NPL Italian firms use private debt instruments for growing their businesses. Ignazio Visco, the Governor of the Bank of Italy, says that the Italian banking system is more resilient to unexpected losses due to NPLs and hopes for a further development of the private debt sector.

NPL Italian firms use private debt instruments for growing their businesses. Ignazio Visco, the Governor of the Bank of Italy, says that the Italian banking system is more resilient to unexpected losses due to NPLs and hopes for a further development of the private debt sector.

Davis & Morgan (DM), a Milan-based merchant bank active in the NPLs space, issued a bond worth 2.5 million of euros (see here a previous post by BeBeez). Such liability will mature in 2023 and pay a 7% coupon. Hugh Malim, the former Italian country manager of Barclays, is the chairman of DM. Andrea Bertoni, the firm’s ceo and main shareholder, said that DM will invest the proceeds of such issuance for buying credits that have a yield of 18-20%. Blue Lake Sicav Sif Alternative Credit, which belongs to Compass Asset management, invested in this bond.

SGA (Società Gestione Attività) is also planning to issue bonds worth up to 1 billion of euros (see here a previous post byBeBeez). The first issuance will be worth 150 million and Sga will list it on Luxembourg Stock Market by the end of July 2018. Sga’s ceo and chairman Marina Natale and Alessandro Rivera aim to gain the financial strenght to handle NPLs that involve companies that still have the potential for a relaunch (the so-called unlikley to pay loans or UTPs). SGA is managing the gross NPLs portfolios of Banca Popolare di Vicenza and Veneto Banca worth 19.2 billion of which a half is made by UTPs. SGA hired Prelios, Fire and further nine servicers to handle in outsourcing an amount of npls worth 5 billion.

Bain Capital Credit is holding talks with the lenders of listed Trevi Finanziaria Industriale for restructuring the whole company’s debt (see here a previous post by BeBeez). The transaction is worth 900 million of euros. Trevi shareholders list includes Cassa Depositi e Prestiti (Cdp) through Cdp Equity (16.85%), Polaris Capital (10%), the Trevisani Family (32.73%). UniCredit, Monte dei Paschi, Banco Bpm, and Bnp Paribas are some of Trevi’s main creditors. Trevi’s net financial debt is of 565.9 million (440.9 million in 2016). The company may launch a capital increase worth 200-300 million.

Unirec, the association of Italian credit recovery firms, said that its associates last year had to handle credits worth 71.4 billion of euros (+3% since 2016) (See here a previous post by BeBeez). Unirec’s firms recovered 7.47 billion (-8.8%) while in 2016 generated aggregated revenues of 667 million. However, the profitability of sector companies is fragmented: 127 firms generate profits of up to 1% of revenues, only one player posts profits of 10% of sales and 49 companies are loss-making. Michela De Marchi, Unirec’s secretary, said that NPLs increased the value of amount of credits given in custody from banks, but also lowered the amount of recovered sums. Furthermore, the management of NPLs requires more skilled professionals that boost the firms costs. Last year, credit recovery firms received in custody:

- 19.96 billion from banks and financial services companies;

- NPLs worth 32 billion euros;

- 2.1 billions from leasing firms;

- 11.8 billions from utility and tlc companies;

- 5.4 billions of credits from the Italian Government and municipalities, and insurance companies.

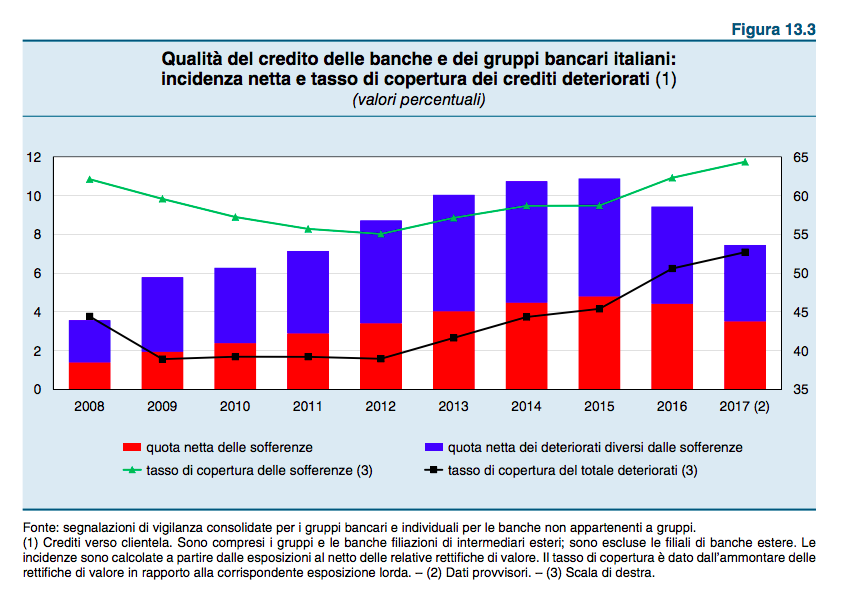

Ignazio Visco, the Bank of Italy’s Governor, said that he Italian banks could sell an amount of NPLs worth 65 billion of euros this year (35 billion last year) (see here a previous post by BeBeez). By 2020, main Italian banks may half the NPLs they hold in portfolio since last year and be worth 4% of the total loans, while for the whole banking system they could amount to 5%. The ordinary activity of credit recovery lowered the incidence of NPLs on the total amount of loans that the Italian banks issued. Furthermore, Italian lenders improved their capability to face unexpected losses due to NPLs. Visco also added that private debt funds could boost the development of bonds market and therefore supply alternative access to the credit market for SMEs (see here a previous post by BeBeez). Even though the issuance of bonds of Italian SMEs increased relevantly, such financing channel has still a smaller size compared to that one of France, USA, and the UK.