Banca IFIS finalised an agreement to acquire control over FBS spa, a company established by Paolo Strocchi operating in the NPL segment as a servicing specialist (including both master and special services), manager of secured and unsecured NPL portfolios, due diligence advisor, and investor authorised to conduct NPL transactions (see here the press release).

Banca IFIS finalised an agreement to acquire control over FBS spa, a company established by Paolo Strocchi operating in the NPL segment as a servicing specialist (including both master and special services), manager of secured and unsecured NPL portfolios, due diligence advisor, and investor authorised to conduct NPL transactions (see here the press release).

The Milan-listed Banca IFIS willa cquire a 90% stake in FBS for a 58.5 million euros price, while Mr. Strocchi will retain a 7.5% stake and FBS’s top managers Elena Ruo and Giorgio Fedocci will retain a 2.5% stake together. Banca Ifis was supported in the deal by Clifford Chance law firm, FBS’s hareholders were advised by Lazard as for the financial issues and by Grande Stevens law firm.

This is just the last m&a deal of many in the the servicers sector in Italy in the last few years

(see here an instant report about all the deals).

FBS was valued about 65 million euros, which is a lower figure than the one that was said the shareholders were asking for the company last Autumn. Back then the figure was about 80 million euros or 10x expected FBS’s 2017 ebitda which was seen at 8 million euros. The 10x ebitda multiple was the one that was being applied to CAF, another Italian NPL servicer previously owned by Lone Star private equity firm and which was being acquired then by Lindorff-Intrum (see here a previous post by BeBeez). FBS’s ebitda in 2017 was actually better or 10 million euro, but the ebitda multiple was instead lower. FBS closed FY 2017 with e 5.6 million euros of net profit (up from 2.1 millions in 2016), 17 millions in net equity and a flat net financial position.

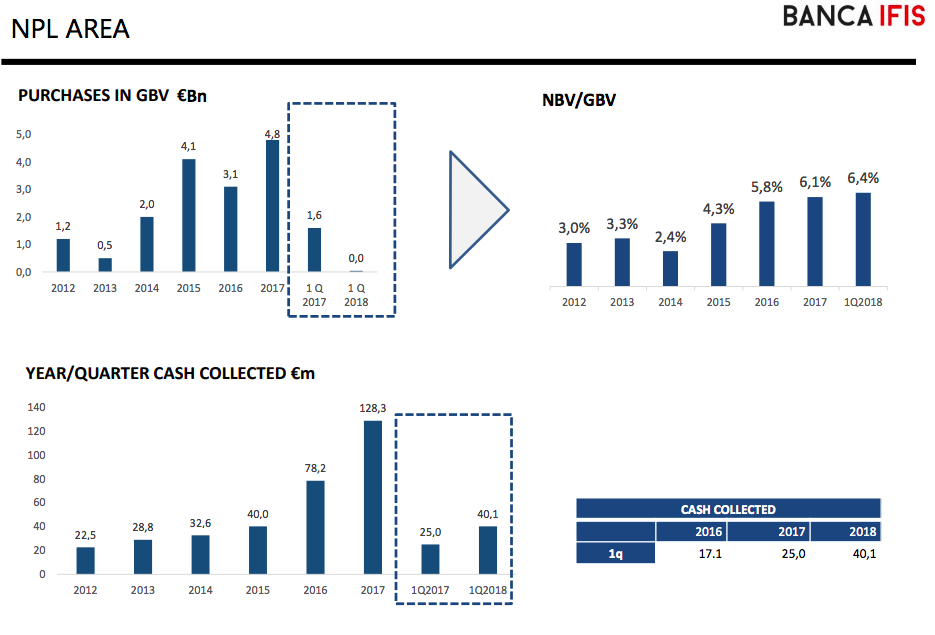

The scope of the transaction includes also a proprietary portfolio of non-performing loans totalling over 1.28 billion euros. With FBS, Banca IFIS now has over 14 billion Euro worth of nonperforming loans and services an additional 7 billion euros in receivables on behalf of third parties, bringing the managed portfolio at over 20 billion euro (see here lathe analysts presentation for Banca Ifis Q1 2018 financial results). A joint platform with approximately 400 employees and that involves also 200 legal advisers as well as almost 300 professionals is then born.

FBS has ratings both from Fitch (RSS2+/CSS2+/ABSS2) and by Standard&Poor’s (“Above Average as special servicer of residential and commercial mortgages” and “Above Average as special servicer of consumer finance”).

“In the last two years, we have received several partnership proposals from foreign and domestic operators. We have always believed that the answer to the great NPL issue, which is not yet solved in our Country, should come from Italy: a system transaction for the system. Thanks to Banca IFIS, a fully Italian opportunity to combine the capital of a private bank with the Italian management knowhow of a qualified provider such as FBS is accomplished”, Mr. Strocchi said.

“This merger gives rise to the first integrated platform of investment and of asset management on the Italian market, capable of providing a comprehensive service—either servicing, investment, or a combination of the two—for all non-performing loan categories, from dispersed unsecured consumer portfolios to corporate and real estate ones”, Banca Ifis’s ceo Giovanni Bossi said, adding that “the business combination with FBS gives the Group worldclass expertise in servicing loans with underlying real estate and corporate assets. Combined with the Bank’s formidable experience in unsecured loans, this will result in specialist services being integrated within a single player for the first time”.

This is just the last m&a deal of many in the the servicers sector in Italy in the last few years

(see here an instant report about all the deals).