Investors in Italian NPLs keep buying portfolios, but also carry on m&a transactions and keep solid the consolidation trend for the sector.

Investors in Italian NPLs keep buying portfolios, but also carry on m&a transactions and keep solid the consolidation trend for the sector.

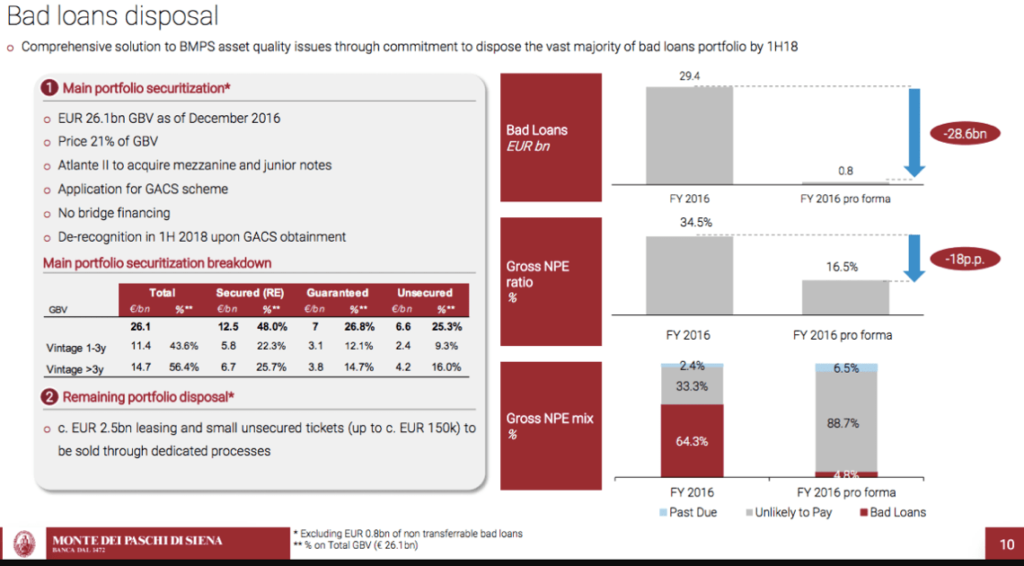

Italian troubled bank MPS will sell through a securitisation an amount of NPLs with a gross value of 24.07 billion of euros through the spv Siena NPL 2018 (see here a previous post by BeBeez). Siena NPL will carry on the securitisation of net NPLs in the following way:

– Senior Gacs backed NPLs for 2.918 billion, that Moody’s, Scope Ratings GmbH and DBRS Ratingsrated A3/BBB+/BBB.

– Unrated Mezzanine debt worth 847.6 million that Quaestio Capital acquired for 805 million

– Junior debts without rating worth 565 million that MPS will sell to Italian Recovery Fund as soon as they receive a Gacs backing.

Four special servicers will manage this portfolio: Credito Fondiario (6.2%), Italfondiario (31.2%), Prelios Credit Servicing (4.5%), and Juliet (58.1%), which belongs to Cerved Credit Management and Quaestio. Credito Fondiario will also act as master servicer.

Private debt alternative asset maanger Main Capital sgr is waiting for the authorisation of the Bank of Italy for starting its activity (see here a previous post by BeBeez). The firm is promoted by Nicola Rossi (1%), Invest Banca (19%), and Vincenzo Macaione (12.4%), the former ceo and shareholder of Npl Primus Capital. Further shareholders of Main Capital are the brothers Homar and Walter Serramidigni through Holding W&H (21.2%); Massimo De Dominicis (16%); the Basile Family (16%); the Cordioli Family (7.6%); Aim Italia listed company WM Capital (5.2%), and further smaller investors. The first fundraising target of Main Capital is of 250 million.Francesco Carobbi will be the firm’s chief investment officer.

The bondholders of Adler Group, an Italian producer of automotive components, have authorised the company to sell a stake to private equity firm FSI (see here a previous post by BeBeez). Adler’s liabilities are worth 350 million of euros listed in Germany and on Irish Stock Exchange, pay a 4.125% coupon, and will mature in 2024. The bondholders will receive a 0.25% consent fee.

Iccrea Banca is working on the sale of NPLs portfolios worth 1 billion of euros, chief operating officerLeonardo Rubattu said (see here a previous post by BeBeez). The bank may consider further sales if it achieves to get the Gacs warranty of the Italian Government. Iccrea aims to sell 7.3 billion of Npls by 2021 out of a current amount of 18 billion in view to lowering its NPL\Gross Assets ratio to 11% from current 19.5%.

Cerberus is in exclusive talks for acquiring a portfolio of NPLs worth 2 billion of euros from consumer credit company Delta, a business in receivership (see here a previous post by BeBeez). Reported suitors for such portfolio were an unnamed financial investor, and Milan listed speciality finance firm Banca Ifis. According to market rumours, Cerberus’ bid is 5% higher than the gross value of the portfolio.

Banco Bpm is working on the sale of a portfolio of NPL worth 3.5 billion of euros for achieving the target that the European Central Bank set (see here a previous post by BeBeez). The bank is conducting a beauty contest for hiring the advisors that may start such sale in summer 2018. Banco BPM is currently completing a securitisation worth 5 billion that the Italian government will warrant with the Gacs.

Banca IFIS paid 58.5 million of euros for acquiring 90% of FBS, an Italian financial firm that manages portfolios of NPLs worth 8 billion (see here a previous post by BeBeez). Lazard advised the vendors. The list of suitors for the asset included Cabot Credit Management, EOS Group, and Tecnoinvestimenti. The Strocchi Family, who sold their majority of FBS, and two managers will retain 10% of the firm after the sale.