family (see here a previous post by BeBeez).

Since the entrance of the funds in the company, Forno d’Asolo has been growing at a fast pace as revenues jumped from 74 million euros in 2013 to over 100 millions in 2017 and are expected to reach 133 millions in 2018, while the ebitda went from 12.8 millions in 2013 to about 20 millions in 2017 and is expected at 25 millions in 2018. So the company is said to be valued around 300 million euros, including debts (the net financial debt was 14 million euros in 2016).

Since 2014 the existing production lines have been improved and over 20 million have been invested in new flexible and efficient lines. In 2016, moreover, Forno d’Asolo acquired La Donatella, a leading company in Italy in the production of frozen pastry, and set up a commercial subsidiary in the US and a branch in Germany, to strengthen its international presence: the export percentage has almost tripled in four years, from 3% to 8%. In 2017 Forno d’Asolo inaugurated the headquarters of its Academy in Maser, with which it accompanies managers and operators of the Horeca channel in a training course aimed at creating managers and entrepreneurs in the sector.

Stefano Ferraresi, a senior partner of BC Partners, commented: “We believe that significant opportunities exist to further grow Forno d’Asolo, both organically and through acquisitions, and our goal is to provide the company with financial and strategic support needed to enable it to achieve its ambitious objectives “.

BC Partners was supported by Intesa Sanpaolo and Latham & Watkins law firm was the legal advisor, Kpmg was financial advisor and Facchini, Rossi & Soci the fiscal advisor. BC Partners was also supported by Molaro, Pezzetta, Romanelli, Del Fabbro. Rothschild and Mediobanca advised 21 Partners as for the financial issues, whoile Hogan Lovells law firm was the legal advisor. Other advisors to 21 Investimenti were Kpmg, KStudio and BCG.

The auction attracted interest from many other private equity firms such as Charterhouse, Triton Partners, Hig Capital, Towerbrook Capital, Idea Taste of Italy and Cerea Capital and from strategic investors such as

Europastry, Delifrance and Vandemoortele